Hyman Minsky facts for kids

Quick facts for kids

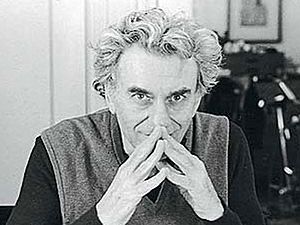

Hyman Minsky

|

|

|---|---|

|

|

| Born |

Hyman Philip Minsky

September 23, 1919 |

| Died | October 24, 1996 (aged 77) |

| Nationality | American |

| Field | Macroeconomics |

| School or tradition |

Post-Keynesian economics |

| Alma mater | University of Chicago (B.S.) Harvard University (M.P.A./Ph.D.) |

| Doctoral advisor |

Joseph Schumpeter Wassily Leontief |

| Doctoral students |

Mauro Gallegati L. Randall Wray |

| Influences | Henry Simons Karl Marx Joseph Schumpeter Wassily Leontief Michał Kalecki John Maynard Keynes Irving Fisher Abba Lerner |

| Contributions | Financial instability hypothesis Minsky moment |

| Information at IDEAS / RePEc | |

Hyman Philip Minsky (born September 23, 1919 – died October 24, 1996) was an American economist and a university professor. He taught economics at Washington University in St. Louis and was a respected scholar at the Levy Economics Institute of Bard College.

Minsky's main work was trying to understand why financial crises happen. He believed they were caused by big ups and downs in the financial system, which he thought was naturally a bit shaky. He is sometimes called a post-Keynesian economist. This means he followed some ideas of John Maynard Keynes, like believing that the government should sometimes step in to help financial markets. He was against relaxing rules for banks in the 1980s. He also thought the Federal Reserve (America's central bank) was important for helping banks when they were in trouble.

For many years, not many people paid attention to Minsky's ideas. But after the subprime mortgage crisis in 2008, his theories became very popular again.

Contents

Early Life and Education

Hyman Minsky was born in Chicago, Illinois. His family had moved from Belarus and were involved in social movements. His mother, Dora Zakon, was active in early trade unions. His father, Sam Minsky, was part of the Socialist party in Chicago.

Minsky finished George Washington High School in New York City in 1937. He then studied mathematics at the University of Chicago, earning his bachelor's degree in 1941. Later, he went to Harvard University where he earned two advanced degrees in economics. At Harvard, he learned from famous economists like Joseph Schumpeter and Wassily Leontief.

Career Highlights

Minsky started his teaching career at Brown University, where he worked from 1949 to 1958. After that, he was an Associate Professor of Economics at the University of California, Berkeley from 1957 to 1965.

In 1965, he became a Professor of Economics at Washington University in St. Louis. He retired from there in 1990. When he passed away, he was a respected scholar at the Levy Economics Institute of Bard College. He also advised the Commission on Money and Credit from 1957 to 1961 while at Berkeley.

Understanding Financial Crises

Minsky developed theories about how financial markets can become unstable. He believed that this instability is a normal part of how an economy works. He said that during good times, companies make a lot of money, more than they need to pay their debts. This can lead to a feeling of "too much excitement" where people start borrowing and investing in risky ways. Soon, these debts become too big for borrowers to pay back from their regular income. This then causes a financial crisis.

When a crisis hits, banks and other lenders become very careful. They stop lending money, even to companies that can afford loans. This makes the economy shrink.

This slow shift from a stable financial system to a shaky one, which then leads to a crisis, is what Minsky is most famous for. The phrase "Minsky moment" refers to this idea. It means a sudden, big drop in asset values after a long period of growth, often caused by too much debt.

Henry Kaufman, a well-known economist, said that Minsky helped people understand how financial markets and the economy are connected. He showed that financial markets can often go too far. He also stressed how important the Federal Reserve is as a "lender of last resort." This means the Fed can lend money to banks when no one else will, to prevent a total collapse.

Minsky called his model of the credit system the "financial instability hypothesis" (FIH). He believed that a key feature of our economy is that the financial system constantly moves between being strong and being weak. These shifts are a natural part of what creates business cycles (the ups and downs of the economy).

Minsky disagreed with many economists of his time. He argued that these ups and downs, and the booms and busts that come with them, are unavoidable in a free market economy. He believed this would happen unless the government steps in to control them. Governments can do this through rules for banks (financial regulation), actions by the central bank, and other methods. These kinds of controls were put in place after past crises like the Panic of 1907 and the Great Depression. Minsky was against the removal of these rules in the 1980s.

While at the University of California, Berkeley, Minsky worked with executives from Bank of America. These discussions helped him develop his ideas about lending and economic activity. He wrote about these views in two important books: John Maynard Keynes (1975) and Stabilizing an Unstable Economy (1986). He also wrote over a hundred articles.

Why His Ideas Weren't Always Popular

Minsky's theories became somewhat popular, but they didn't have a big impact on mainstream economics or how central banks made decisions for a long time.

One reason was that Minsky explained his theories mostly in words, not with complex mathematical models. He preferred to use "interlocking balance sheets" (which show how different parts of the economy owe money to each other) instead of math equations. Because of this, his ideas weren't easily added into the main economic models, which often didn't include private debt as a major factor.

