HSBC facts for kids

|

|

|

|

| Public | |

| Traded as | |

| Industry | Financial services |

| Founded |

|

| Founder | Sir Thomas Sutherland |

| Headquarters | 8 Canada Square,

London, England

,

United Kingdom

|

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

221,000 (2025) |

| Subsidiaries |

Subsidiaries

Hang Seng Bank HSBC Bank Australia HSBC Bank Bermuda HSBC Bank India HSBC Bank Hong Kong HSBC Trinkaus HSBC Bank Malaysia HSBC México HSBC Bank Middle East HSBC Sri Lanka HSBC Bank USA HSBC Finance HSBC UK M&S Financial Services HSBC Innovation Bank Limited |

HSBC Holdings plc is a large British bank and financial services group. Its name comes from its original founding member, The Hongkong and Shanghai Banking Corporation. The company's main office is in London, England. It has strong historical and business connections to East Asia.

HSBC is the largest bank based in Europe when you look at its total assets. It manages trillions of dollars in assets for its customers. This makes it one of the biggest banks in the world.

The bank started in 1865 in Hong Kong and opened branches in Shanghai that same year. In 1991, the current parent company, HSBC Holdings plc, was set up in London. The original Hong Kong bank became a part of this new group. In 1992, HSBC bought Midland Bank, which made it a very big bank in the United Kingdom.

Today, HSBC has offices and branches in 62 countries and regions. These are spread across Africa, Asia, Oceania, Europe, North America, and South America. It serves about 39 million customers worldwide. HSBC is listed on the Hong Kong Stock Exchange and the London Stock Exchange.

Contents

History of HSBC

How HSBC Started

After Hong Kong became a British colony, merchants needed a bank. They wanted to help finance trade between China, India, and Europe. Thomas Sutherland from P&O shipping company helped start the bank. He wanted it to follow "sound Scottish banking principles."

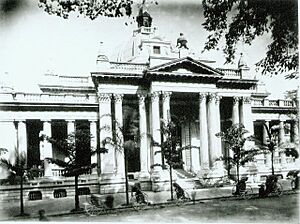

The bank opened on March 3, 1865, with HK$5 million in capital. It quickly opened a branch in Shanghai in April of the same year. The bank also started printing its own local banknotes. In 1866, it was officially named The Hongkong and Shanghai Banking Corporation. A branch in Yokohama, Japan, also opened in 1866.

Growing the Business

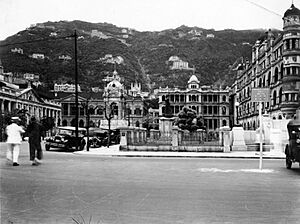

Sir Thomas Jackson became the chief manager in 1876. Under his leadership, the bank became a major player in Asia. HSBC expanded, building new offices in places like Bangkok (1921) and Shanghai (1923). A new main office was built in Hong Kong in 1935. HSBC's ability to issue banknotes gave it a lot of influence.

Expanding Around the World

Michael Turner became chief manager in 1953 and worked to make the business more diverse. He helped set up The Hong Kong and Shanghai Banking Corporation of California in 1955. He also bought The British Bank of the Middle East and the Mercantile Bank in 1959.

In the 1960s, during a time of conflict, a building used by HSBC in Singapore was bombed. Three people died and many were injured.

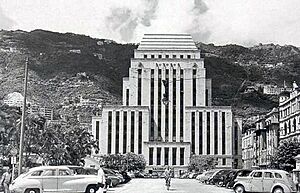

The current HSBC building in Hong Kong was designed by Sir Norman Foster. When it was finished in 1985, it was one of the most expensive and high-tech buildings in the world.

Creating the HSBC Group

On March 25, 1991, HSBC Holdings plc was created in England. This new company became the parent company for the original Hongkong and Shanghai Banking Corporation. This was done to prepare for buying Midland Bank in the UK. The purchase of Midland Bank was completed in 1992. This made HSBC a very big bank in the United Kingdom.

As part of the deal, HSBC Holdings plc had to move its main world headquarters. It moved from Hong Kong to London in 1993. HSBC also bought banks in South America in 1997. In 1999, it expanded in the United States by buying Republic National Bank of New York.

From 2000 to 2010

HSBC continued to grow in Europe by buying a large French bank, Crédit Commercial de France, in 2000. It also bought banks in Turkey and Mexico in 2001 and 2002. In 2002, HSBC expanded its business in the United States by acquiring Household Finance Corporation (HFC). This company focused on credit cards and loans.

The new main office for HSBC Holdings in London, at 8 Canada Square, opened in April 2003. HSBC also bought parts of banks in South Korea, Poland, and China. In the UK, it acquired Marks & Spencer Retail Financial Services in 2004.

In 2005, there were concerns about HSBC's systems for tracking money. The bank later admitted to problems with following rules about money transfers. HSBC worked to fix these issues and improve its systems.

