Meta Platforms facts for kids

|

|||

Headquarters in Menlo Park, California

|

|||

|

Trade name

|

Meta | ||

|---|---|---|---|

|

Formerly

|

|

||

| Public | |||

| Traded as | |||

| Industry |

|

||

| Founded | January 4, 2004 in Cambridge, Massachusetts, U.S. | ||

| Founders |

|

||

| Headquarters |

,

U.S.

|

||

|

Area served

|

Worldwide | ||

|

Key people

|

|

||

| Products | |||

| Revenue | |||

|

Operating income

|

|||

| Total assets | |||

| Total equity | |||

| Owner | Mark Zuckerberg (13.68% equity; 61.2% voting) | ||

|

Number of employees

|

75,945 (June 2025) | ||

| Divisions |

|

||

|

|||

Meta Platforms, Inc. is a huge technology company from the United States. It is based in Menlo Park, California. Meta owns and runs many popular social media apps and communication services. These include Facebook, Instagram, Threads, Messenger, and WhatsApp.

The company also runs an advertising network. This network helps businesses show ads on Meta's sites and other websites. Most of Meta's money comes from these advertisements.

Meta started in 2004 as TheFacebook, Inc. It changed its name to Facebook, Inc. in 2005. In 2021, the company changed its name again to Meta Platforms, Inc. This new name shows its goal to build the metaverse. The metaverse is a digital world that combines virtual and augmented reality technologies.

Meta is one of the "Big Five" American technology companies. The others are Alphabet (which owns Google), Amazon, Apple, and Microsoft. In 2023, Meta was ranked among the world's largest public companies. It also spends a lot of money on research and development to create new technologies.

Contents

How Meta Started

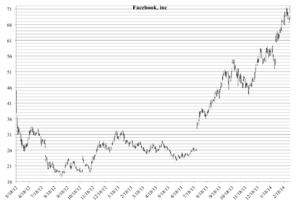

In 2012, Facebook decided to offer its shares to the public for the first time. This is called an initial public offering (IPO). The company wanted to raise a lot of money. At that time, Facebook had 845 million users every month.

Experts valued the company at $104 billion, which was a very high value for a new public company. Facebook sold more shares than planned because many people wanted to buy them. The IPO raised $16 billion, making it one of the biggest in U.S. history. This made Mark Zuckerberg, the founder, very wealthy.

When the stock started trading on May 18, 2012, there were some technical issues. The stock price stayed close to its starting price. By the end of the first week, the stock price had gone down a bit.

Shifting Focus to the Metaverse

In 2018, Facebook launched an app called Lasso. It was a short-video sharing app, much like TikTok, and was made for teenagers. However, Lasso was shut down in July 2020.

Around 2018, leaders at Facebook started thinking more about the metaverse. This idea involves creating a shared digital world using virtual reality (VR) and augmented reality (AR). They wanted to invest a lot in this new area.

During the COVID-19 pandemic, more people used online services like Facebook. Mark Zuckerberg believed this increase would continue even after the pandemic. Facebook hired many new employees during this time.

The Big Name Change: Meta

In October 2021, Facebook, Inc. announced it would change its company name to Meta Platforms. This change showed the company's new long-term goal: to build the metaverse. The metaverse is seen as a digital extension of the real world, using social media, virtual reality, and augmented reality.

The name "Meta" was already a trademark owned by another company. However, that company was bought by a foundation started by Zuckerberg and his wife. They decided to transfer the rights to the name "Meta" to Meta Platforms.

Challenges and Changes (2022-2025)

After the name change, in early 2022, Meta reported that its profits had gone down. It also saw no growth in monthly users. Measures taken by Apple Inc. to protect user privacy also affected Meta's advertising income. Zuckerberg said that competition from video apps like TikTok was a reason for these challenges.

The company's share price dropped a lot, reducing its total value. Zuckerberg's own wealth also decreased significantly.

In March 2022, Meta and Luxottica, an eyewear company, released Ray-Ban Stories. These are smartglasses that can play music and take pictures.