However, after the financial crisis of 2007–2010, there was much more interest in Minsky's ideas. Some central bankers even suggested that central bank policies should consider a "Minsky factor" to prevent future crises.

Minsky's Ideas and the 2008 Crisis

Hyman Minsky's theories about how debt builds up got a lot of attention during the subprime mortgage crisis that started around 2007. The New Yorker magazine even called it "the Minsky Moment."

Minsky said that a main reason an economy moves towards a crisis is when people and businesses (not the government) take on too much debt. He identified three types of borrowers who contribute to this problem:

- Hedge borrowers: These borrowers can easily pay back both the interest and the main amount of their loans from their current income. They are very safe.

- Speculative borrowers: These borrowers can only afford to pay the interest on their loans from their income. They have to keep borrowing new money to pay back the main amount of the loan when it's due. This is riskier.

- Ponzi borrowers: These borrowers cannot even pay the interest on their loans from their income. They rely on the value of their assets (like a house) going up so they can borrow even more money to pay off their old debts. This is the riskiest type of borrowing, named after Charles Ponzi who ran a famous fraud scheme.

Minsky saw these three types of borrowers appearing in a three-stage cycle:

The Three Phases of Debt

- Hedge Phase: This happens right after a financial crisis, when the economy is recovering. Banks and borrowers are very careful. Loans are only given to people who can easily pay back both the main amount and the interest. The economy is stable and balanced.

- Speculative Phase: As people gain more confidence in the banking system, the speculative period begins. Banks start taking more risks. They give loans where the borrower can only afford to pay the interest, not the main amount. This is when the economy starts to become less stable.

- Ponzi Phase: Confidence keeps growing, and banks believe that asset prices (like house prices) will keep rising forever. In this final stage, borrowers cannot afford to pay either the main amount or the interest on their loans. They are completely dependent on asset prices going up. When asset prices stop rising, these borrowers cannot refinance their debts, leading to many people losing their homes and huge debt failures.

If too many people are using Ponzi finance in the financial system, the whole system can freeze up when asset prices stop increasing. This can cause a chain reaction, like falling dominoes. Speculative borrowers can't refinance, and then even hedge borrowers, who were safe before, might struggle to get loans.

Applying Minsky's Ideas to the 2008 Crisis

Economist Paul McCulley explained how Minsky's ideas fit the subprime mortgage crisis. He used examples from the mortgage market:

- A hedge borrower would have a normal mortgage, paying back both the main amount and interest.

- A speculative borrower would have an "interest-only" loan, paying only the interest and needing to refinance the main amount later.

- A Ponzi borrower would have a "negative amortization" loan, where payments don't even cover the interest, so the amount owed actually grows! Lenders gave money to Ponzi borrowers because they believed house prices would keep going up.

McCulley noted that the shift through Minsky's three borrowing stages was clear as the credit and housing bubbles grew before August 2007. The demand for housing, and the growth of the "shadow banking system" (lending outside traditional banks), helped fund more risky speculative and Ponzi loans. This pushed house prices even higher. After the bubble burst, the process reversed. Businesses paid down debt, lending rules became stricter, and more borrowers returned to the safer "hedge" type.

McCulley also pointed out that people tend to follow trends. In Minsky's words, "capitalist economies show inflations and debt deflations that can spin out of control." This means people's actions often make economic ups and downs even bigger. For example, during a boom, people invest more, making the boom bigger. During a bust, they pull back, making the bust worse. This suggests that governments and regulators should use "counter-cyclical policies." These are policies that go against the trend, like making banks hold more capital during booms and less during busts, to help stabilize the economy.

Minsky's Views on John Maynard Keynes

In his book John Maynard Keynes (1975), Minsky looked closely at the ideas of John Maynard Keynes, a very important economist. Minsky disagreed with how some other economists understood Keynes's famous book, The General Theory of Employment, Interest and Money. Minsky offered his own interpretation, focusing on parts that others had overlooked, like the idea of "Knightian uncertainty" (situations where risks cannot be measured or predicted).

Selected publications

- (2013) Ending Poverty: Jobs, Not Welfare. Levy Economic Institute, New York. ISBN: 978-1936192311

- (2008) [1st. Pub. 1975]. John Maynard Keynes. McGraw-Hill Professional, New York. ISBN: 978-0-07-159301-4

- (2008) [1st. Pub. 1986]. Stabilizing an Unstable Economy. McGraw-Hill Professional, New York. ISBN: 978-0-07-159299-4

- (1982) Can "It" Happen Again?. M.E. Sharpe, Armonk. ISBN: 978-0-87332-213-3

- (Winter 1981–82) "The breakdown of the 1960s policy synthesis". New York: Telos Press. Archived at Hyman P. Minsky Archive. 166.

See also

In Spanish: Hyman Minsky para niños

In Spanish: Hyman Minsky para niños

- 2008–2009 Keynesian resurgence

- Rudolf Hilferding, whose writings on 'Finance Capitalism' anticipated Minsky's elaboration on Financial Capitalism

| Bayard Rustin |

| Jeannette Carter |

| Jeremiah A. Brown |