History of accounting facts for kids

The history of accounting is a super old story, going all the way back to ancient times! Imagine people thousands of years ago needing to keep track of their stuff. That's where accounting began.

It started in places like Mesopotamia, where people first learned to write, count, and use money. Even the ancient Egyptians and Babylonians had ways to check their records, a bit like early auditing systems. By the time of the Roman Empire, governments had really detailed financial information.

In India, a wise man named Chanakya wrote a book similar to a financial guide during the Mauryan Empire. His book, Arthashastra, even had tips for how a country should keep its money records.

Later, an Italian named Luca Pacioli became known as The Father of accounting and bookkeeping. He was the first to publish a book explaining double-entry bookkeeping, which is a key part of modern accounting.

The accounting profession as we know it today, with "chartered accountants," began in Scotland in the 1800s. Back then, accountants often worked with lawyers. Early modern accounting was a bit like today's forensic accounting, where people investigate financial crimes. Accounting became an organized profession in the 19th century, with groups like the Institute of Chartered Accountants in England and Wales forming in 1880.

Contents

Ancient Accounting: Keeping Track of Stuff

Early Ways to Count and Record

Accounting records from over 7,000 years ago have been found in Mesopotamia. These old documents show lists of things spent, received, and traded. Accounting, along with money and numbers, likely grew because of temples needing to track taxes and trade.

One big step in counting was learning to count things in an abstract way, not just specific items. This happened in Mesopotamia and was linked to early accounting and money.

Other old accounting records were found in places like Babylon, Assyria, and Sumer. People used simple methods to track crops and animals. Since farming had seasons, it was easy to see if they had extra food or animals after harvests or births.

Growing Role of Accountants

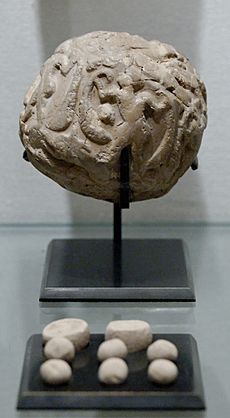

Between 4000 BC and 3000 BC, leaders in ancient Iran had people manage financial matters. In places like Godin Tepe and Tepe Yahya, cylindrical clay tokens were found. These tokens were used for bookkeeping on clay tablets. Some tablets just had numbers, while others had pictures too. Using these clay tokens for bookkeeping was a huge step for humans!

As trade grew in the 2000s BC, the job of an accountant became more important. The Phoenicians even invented an alphabet, probably to help with bookkeeping. In ancient Egypt, there was a person called the "comptroller of the scribes," who likely handled accounts. The Old Testament also mentions Moses asking Ithamar to account for materials used to build the tabernacle.

Around 400 BC, the ancient Egyptians and Babylonians had systems to check what went in and out of storehouses. They even had oral "audit reports," which is where the word "auditor" comes from (it means "to hear"). Taxes were important, so recording payments was necessary. The Rosetta Stone even talks about a tax revolt!

Roman Empire: Detailed Records

By the time of Emperor Augustus (63 BC - AD 14), the Roman government had very detailed financial information. A famous inscription called the Res Gestae Divi Augusti (meaning "The Deeds of the Divine Augustus") shows this. It was a report to the Roman people about Augustus's management. It listed his public spending, like money given to people, land for army veterans, and costs for temples and games. This shows that the accounting information helped with planning and making decisions.

Roman historians say that in 23 BC, Augustus created a rationarium (an account). This listed public money, cash in the treasury, and money held by tax officials. It even named the people who could give detailed accounts. This shows how closely the emperor was involved with financial details.

The Roman army also carefully kept records of cash, goods, and transactions. For example, records from the fort of Vindolanda around AD 110 show that the fort could track daily cash income. This might have come from selling extra supplies or goods made in the camp. They also tracked items given to slaves, like beer and nails for boots, and goods bought by soldiers.

The Heroninos Archive is a huge collection of papyrus documents from Roman Egypt in the 3rd century AD. Most are letters, but many are accounts. They show how a large private farm was run. The farm had a complex accounting system. Each local farm manager kept their own daily accounts for things like worker payments, crop production, sales, animal use, and general spending. This information was then summarized into a big yearly account for each part of the farm. This helped the owner make better economic decisions.

Medieval and Renaissance: New Ways to Balance Books

Double-Entry Bookkeeping

In the 700s, scholars in Persia faced a challenge. The Qur'an required Muslims to keep records of their debts, especially for inheritance. After someone died, their remaining assets had to be carefully divided among family members. This needed a lot of math, using ratios, multiplication, and division.

The medieval Islamic mathematician Muhammad ibn Musa al-Khwarizmi (known in Europe as Algorithmi) solved these inheritance math problems. His book, "The Compendious Book on Calculation by Completion and Balancing," created the math of algebra. The last chapter was about the double-entry bookkeeping needed for Islamic inheritance. Al-Khwarizmi's work spread widely. Bankers in Cairo, for example, used a double-entry system before it was widely known in Italy.

Al-Khwarizmi's book introduced "al-jabr" (meaning "restoration" or "algebra"). This led to three key accounting ideas:

- Debits = Credits: Just like in algebra, both sides of an equation must balance. This is like the "bookkeeping equation" for checking errors.

- Real accounts: These track wealth (assets), what others claim from that wealth (liabilities), and what the owner truly owns (owner's equity). This was Al-Khwarizmi's "basic accounting equation."

- Nominal accounts: These track activities that change wealth. The "restoration" into real accounts is like the closing process in accounting, calculating how much the owner's wealth increased.

Algebra balances and restores formulas. Double-entry bookkeeping similarly balances and restores debit and credit totals. Accounting is basically applying algebra to track wealth.