In July 2022, Meta's total income went down for the first time compared to the previous year. This was due to Apple's privacy features and more competition from TikTok. By October 2022, Meta's market value had dropped even further.

In November 2022, Meta had to lay off many employees, about 13% of its workforce. Zuckerberg admitted he had made a mistake by investing too much, thinking that online shopping would keep growing after the pandemic. More layoffs happened in April 2023. These layoffs were part of a larger trend in the technology industry.

Meta also started focusing more on artificial intelligence (AI) in 2022. It invested in better hardware and software for AI.

In March 2023, Meta announced more layoffs to make the company more efficient. Its income then started to grow again, partly because of its focus on AI. On July 6, Meta launched Threads, a new app that competes with Twitter.

In July 2023, Meta released its AI model called Llama 2. It was made available for businesses to use. This was the first big project from Meta's new generative AI group.

In August 2023, Meta stopped showing news content from Facebook and Instagram in Canada. This was because of a new law that would require them to pay Canadian news outlets for sharing their content.

By the end of 2023, Meta's stock price had increased a lot, making it one of the best-performing tech stocks. In January 2024, its stock reached an all-time high.

In November 2023, Meta launched an ad-free service in Europe. This allowed people to pay a fee to avoid having their personal data collected for targeted ads. However, some groups were concerned this might weaken privacy rules.

In February 2024, Meta removed the accounts of Iran's Supreme Leader Ali Khamenei. This was because his accounts repeatedly broke rules about dangerous organizations and individuals. In May 2024, the European Commission started an investigation into Meta regarding child safety concerns.

In May 2023, an issue arose in the Middle East where scammers used Meta's tools to remove original content from influencers. They then demanded money to restore the content. This showed challenges Meta faces in stopping scams in different regions.

In September 2024, Meta banned Russian state media from its platforms worldwide. This was due to concerns about them secretly funding influence campaigns.

At its 2024 Connect conference, Meta showed off Orion, its first augmented reality glasses. These glasses were originally meant for consumers but became too complex to make. Now, a small number are used internally by the company.

In October 2024, Meta announced a new AI model called Movie Gen. It can create realistic video and audio from user descriptions. Meta plans to work with content creators and add it to its products.

In November 2024, Meta closed 2 million accounts on Facebook and Instagram. These accounts were linked to scam centers in several countries that were running "pig butchering" scams.

In December 2024, Meta announced new rules for advertisers in Australia. Starting February 2025, advertisers for financial services must verify who is paying and who benefits from the ads. This is to help fight scams.

On December 4, 2024, Meta announced a large investment of $10 billion for a new AI data center in Louisiana. This center will be powered by natural gas.

On December 11, 2024, Meta experienced a global outage. This affected accounts on all its social media and messaging apps, including Instagram and Facebook.

In January 2025, Meta announced changes to its diversity, equity, and inclusion (DEI) programs. This decision came after the 2024 U.S. presidential election. Meta also changed its content moderation rules. These changes allowed some insults about a person's intellect or mental illness, but made an exception for calling LGBTQ people mentally ill because of their sexual orientation or gender identity. Later that month, Meta agreed to pay $25 million to settle a lawsuit from Donald Trump after his accounts were suspended following the January 6 riots.

In June 2025, Meta Platforms Inc. decided to invest billions of dollars in an AI startup called Scale AI. This could be one of the largest private company funding events ever.

Buying Other Companies

Meta has bought many other companies over the years. Often, they buy companies to gain talented employees.

One of its first big purchases was Instagram in April 2012 for about $1 billion. In February 2014, Facebook, Inc. bought the mobile messaging company WhatsApp for $19 billion. Later that year, Facebook bought Oculus VR for $2.3 billion. Oculus VR makes virtual reality headsets. In late 2019, Facebook, Inc. bought Beat Games, which made the popular VR game Beat Saber. In late 2022, after Facebook Inc. became Meta Platforms Inc., Oculus was renamed Meta Quest.