In 2007, HSBC was one of the first major banks to report losses from problems in the housing market. Despite this, HSBC was considered one of the world's strongest banks. In March 2009, HSBC announced it would close many of its HSBC Finance branches in the US. This led to job losses, and the bank focused more on its credit card business there.

From 2010 to 2013

In 2011, HSBC decided to close its regular banking business in Russia. It also changed the name of its Personal Financial Services group to Retail Banking and Wealth Management.

In 2013, the new chief executive, Stuart Gulliver, announced big changes. HSBC planned to save money by reducing its operations, especially in retail banking. The goal was to focus on key markets like the UK, Hong Kong, Mexico, Singapore, Turkey, and Brazil.

In 2011, HSBC announced it would cut 25,000 jobs and leave 20 countries by 2013. It sold many branches in New York and Connecticut to other banks. HSBC also sold its US credit card business to Capital One.

In 2012, HSBC faced investigations in the US Senate. These investigations found serious problems with how HSBC prevented illegal money transfers. HSBC admitted to its mistakes and agreed to pay a large fine in December 2012. The bank said it was "profoundly sorry" and took responsibility for its past actions.

Since 2013

In 2014, HSBC sold its UK pensions business. In 2015, information about HSBC's business practices was released, called Swiss Leaks. It suggested the bank had done business with people involved in tax evasion and other issues. HSBC stated it was against financial crime.

In August 2015, HSBC sold its business in Brazil. In 2016, the bank was mentioned in connection with the Panama Papers investigation. In 2017, a report called Global Laundromat suggested HSBC had processed money from Russia that was linked to illegal activities. HSBC said it was working to prevent financial crime and needed more information sharing between banks and governments.

Mark Tucker became the group chairman in October 2017. In February 2020, HSBC announced it would cut 35,000 jobs worldwide. This was because company profits had decreased. In 2020, HSBC combined two of its business lines to form a new unit called Wealth and Personal Banking.

In October 2020, HSBC promised to achieve zero-emission by 2050. This means it aims to be carbon neutral itself and only work with carbon-neutral clients. It also pledged to help clients make this transition.

In January 2021, HSBC announced it would close 82 branches in Britain. In May 2021, HSBC decided to leave the US retail banking business. It sold many branches and closed others. The bank wants to focus on wealthy clients who are connected globally.

In May 2021, HSBC committed to stop financing the coal industry. It published a new policy in December 2021. However, in 2023, the company helped a mining giant raise money, which some saw as breaking its promise.

In June 2022, HSBC announced it would sell its business in Russia. This deal was approved by the Russian government and completed in the first half of 2024. In July 2022, HSBC became the first foreign bank to open a Chinese Communist Party committee in its Chinese investment banking branch.

In November 2022, HSBC announced it would leave the Canadian market. Royal Bank of Canada bought HSBC Canada for $13.5 billion. This deal was completed by late 2023. HSBC has been trying to cut costs and sell businesses outside of Asia.

In February 2023, HSBC announced that its profits had almost doubled in the last quarter of 2022. However, its overall profit fell because of the cost of selling its French retail banking operations. The bank also announced it was closing 114 branches in the United Kingdom. This was due to more people using online banking.

In May 2023, HSBC rejected a proposal to spin off its Asia business. This proposal was supported by its largest shareholder, Ping An. In December 2023, HSBC Asset Management announced it would buy Silkroad Property Partners, an investment manager in Singapore. This deal helps HSBC expand its real estate fund management in Asia.

HSBC announced in December 2023 that it plans to move its main office in London. It will move from 8 Canada Square to 81 Newgate Street when its lease ends in 2027.

In 2024, HSBC, along with other banks in Hong Kong, started working on a plan to stop using cheques. They want to switch to electronic payments. Cheque transactions in Hong Kong have been falling.

In 2024, HSBC launched a new international payments app called Zing. This app was meant to compete with other money transfer apps. However, in January 2025, HSBC decided to close the app after only one year. This was part of a plan to cut costs.

In 2024, HSBC Philippines launched "Omni Collect." This allows companies to connect to HSBC's system to manage payments. It supports many online and offline payment options.

On April 9, 2024, HSBC announced the sale of its Argentina business to Galicia for $550 million. This deal was finalized by the end of 2024. HSBC also sold its Armenia holdings to Ardshinbank in August 2024.

In January 2025, HSBC announced it would close some of its investment banking units in Europe, the UK, and the US. This is part of a big restructuring effort by its CEO, Georges Elhedery. These changes are expected to save $1.8 billion by the end of 2026.

In May 2025, HSBC announced that its group chairman, Mark Tucker, will retire by the end of 2025. He will have served for eight years. In July 2025, HSBC became the first major UK bank to leave the Net-Zero Banking Alliance. This raised questions about other European banks.