The Tang dynasty in China also used double-entry bookkeeping. They invented paper money, which needed much more detailed accounting. Paper money was lighter than metal coins, and the Tang government made sure everyone used it. The Tangs also used paper widely for accounting books and documents. They even developed printing techniques. Their accounting methods spread across Asia.

Later, the Mongols, led by Genghis Khan and Kublai Khan, were influenced by the Tang dynasty's system. When Mongols conquered a city, accountants were the first to enter. They would count all the city's wealth, and the Mongols would take 10%. Double-entry bookkeeping helped the Mongols stay informed about taxes and spending.

Roman numerals made calculations like ratios and division very hard. This meant medieval Europe was behind Eastern and Central Asia in using double-entry bookkeeping. Even though Hindu-Arabic numerals were known in Europe, some people thought using them was wrong. But merchants found double-entry bookkeeping very useful.

Fibonacci's book, Liber Abaci, helped spread knowledge about double-entry and Hindu-Arabic numerals, mainly to Italian merchants and bankers. The oldest example of full double-entry bookkeeping is from the Farolfi ledger (1299–1300) in Florence. The oldest complete system found is the Messari accounts from Genoa in 1340.

The Renaissance: Accounting Becomes Popular

In the 14th century, the Vatican and Italian banking centers like Genoa, Florence, and Venice became very rich. They recorded transactions, made loans, and did other modern banking activities. Giovanni di Bicci de' Medici introduced double-entry bookkeeping for the Medici bank. By the late 1400s, merchants in Venice widely used this system.

It was in this exciting time that Luca Pacioli, a friend of Leonardo da Vinci, published a very important book in 1494. He wrote it in Italian, not Latin, so merchants could easily understand it. Pacioli's book, Summa de Arithmetica, Geometria, Proportioni et Proportionalita (meaning "Everything About Arithmetic, Geometry and Proportion"), became super popular.

Pacioli's book explained Hindu-Arabic numbers, new math ideas, and the double-entry system. It was easy for regular business people to read. His book stayed in print for almost 400 years!

Luca's book helped popularize the words "credre" (to entrust) and "debere" (to owe), which are where "debit" and "credit" come from. Debit in Latin means "he owes," and credit means "he trusts."

While Luca Pacioli didn't invent double-entry bookkeeping (Benedetto Cotrugli had written about it earlier), his 27-page section on bookkeeping was very important because it was printed and widely read in Italian.

Pacioli saw accounting as a way for merchants to organize their business. It gave them ongoing information to see how things were going and make smart choices. He highly recommended the Venetian method of double-entry bookkeeping, which used three main books:

- The memoriale (a memorandum book)

- The giornale (a journal)

- The quaderno (a ledger)

The ledger was the most important book, with an alphabetical index to help find things.

Pacioli's book also gave instructions for recording trade (barter) and transactions in different currencies, which were common back then. It also helped merchants check their own books and make sure their bookkeepers followed the correct methods. Without such a system, merchants were more likely to have employees steal from them. That's why the first and last things in his book are about keeping an accurate list of goods (inventory).

Financial and Management Accounting

As joint-stock companies (companies owned by many investors) grew, especially from the 1600s, more people needed accounting information. Investors who weren't directly involved in the business relied on accounts to understand how it was doing. This led to two types of accounting:

- Management accounting: For internal use, helping managers make decisions.

- Financial accounting: For external use, giving information to investors and the public.

This also led to rules for accounting and a need for independent auditors to check the external accounts.

Modern Professional Accounting

Modern accounting has grown over centuries. Two big ideas shaped it: the double-entry system and the professionalization of accountants in the 1800s and 1900s. The modern profession of the chartered accountant started in Scotland in the 19th century.

Back then, accountants often worked with lawyers. Early modern accounting was similar to today's forensic accounting, where accountants investigate financial matters for courts. For example, in 1824, an accountant named James McClelland advertised that he would prepare "statements for laying before arbiters, courts or council."

In 1854, accountants in Glasgow, Scotland, asked Queen Victoria for a royal charter. They argued that accounting was a respected profession in Scotland and was growing fast. They also said that accountants needed many skills, including math and knowledge of the legal system, because courts often asked them to give evidence on financial issues. The Edinburgh Society of accountants started using the name "Chartered Accountant" for its members.

By the mid-1800s, Britain's Industrial Revolution was booming, and London was the world's financial center. With the rise of large companies and factories, there was a huge demand for skilled accountants. They needed to handle complex global transactions, calculate things like how much assets lose value (depreciation), and understand new laws. As companies grew, the need for reliable accounting soared, and the profession became a key part of business and finance.

Accounting Around the World

To improve their standing, local accounting groups in England joined together to form the Institute of Chartered Accountants in England and Wales in 1880. It started with almost 600 members and grew quickly. The institute set rules for conduct and exams for new members. Members could use professional titles like "FCA" (Fellow Chartered Accountant) for partners in a firm and "ACA" (Associate Chartered Accountant) for qualified staff.

In the United States, the American Institute of Certified Public Accountants was created in 1887.

In Canada, several accounting bodies formed, like the Canadian Institute of Chartered Accountants (1902), the Certified General Accountants Association of Canada (1908), and the Certified Management Accountants of Canada (1920). These three groups later joined together to form the Chartered Professional Accountants of Canada (CPA) in 2013.

See also

In Spanish: Historia de la contabilidad para niños

In Spanish: Historia de la contabilidad para niños

- Kushim (individual)

| Charles R. Drew |

| Benjamin Banneker |

| Jane C. Wright |

| Roger Arliner Young |