Tax resistance in the United States facts for kids

Tax resistance in the United States has been a part of American history since the country's early days. It means refusing to pay taxes, often as a way to protest or show that you disagree with something the government is doing. This idea played a big role in the American Revolution and has been used in many other protests throughout American history.

The idea behind tax resistance, like "no taxation without representation" (which means you shouldn't have to pay taxes if you don't have a say in the government), was a key part of the Revolution. Later, Henry David Thoreau's famous essay Civil Disobedience talked about refusing to obey unfair laws, including tax laws. These ideas have shaped how Americans think about their government and their rights.

Why People Resist Taxes

People resist taxes for different reasons. Sometimes it's because they feel they aren't fairly represented. Other times, it's a way to protest wars or government actions they believe are wrong.

No Say, No Pay

The idea of "no taxation without representation" became very famous during the American Revolution. It means that if a government wants to collect taxes from people, those people should have representatives (like elected officials) who can speak for them in the government.

The American colonies didn't have representatives in the British Parliament. So, when Britain tried to tax them directly, the colonists used this slogan to explain why they were rebelling.

Later, this same idea was used by African-Americans and women who didn't have the right to vote. They argued that they shouldn't have to pay taxes if they couldn't help choose their leaders. Today, people in Washington, D.C., use this slogan because they pay federal taxes but don't have a voting representative in the U.S. Congress.

Following Your Conscience

Henry David Thoreau wrote an important essay called Civil Disobedience in 1849. He wrote it after he refused to pay a poll tax. He didn't want to support a government that allowed slavery and was fighting a war he thought was wrong (the Mexican-American War).

Thoreau believed that people should listen to their own conscience (their inner sense of right and wrong) instead of just blindly following laws. His ideas have inspired many people who refuse to pay taxes because of their personal beliefs, especially those who act alone rather than as part of a big group.

Not Paying for War

Some people believe that if they pay taxes, they are helping to fund everything the government does, including wars. If they are morally against war, they might refuse to pay taxes that go towards military spending. This idea is very important to groups like the Quakers, who have refused to pay war taxes since colonial times.

These "war tax resisters" believe that people who are against war should not be forced to pay for it, just like some people are allowed to avoid fighting in wars because of their beliefs.

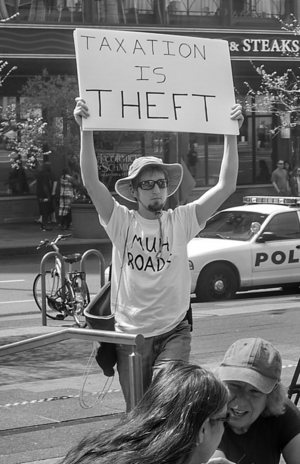

Is Taxation Theft?

Some people, especially those who believe in anarchism or libertarianism, think that taxes are basically like stealing. They argue that taking someone's money without their permission, even if it's done by a government, is wrong.

For example, the philosopher Lysander Spooner said that taking money without consent is robbery, whether it's done by one person or by millions of people calling themselves a government. Some groups even believe that all taxes should eventually be removed and that government services should be paid for by people who choose to pay for them.

How People Resisted Taxes

Throughout history, Americans have used many different ways to resist taxes. Here are some important examples:

Quakers Against War Taxes

The Quakers (also known as the Religious Society of Friends) have a long history of refusing to pay taxes that support war. When they founded the colony of Pennsylvania, they tried to avoid paying money to the British Crown for military defense.

During the French and Indian War, the Pennsylvania government started collecting taxes for military forts. Some Quakers, like John Woolman, refused to pay these taxes because they were against war. Their actions and clear explanations influenced others, and Quakers have continued to resist war taxes throughout American history.

Colonial Protests

In colonial America, there were often disagreements between the British-appointed governors and the colonial assemblies (who were elected by the colonists). When governors tried to tax colonists without the assembly's approval, people often resisted.

For example, in 1687, Governor Edmund Andros tried to create a new tax in New England. Colonists, led by John Wise, refused to pay and were put in jail. This led to the 1689 Boston revolt, where Andros was overthrown. This event showed the colonists' growing desire for independence.

The War of the Regulation in North Carolina was another important protest before the American Revolution. Colonists were unhappy with a corrupt government, so they stopped paying taxes and eventually started an armed revolt.

Colonists used many tactics to resist British taxes and become more independent. These included:

- Smuggling: Illegally bringing goods into the country to avoid taxes.

- Attacks on customs ships: Like the Gaspee Affair, where a British ship was burned.

- Refusing British goods: Events like the Boston Tea Party and Philadelphia Tea Party involved colonists dumping British tea into the harbor to protest taxes.

- Boycotts: Refusing to buy British-made goods and encouraging local production.

- Attacks on tax collectors: Sometimes, tax collectors faced social shunning or even violence.

These actions were so successful that John Adams believed the American Revolution had already happened before the actual war began.