How HSBC Operates

HSBC's world headquarters is in London, at 8 Canada Square in Canary Wharf. The bank announced in June 2023 that it plans to move from this building in 2027. It will move to a new building in the City of London.

HSBC's main office in the US is in Hudson Yards, New York City. It is a large, modern office space.

Size and Profits

HSBC is one of the largest banks in the world by assets. It is also very profitable. In 2007, it was the most profitable bank globally. HSBC has been audited by PwC since 2015. Even though it's based in the UK, about two-thirds of HSBC's profits come from Asia. China alone contributed 44% of the bank's profit in 2022.

Main Business Groups

HSBC has three main business groups that serve its customers:

- Commercial Banking (CMB)

- Global Banking and Markets (GBM)

- Wealth and Personal Banking (WPB)

Commercial Banking

The Commercial Banking group helps over 2 million business customers. These include small businesses, partnerships, and large public companies.

Wealth and Personal Banking

The Wealth and Personal Banking group helps people manage their daily money. It also helps them grow and protect their wealth. HSBC serves over 54 million customers in this group. It focuses on wealth management, asset management, and private banking.

Service Centers

HSBC has many global service centers around the world. These centers help the bank save money by handling tasks like data processing.

Main Companies HSBC Owns

Here are some of HSBC's main companies around the world:

- Africa

- HSBC Mauritius (Commercial banking only)

- HSBC South Africa (Commercial banking only)

- Asia-Pacific

- HSBC (Hong Kong)

- Hang Seng Bank

- Hang Seng Bank (China)

- Hang Seng Bank

- HSBC Bank Australia

- HSBC Bangladesh

- HSBC China

- HSBC Bank India

- HSBC Bank Indonesia

- HSBC Japan (Commercial banking only)

- HSBC Korea (Commercial banking only)

- HSBC Bank Macau

- HSBC Bank Malaysia

- HSBC Maldives (Commercial banking only)

- HSBC New Zealand (Commercial banking only)

- HSBC Bank Philippines

- HSBC Bank Singapore

- HSBC Sri Lanka

- HSBC Taiwan

- HSBC Thailand (Commercial banking only)

- HSBC Bank Vietnam

- Europe

- HSBC Austria (Asset Management only)

- HSBC Channel Islands and Isle of Man

- HSBC Continental Europe (Commercial banking only). This includes:

- HSBC Continental Europe, Belgium

- HSBC Continental Europe, Czech Republic

- HSBC Continental Europe, France

- HSBC Continental Europe, Germany

- HSBC Continental Europe, Ireland

- HSBC Continental Europe, Italy

- HSBC Continental Europe, Luxembourg

- HSBC Continental Europe, Netherlands

- HSBC Continental Europe, Poland

- HSBC Continental Europe, Spain

- HSBC Continental Europe, Sweden

- HSBC Denmark (Asset Management only)

- HSBC Finland (Asset Management only)

- HSBC Greece (Asset Management only)

- HSBC Bank Malta

- HSBC Norway (Asset Management only)

- HSBC Portugal (Asset Management only)

- HSBC Switzerland

- HSBC UK Bank plc

- The Americas

- HSBC Bank Bermuda

- HSBC Brazil (Commercial banking only)

- HSBC Institutional Trust Services (British Virgin Islands)

- HSBC Cayman Services (Cayman Islands)

- HSBC Bank Chile (Commercial banking only)

- HSBC Colombia

- HSBC Peru

- HSBC México

- HSBC Uruguay

- HSBC Bank USA

- HSBC Securities (USA) Inc.

- Middle East

- HSBC Bank Egypt

- HSBC Israel (Commercial banking only)

- HSBC Lebanon (Commercial banking only)

- HSBC Bank Middle East. This includes:

- HSBC Bank Middle East Limited Algeria Branch (Commercial banking only)

- HSBC Bank Middle East Limited Bahrain Branch

- HSBC Bank Middle East Limited Kuwait Branch (Commercial banking only)

- HSBC Bank Middle East Limited Oman Branch (Commercial banking only)

- HSBC Bank Middle East Limited Qatar Branch

- HSBC Bank Middle East Limited UAE Branch

- Saudi Awwal Bank

- HSBC Saudi Arabia

- HSBC Bank (Turkey)

Specialized Businesses

- HSBC Finance focuses on credit cards and consumer loans.

- HSBC Insurance (Asia Pacific) is the insurance part of the bank.

- HSBC Private Bank helps very wealthy individuals manage their money.

- HSBC Expat helps people living abroad with their banking needs.

Businesses HSBC Has Sold or Closed

HSBC has stopped offering regular banking services in several countries. These include Thailand and Japan (2012), South Korea (2013), Brazil and Maldives (2016), Oman (2023), and New Zealand, Mauritius, and France (2024).