In May 2020, Facebook, Inc. announced it had bought Giphy for about $400 million. Giphy makes animated images called GIFs. However, in August 2021, a UK authority said that Meta might have to sell Giphy. They believed the deal would harm competition in advertising. Meta was fined for not providing all information about the deal. In October 2022, the UK authority again ruled that Meta must sell Giphy. Meta agreed to the sale, and in May 2023, Giphy was sold to Shutterstock.

In November 2020, Facebook, Inc. planned to buy Kustomer, a company that helps businesses with customer service and chatbots. This deal was completed in February 2022. In September 2022, Meta also bought Lofelt, a company that works on haptic tech, which creates touch sensations.

How Meta Works

Management Team

Meta is led by a team of important people:

- Mark Zuckerberg: He is the co-founder, chairman, and chief executive officer (CEO).

- Javier Olivan: He is the chief operating officer (COO).

- Sir Nick Clegg: He is the president of global affairs.

- Susan Li: She is the chief financial officer.

- Andrew Bosworth: He is the chief technology officer (CTO).

- David Wehner: He is the chief strategy officer.

- Chris Cox: He is the chief product officer (CPO).

- Jennifer Newstead: She is the chief legal officer.

As of October 2022, Meta had over 83,000 employees around the world.

Board of Directors

Meta's board helps guide the company. As of June 2024, it included:

- Mark Zuckerberg (chairman and CEO)

- Peggy Alford (from PayPal)

- Marc Andreessen (from Andreessen Horowitz)

- Drew Houston (from Dropbox)

- Nancy Killefer (from McKinsey & Company)

- Robert M. Kimmitt (from WilmerHale)

- Tracey Travis (from Estée Lauder Companies)

- Tony Xu (from DoorDash)

- Hock Tan (CEO of Broadcom)

- John D. Arnold

- Dana White (president and CEO of UFC)

- John Elkann (chairman of Stellantis and CEO of Exor)

- Charlie Songhurst

Company Ownership

Most of Meta Platforms is owned by large investment groups. However, Mark Zuckerberg and other key people control most of the voting power. The largest individual investors in late 2024 and early 2025 were Mark Zuckerberg, The Vanguard Group, and BlackRock.

Money and Business

| Year | Revenue $ | Growth % |

|---|---|---|

| 2004 | $0.4 | — |

| 2005 | 9 | 2150 |

| 2006 | 48 | 433 |

| 2007 | 153 | 219 |

| 2008 | 280 | 83 |

| 2009 | 775 | 177 |

| 2010 | 2,000 | 158 |

| 2011 | 3,711 | 86 |

| 2012 | 5,089 | 37 |

| 2013 | 7,872 | 55 |

| 2014 | 12,466 | 58 |

| 2015 | 17,928 | 44 |

| 2016 | 27,638 | 54 |

| 2017 | 40,653 | 47 |

| 2018 | 55,838 | 37 |

| 2019 | 70,697 | 27 |

| 2020 | 85,965 | 22 |

| 2021 | 117,929 | 37 |

| 2022 | 116,609 | -1 |

| 2023 | 134,902 | 16 |

| 2024 | 164,501 | 22 |

Meta makes billions of dollars in revenue each year. Most of this money comes from advertising. In 2020, Facebook was ranked among the largest U.S. companies by revenue.

After its name change, Meta faced challenges with its profits. This was partly due to new privacy rules from companies like Apple and Google. These rules made it harder for Meta to collect user data for ads.

| Market | Revenue | Share |

|---|---|---|

| United States | $59.7 bn. | 36.3% |

| Europe | $38.4 bn. | 23.3% |

| Asia-Pacific (excl. China) | $26.7 bn. | 16.2% |

| China | $18.4 bn. | 11.2% |

| Rest of the World | $17.9 bn. | 10.9% |

| Canada | $3.5 bn. | 2.1% |

Number of Advertisers

In 2015, Facebook announced it had two million active advertisers. Most of these were small businesses. By 2016, this number grew to three million. More than 70% of these advertisers were from outside the United States.

