Wells Fargo facts for kids

Company logo since 2019

|

|

30 Hudson Yards, home of Wells Fargo's Midtown Manhattan executive headquarters and the bank's securities trading floors

|

|

| Public | |

| Traded as | |

| ISIN | ISIN: [https://isin.toolforge.org/?language=en&isin=US9497461015 US9497461015] |

| Industry | |

| Predecessors |

|

| Founded | January 24, 1929 in Minneapolis, Minnesota, U.S. (as Northwest Bancorporation) April 1983 (as Norwest Corporation) November 2, 1998 (as Wells Fargo & Company) |

| Founders | (Wells Fargo Bank) |

| Headquarters | San Francisco, California, U.S. (corporate) 30 Hudson Yards New York City, U.S. (executive) |

|

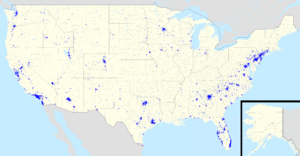

Number of locations

|

|

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

217,000 (2024) |

| Subsidiaries |

|

Wells Fargo & Company is a large American company that helps people with their money. It works in many countries and helps over 70 million customers around the world. It is one of the largest and most important banks in the United States, often called one of the "Big Four" banks. Other big banks include JPMorgan Chase, Bank of America, and Citigroup.

Its main part is Wells Fargo Bank, N.A., which has its main office in Sioux Falls, South Dakota. It is one of the biggest banks in the U.S. based on how much money it handles. Wells Fargo has thousands of branches and ATMs across the country. It also helps many people get home loans.

Besides banking, Wells Fargo also helps businesses get equipment and offers services like investment management (helping people invest money) and stockbrokerage (helping people buy and sell stocks). A big part of Wells Fargo's plan is to encourage customers to use more of its services.

Wells Fargo has offices in many cities around the world, like London, Paris, Tokyo, and Singapore. It also has large support offices in India and the Philippines. The company operates under Charter No. 1, which was the very first national bank charter given in the United States back in 1863. The Wells Fargo we know today was formed in 1998 when the original Wells Fargo company joined with another company called Norwest Corporation. Later, in 2008, Wells Fargo grew even bigger by buying Wachovia.

Contents

The Story of Wells Fargo

How Wells Fargo Started

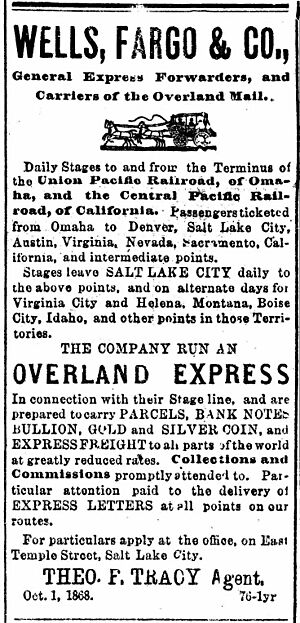

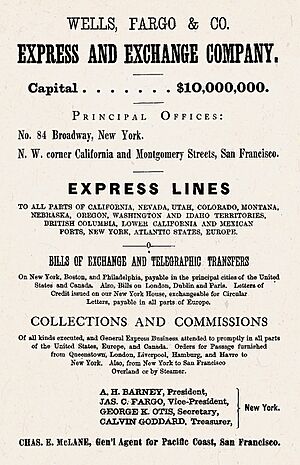

Henry Wells and William G. Fargo started Wells Fargo & Company in 1852. They also helped create American Express. They began Wells Fargo to offer "express" (fast delivery) and banking services in California. California was growing very fast because of the California Gold Rush.

Wells Fargo's first important jobs included moving gold from the Philadelphia Mint. They also delivered mail that was quicker and cheaper than the regular U.S. Mail. American Express was not interested in working in California at that time.

Growing in the West

By the end of the Gold Rush, Wells Fargo was a major express and banking company in the western U.S. They shipped large amounts of gold and delivered mail and supplies. They also helped the Butterfield Overland Mail Company, which ran a long mail route to San Francisco.

In 1860, the U.S. government could not pay the Overland Mail Company. This meant Overland could not pay its debts to Wells Fargo. So, Wells Fargo took over the mail route. Wells Fargo then ran the western part of the famous Pony Express.

Six years later, in 1866, Wells Fargo joined with other stagecoach lines. This brought all these services together under the Wells Fargo name.