HSBC has also sold its businesses in many countries. These include Costa Rica, El Salvador, Honduras, Colombia, Peru, Uruguay, Paraguay, and Hungary (2012). It also sold businesses in Panama and Guatemala (2013), Kazakhstan, Pakistan, Jordan, Libya, Cook Islands, and Cayman Islands (2014). More recently, it sold businesses in Monaco and Lebanon (2016), Greece (2023), and Canada, Argentina, Russia, and Armenia (2024).

HSBC stopped banking operations in Nicaragua (2009), Georgia (2011), Slovakia (2012), and Palestine (2015). It also sold its share in Dar Es Salaam Investment Bank in Iraq in 2013. HSBC stopped offering Islamic banking products in some countries after a review.

HSBC Products and Services

HSBC Direct

HSBC Direct is an online and phone banking service. It offers mortgages, accounts, and savings. It started in the USA in 2005 and is now available in other countries like Taiwan and Australia.

HSBCnet

HSBCnet is a digital platform for businesses. It helps companies manage payments, cash, and trade services. It also provides financial research and allows trading in foreign exchange. Large companies use HSBCnet for their global banking needs.

HSBC Advance

HSBC Advance is a product for working professionals. The benefits and requirements change by country. Customers usually need to have a certain amount of money in their accounts. It offers everyday banking services and financial planning. HSBC Advance customers can easily open accounts in other countries.

HSBC Premier

HSBC Premier is a special service for high-value customers. It offers dedicated managers, 24-hour call centers, and better rates. If you are a Premier customer in one country, you get Premier services in all countries that offer it.

HSBC Jade

HSBC Jade is an invite-only service for very wealthy individuals. Customers usually have between $1 million and $5 million in investments with HSBC. It offers special concierge services and access to exclusive Jade Centres.

HSBC Logo

In 1998, HSBC decided to use the HSBC brand and the hexagon symbol everywhere. This was to make the group more recognizable worldwide. The hexagon symbol was first used by The Hongkong and Shanghai Banking Corporation in 1983. It came from the bank's flag, which had a red hourglass shape. The design was based on the cross of Saint Andrew. The logo was designed by Austrian artist Henry Steiner.

In 2018, HSBC made small changes to its logo. The word "HSBC" was moved to the right and made smaller. The font was also changed, and the red color was made a bit darker.

Sponsorships

HSBC used to sponsor the Jaguar Racing Formula One team. They ended this sponsorship after seven years.

In the mid-2000s, HSBC started focusing on sponsoring golf. They became the main sponsor for several big golf events. These include the WGC-HSBC Champions and the Abu Dhabi HSBC Golf Championship. HSBC also supports youth golf programs. Since 2010, HSBC has been the 'Official Banking Partner' of the Open Championship.

In 2010, HSBC made a big deal to sponsor the World Sevens Series in rugby. They pay over $100 million for the naming rights to all the tournaments. HSBC also sponsors the Hong Kong Rugby Union and the New South Wales Waratahs rugby team.

HSBC is the official banking partner of the Wimbledon Championships tennis tournament. They provide banking services at the event. They also renamed the junior tennis event to the HSBC Road to Wimbledon.

HSBC also sponsors projects in education, health, and the environment. In 2006, they partnered with SOS Children to help young people. In 2022, Zhou Guanyu, the first Chinese F1 driver, became an ambassador for HSBC's Chinese branch.

From 1999 to 2011, HSBC's American division sponsored the arena for the Buffalo Sabres hockey team. It was called the HSBC Arena.

Ownership

About 44% of HSBC shares are owned by the general public. Around 56% are held by large institutions. The biggest shareholders in early 2024 included:

- BlackRock (8.9%)

- Ping An Asset Management (8.82%)

- The Vanguard Group (4.75%)

- Norges Bank (2.87%)

- Legal & General (1.89%)

- State Street Global Advisors (1.66%)

Leadership

- Group Chairman: Sir Mark Tucker (since October 2017)

- Group Chief Executive: Georges Elhedery (since September 2024)

Former Group Chairmen

The role of Group Chairman started in 1991.

- Sir William Purves (1991–1998)

- Sir John Bond (1998–2006)

- The Lord Green (2006–2010)

- Sir Douglas Flint (2010–2017)

Former Group Chief Executives

The role of Group Chief Executive started in 1991.

- William Purves (1991–1993)

- John Bond (1993–1998)

- Keith Whitson (1998–2003)

- Stephen Green (2003–2006)

- Michael Geoghegan (2007–2010)

- Stuart Gulliver (2011–2018)

- John Flint (2018–2019)

- Noel Quinn (2020–2024)

|

See also

In Spanish: HSBC para niños

In Spanish: HSBC para niños

| Charles R. Drew |

| Benjamin Banneker |

| Jane C. Wright |

| Roger Arliner Young |