After the Revolution

Even after the United States became independent, its own government faced tax resistance. Here are three famous examples that the new U.S. government had to deal with:

Shays' Rebellion

In Massachusetts, farmers were struggling with high taxes and strict tax collection. In Shays' Rebellion, they protested by stopping government agencies that were seizing property for unpaid taxes. The government eventually had to send troops to stop the rebellion.

The Whiskey Rebellion

Farmers in western Pennsylvania often turned their grain into whiskey because it was easier and cheaper to transport. When the U.S. government put a tax on whiskey, these farmers felt it was unfair and mostly hurt them.

Many refused to pay the tax. In western Pennsylvania, this resistance turned violent, with attacks on tax collectors. This became known as the Whiskey Rebellion. President George Washington himself led federal troops to put down the revolt.

Fries's Rebellion

Fries's Rebellion started because people opposed a new federal tax on windows. Resisters tried to stop tax assessors and refused to pay. This rebellion was also put down by the federal government.

Native American Conflicts

Sometimes, conflicts arose between the U.S. government and Native American nations over who had the right to tax whom. Native American groups, who often lived in their own sovereign territories, resisted U.S. taxes.

For example, in 1959, Wallace "Mad Bear" Anderson led a tax resistance campaign for the Tuscarora Nation. They refused to pay state income tax and publicly destroyed tax notices. In 1992, members of the Seneca Nation blocked a highway to protest a state sales tax. Similar protests by the Iroquois Confederacy in 1997 also involved road blockades.

African-Americans and Civil Rights

Tax resistance was sometimes used in the fight for civil rights for African-Americans.

Paul Cuffee, an African-American businessman, refused to pay his state taxes in 1780. He argued that he and other African-Americans should not have to pay taxes if they weren't allowed to vote or have a say in the government.

In 1853, Robert Purvis refused to pay a school tax in Philadelphia. He argued that it was unfair because his children were not allowed to attend the whites-only schools that the tax supported.

Women's Right to Vote

Tax resistance also played a role in the women's suffrage movement, which fought for women's right to vote.

At a meeting in 1852, Susan B. Anthony suggested that women who owned property should refuse to pay taxes because they were not represented in the government.

Lucy Stone refused to pay her tax in 1858, saying that it was unfair for women to be taxed without having a voice in government.

Sisters Abby and Julia Evelina Smith in Connecticut refused to pay their property taxes in the 1870s. They noticed their taxes were rising compared to men's, and they used the "no taxation without representation" argument. Their fight became famous among those who supported women's right to vote.

Anna Howard Shaw, a leader in the suffrage movement, also had her car sold at a tax auction in 1915 because she refused to pay taxes. She explained that she believed "taxation without representation is tyranny."

Property Tax Strikes in the Great Depression

During the Great Depression in the 1930s, many Americans faced huge financial problems. Property values dropped, and many people lost their jobs, but the cost of government stayed high. Taxes became a much larger part of people's income.

Many people formed "taxpayers' leagues" to demand lower taxes and less government spending. Some of these groups even encouraged people to stop paying taxes.

One of the biggest tax strikes happened in Chicago, led by the Association of Real Estate Taxpayers (ARET). From 1930 to 1933, ARET encouraged people to stop paying their property taxes while they challenged the tax laws in court. The mayor tried to stop the strike by threatening legal action, but ARET grew to almost 30,000 members.

Modern War Tax Resistance

The Vietnam War led to strong opposition in the United States. Many people who were against the war decided to resist taxes as a form of protest.

In 1966, singer Joan Baez and 370 others signed a pledge to refuse taxes, saying, "I will not pay for organized murder. I will not pay for the war in Vietnam."

When President Lyndon B. Johnson proposed a special tax to pay for the war, it made war tax resistance even more popular. Thousands of Americans also refused to pay the federal tax on their phone service, which was seen as a "war tax."

Many famous writers, artists, and professors, including Noam Chomsky and Kurt Vonnegut, signed a "Writers & Editors War Tax Protest." They quoted Thoreau, saying that if people refused to pay their taxes, it would be a less violent act than paying them and allowing the government to shed innocent blood.

Tax Resistance Today

Tax resistance continues to be a part of American political discussions. Sometimes, new campaigns emerge.

The National War Tax Resistance Coordinating Committee helps people who refuse to pay taxes for military spending.

In 2007-2008, the group Code Pink organized a "Don't Buy Bush's War" campaign, where 2,000 people pledged to resist taxes to protest the war in Iraq.

The Tea Party protests in 2009 were partly a protest against high taxes. The name "Tea Party" was a nod to the Boston Tea Party, and it also stood for "Taxed Enough Already."

Tax resistance is also used in smaller, local protests. For example, in 2010, residents in Luzerne County, Pennsylvania, rebelled against a tax increase after county officials were charged with corruption. One resident even wrote a song called "Take This Tax and Shove It" to encourage people to refuse to pay.

Take this tax and shove it

We ain't paying you crooks no more

The good ol' boys stole all our cash

And ran out the courthouse door—Fred Heller

Images for kids

| May Edward Chinn |

| Rebecca Cole |

| Alexa Canady |

| Dorothy Lavinia Brown |