United States dollar facts for kids

The United States dollar (often called the American dollar) is the official currency (money) of the USA. It's also used in some other countries. This money is the main currency for buying and selling important goods like gold and oil around the world. When you write about dollars, you use the dollar sign ($). People also call it USD, which means 'U.S. dollar'.

Contents

What Are Dollar Bills and Coins?

The American one dollar bill has a picture of George Washington on it. There are paper bills for 1, 2, 5, 10, 20, 50, and 100 dollars.

Since 1928, all U.S. dollar bills have been the same size and general design. This is different from some countries where money of different values might be different sizes.

The U.S. also has dollar coins. Some are silver-colored, and some are gold-colored. Vending machines often give dollar coins as change. This is because it's easier for machines to give out coins than paper money. Some newer machines can give paper money as change too. Paper dollars are much more common than dollar coins.

How Cents Make a Dollar

The US dollar is divided into cents. One hundred cents equals one US dollar. You can write one cent as $0.01 or 1¢. The cent, also called a "penny", is the smallest coin used in the U.S. (It's not the same as the English penny).

There are different coins with different cent values:

- The penny (1¢ or $0.01)

- The nickel (5¢ or $0.05)

- The dime (10¢ or $0.10)

- The quarter (25¢ or $0.25)

- The half-dollar (50¢ or $0.50), which is much rarer.

All U.S. coins and paper bills have the faces of famous Americans on the front.

The Federal Reserve and Your Money

The paper dollar bill is officially called a "Federal Reserve Note". These notes are special currency that everyone must accept for debts. The twelve Federal Reserve Banks put them into circulation. Banks that are part of the Federal Reserve System can get these notes from their local Federal Reserve Bank. They pay for them using money from their accounts.

The Federal Reserve Banks get the notes from the U.S. Bureau of Engraving and Printing (BEP). The BEP is where the money is printed. The Federal Reserve pays the BEP for the cost of printing the notes.

Congress has decided that a Federal Reserve Bank must have something valuable (called "collateral") that is worth the same as the notes it gives out. This collateral is mostly gold certificates and U.S. government bonds. This helps make sure the money has value.

Since 1933, Federal Reserve notes cannot be exchanged for gold, silver, or anything else. The notes themselves don't have value. Their value comes from what you can buy with them.

What "Legal Tender" Means

The Coinage Act of 1965 says that "United States coins and currency (including Federal Reserve notes...) are legal tender for all debts, public charges, taxes, and dues". This means that all U.S. money is a valid way to pay for debts.

However, there is no law that says a business must accept cash for goods or services. Private businesses can decide their own rules about accepting cash. For example, a bus company might not accept pennies for fares. Also, movie theaters or gas stations might not accept very large bills (like $50 or $100 notes).

How Cash Moves Around

People usually get cash from banks, either by using ATMs (Automated Teller Machines) or by cashing checks. The amount of cash people need changes throughout the year. For example, people need more cash for shopping during holidays. Also, people often get cash from ATMs on weekends, so there's more cash in use on Mondays.

To meet their customers' needs, banks get cash from Federal Reserve Banks. Most banks have accounts at one of the 12 regional Federal Reserve Banks. They pay for the cash they get by having their accounts charged. Smaller banks might get cash through bigger "correspondent" banks, which charge a fee for this service.

When people need less cash, like after the holiday season, banks might have too much cash. They then deposit this extra cash back at the Federal Reserve. The Fed manages these changes in cash demand to keep the financial system stable.

ATMs have become very popular. This has increased how much cash people want and how much cash banks order from the Fed. Interestingly, because of ATMs, some banks now ask for used bills instead of new ones. Used bills often work better in ATMs.

Keeping Money in Stock

Each of the 12 Federal Reserve Banks keeps a supply of cash ready. This is to meet the needs of banks in their area. There are also special storage places in other countries. These help the U.S. dollar be used internationally. They also help local banks get U.S. currency when needed.

New money comes from two parts of the Treasury Department:

- The Bureau of Engraving and Printing, which prints paper money.

- The United States Mint, which makes coins.

Most of the money in stock comes from banks depositing extra cash they don't need. When a Federal Reserve Bank gets cash from a bank, it checks each bill. About one-third of the bills are too worn out to be used again. The Fed then destroys these old bills.

The life of a bill depends on its value:

- A $1 bill, which is used the most, lasts about 5.9 years.

- A $100 bill lasts about 15 years.

Gallery

-

George Washington is on the front of the $1 bill

-

The Great Seal of the United States is on the back of the $1 Bill

-

Thomas Jefferson is on the front of the $2 bill

-

the back of the bill showing the signing of the Declaration of Independence

-

Abraham Lincoln is on the front of the $5 bill

-

The Lincoln Memorial is on the back of the $5 bill

-

Alexander Hamilton is on the front of the $10 bill

-

The U.S. Treasury Building is on the back of the $10 bill

-

Andrew Jackson is on the front of the $20 bill

-

The White House is on the back of the $20 bill

-

Ulysses S. Grant is on the front of the $50 bill

-

The U.S. Capitol is on the back of the $50 bill

-

Benjamin Franklin is on the front of the $100 bill

-

Independence Hall is on the back of the $100 bill

-

William McKinley was on the front of the $500 bill

-

Grover Cleveland was on the front of the $1,000 bill

-

James Madison was on the front of the $5,000 bill

-

Salmon P. Chase was on the front of the $10,000 bill

-

Woodrow Wilson was on the front of the $100,000 bill

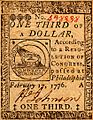

Images for kids

-

Series of 1917 $1 United States bill

-

Spanish silver real or peso of 1768

See also

In Spanish: Dólar estadounidense para niños

In Spanish: Dólar estadounidense para niños