In 1872, Lloyd Tevis became the president of the company. He stayed in this role until 1892.

Changes in the 20th Century

In 1905, Wells Fargo separated its banking and express delivery businesses. The bank part joined with Nevada National Bank to form the Wells Fargo Nevada National Bank.

During World War I, the U.S. government took over Wells Fargo's express business. It became a government agency called the US Railway Express Agency (REA). After the war, REA became a private company again and operated until 1975.

In 1923, Wells Fargo Nevada merged with another company called Union Trust Company. They formed the Wells Fargo Bank & Union Trust Company.

In 1954, the name was shortened to Wells Fargo Bank. A few years later, in 1958, it merged with American Trust Company. In 1962, it changed its name back to Wells Fargo Bank.

In 1968, Wells Fargo became a national bank and was named Wells Fargo Bank, N.A.. A year later, the Wells Fargo & Company holding company was created, with Wells Fargo Bank as its main part.

Growth and Mergers

Throughout the 1980s and 1990s, Wells Fargo bought several other banks. For example, in 1986, it bought Crocker National Bank. In 1996, it acquired First Interstate Bancorp.

In May 1995, Wells Fargo was one of the first major U.S. financial companies to offer banking services online.

In 1998, Wells Fargo Bank was bought by Norwest Corporation. The combined company decided to keep the more famous Wells Fargo name. The main office moved to Wells Fargo's hub in San Francisco.

After this, Wells Fargo continued to grow by buying more companies. In 2000, it acquired National Bank of Alaska and First Security Corporation.

In 2008, during a time when many banks were having problems, Wells Fargo bought Wachovia. This made Wells Fargo a bank that served customers from coast to coast in the U.S.

The U.S. government helped banks during this time. In October 2008, Wells Fargo received $25 billion from the government. Wells Fargo paid this money back to the government in December 2009.

In 2015, Wells Fargo Rail bought another rail services company. Wells Fargo also bought three business loan and equipment financing units from GE.

In March 2017, Wells Fargo announced that customers could use their smartphones for transactions with mobile wallets like Wells Fargo Wallet, Android Pay, and Samsung Pay.

In June 2018, Wells Fargo sold all 52 of its bank branches in Indiana, Michigan, and Ohio to Flagstar Bank.

In September 2018, Wells Fargo announced plans to reduce its costs by cutting many jobs by 2020.

In March 2019, CEO Tim Sloan left the company. C. Allen Parker became the temporary CEO. In September 2019, Charles Scharf was named the new CEO.

In 2020, the company sold its student loan business. In 2021, it sold its Canadian equipment finance business and its asset management division. The asset management division was renamed Allspring Global Investments.

In December 2024, Wells Fargo announced it would sell its long-time headquarters building in San Francisco. The company planned to move to a smaller building nearby. This move was seen by some as a sign of the financial industry changing in San Francisco.

Helping the Environment

Wells Fargo has set goals to help the environment. In 2022, they announced a plan to reduce pollution from companies they lend money to in the oil and gas industry by 26% by 2030. They also want to reach "net zero" pollution from their financed projects by 2050.

The company has said it will not fund any new oil and gas exploration projects in the Arctic. Wells Fargo has also provided money for projects that use renewable energy, like solar and wind power.

In December 2024, Wells Fargo left the Net-Zero Banking Alliance, which is a group of banks working towards net-zero emissions.

Charity Work

Wells Fargo also does a lot of charity work.

- In March 2022, Wells Fargo gave $1 million to the American Red Cross. This money helped Ukrainian refugees who were leaving their homes because of the conflict.

- In April 2022, the Wells Fargo foundation promised $210 million to help people of color become homeowners. Part of this money helps lower mortgage rates and reduce costs for minority homeowners.

- In April 2023, Wells Fargo started a 10-year partnership with TD Jakes Group. They plan to create communities where people of all income levels can live. Wells Fargo has promised about $1 billion for these projects. The first project is building homes and shops outside of Atlanta.

- In December 2023, Darlene Goins became the president of the Wells Fargo Foundation. She helps low-income people and works to make banking services easier to access for everyone. She also leads a plan to help people without bank accounts get low-cost banking services and learn about money.

More to Explore

- List of Wells Fargo directors

- List of Wells Fargo presidents

- Wells Fargo Arena

- Wells Fargo Center

- Wells Fargo History Museum

- Big Four banks

See also

In Spanish: Wells Fargo para niños

In Spanish: Wells Fargo para niños