Meta's advertising prices change based on how many people want to show ads. Like other online ad platforms, Meta lets businesses target their ads to specific groups of people. This means ads can be shown to people based on their interests and online habits.

Where Meta Has Offices

Meta has offices around the world. Users outside of the U.S. and Canada often deal with Meta's Irish company, Meta Platforms Ireland Limited. This helps Meta manage its taxes for users in Europe, Asia, Australia, Africa, and South America.

In 2010, Facebook opened an office in Hyderabad, India. This office helps with online advertising and supports developers and users. Meta also has support centers in places like Chittagong, Dublin, and Austin, Texas.

Facebook opened its London headquarters in 2017. In 2018, it opened an office in Cambridge, Massachusetts. This office was initially for a group working to bring internet access to more people. In April 2019, Facebook opened its Taiwan headquarters in Taipei. In March 2022, Meta opened new regional headquarters in Dubai.

In September 2023, Meta paid to end its lease early on an office building in London.

Data Centers

As of 2023, Facebook operated 21 data centers. These are large buildings that store and process all the information for Meta's services. Meta has promised to use 100% renewable energy for its operations. It also aims to greatly reduce its greenhouse gas emissions.

Important Topics and Concerns

Lobbying Efforts

Meta spends money to influence government decisions. This is called lobbying. In 2020, Facebook, Inc. spent $19.7 million on lobbying and hired many lobbyists. This made it the biggest spender among the Big Tech companies in lobbying that year. In December 2024, Meta donated $1 million to the inauguration fund for then-President-elect Donald Trump.

Content Moderation and Censorship

Meta has faced discussions about what content is allowed on its platforms. In August 2024, Mark Zuckerberg stated that during the COVID-19 pandemic, the U.S. government asked Meta to limit certain COVID-19 content.

In 2016, Meta hired Jordana Cutler, who used to work for the Israeli Embassy. Critics have said that her role might give the Israeli government too much influence over Meta's policies.

After the election of Donald Trump in 2025, some people noticed possible changes in how content related to the Democratic Party was handled on Instagram and other Meta platforms. In February 2025, a Meta representative flagged a journalist's article and other "critiques of tech industry figures" as spam, which limited their reach.

In March 2025, Meta tried to stop a former employee from sharing her memoir, Careless People. The book included claims of unaddressed workplace issues. The publisher, Macmillan, said it would ignore the ruling and continue selling the book.

Disinformation Concerns

Since it started, Meta has been accused of being a place where fake news and wrong information spread. After the 2016 United States presidential election, Zuckerberg began to take steps to reduce fake news. The company partnered with news organizations to check facts.

However, a 2017 review found that these fact-checking efforts were not always effective. In 2018, some journalists working as fact-checkers criticized the partnership, saying it had little impact.

In 2024, Meta faced criticism for allowing a fake video of U.S. president Joe Biden to stay on its platform, even after it was proven to be false.

Misinformation and Hate Speech

In January 2025, Meta stopped using outside fact-checkers. Instead, it started a system where users could add notes to content, similar to what is used on X.

While Zuckerberg supported these changes, saying there was too much censorship, fact-checking groups criticized the decision. They said it would make it harder for users to spot wrong information. Meta also faced criticism for making its rules on hate speech weaker. These rules were meant to protect minority groups and LGBTQ+ individuals. The company changed its policy to allow users to accuse LGBTQ+ people of being mentally ill based on their sexual orientation or gender identity.

In January 2025, Meta was criticized for removing LGBTQ+ content from its platforms. This happened while the company was trying to address anti-LGBTQ+ hate speech. Posts about LGBTQ+ identities, support, or political issues were sometimes flagged and removed. Many LGBTQ+ activists and users were concerned that this limited their visibility and expression.

Images for kids

-

Entrance to Meta's headquarters complex in Menlo Park, California

-

Entrance to Facebook's previous headquarters in the Stanford Research Park, Palo Alto, California

See also

In Spanish: Meta Platforms para niños

In Spanish: Meta Platforms para niños