Andrew Mellon facts for kids

Quick facts for kids

Andrew Mellon

|

|

|---|---|

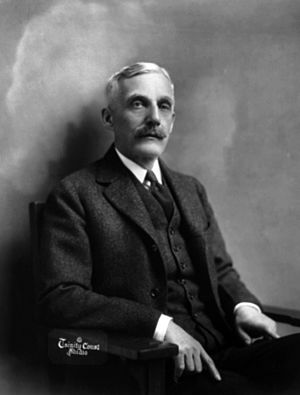

Mellon in 1921

|

|

| United States Ambassador to the United Kingdom | |

| In office April 9, 1932 – March 17, 1933 |

|

| President | Herbert Hoover Franklin D. Roosevelt |

| Preceded by | Charles G. Dawes |

| Succeeded by | Robert Worth Bingham |

| 49th United States Secretary of the Treasury | |

| In office March 9, 1921 – February 12, 1932 |

|

| President | Warren G. Harding Calvin Coolidge Herbert Hoover |

| Preceded by | David F. Houston |

| Succeeded by | Ogden L. Mills |

| Personal details | |

| Born |

Andrew William Mellon

March 24, 1855 Pittsburgh, Pennsylvania, U.S. |

| Died | August 26, 1937 (aged 82) Southampton, New York, U.S. |

| Political party | Republican |

| Spouse | Nora McMullen (1900–1912) |

| Children | Ailsa Paul |

| Relatives | Thomas Mellon (father) Richard B. Mellon (brother) |

| Education | University of Pittsburgh |

Andrew William Mellon (March 24, 1855 – August 26, 1937) was an American banker, businessman, and politician. He came from the wealthy Mellon family in Pittsburgh, Pennsylvania. Before entering politics, he built a huge business empire. He served as the United States Secretary of the Treasury from 1921 to 1932. This period included the economic boom of the 1920s and the start of the Wall Street Crash of 1929. As a Republican, Mellon believed in policies that lowered taxes and reduced the national debt after World War I.

Andrew's father, Thomas Mellon, was a successful banker and lawyer in Pittsburgh. Andrew started working at his father's bank, T. Mellon & Sons, in the early 1870s. He eventually became the main leader of the bank. He later renamed it Mellon National Bank and also started another financial company called Union Trust Company. By 1913, Mellon National Bank held more money than any other bank in Pittsburgh. Mellon also owned or helped fund many large companies, including Alcoa (aluminum), Gulf Oil, and Westinghouse Electric Corporation. He was also a big supporter of the Republican Party.

In 1921, President Warren G. Harding chose Mellon to be his Secretary of the Treasury. Mellon stayed in this role until 1932, serving under Presidents Harding, Calvin Coolidge, and Herbert Hoover. He worked to change federal taxes after World War I. He believed that lowering tax rates for the wealthiest people would actually bring in more tax money for the government. He also helped reduce the national debt significantly in the 1920s.

Mellon's influence grew a lot during President Coolidge's time. However, his reputation suffered after the Wall Street Crash of 1929 and the start of the Great Depression. He tried to help the economy, but he was against the government getting too involved. After some disagreements about his taxes, President Hoover appointed Mellon as the United States ambassador to the United Kingdom. Mellon returned to private life after Hoover lost the 1932 election. Before he passed away in 1937, Mellon helped create the National Gallery of Art. His generous donations also led to the creation of Carnegie Mellon University and the National Portrait Gallery.

Contents

Early Life and Business Beginnings

Andrew Mellon's grandparents came to the United States from Ireland in 1818. They settled in Pennsylvania with their son, Thomas Mellon. Thomas became a successful lawyer and banker in Pittsburgh. He and his wife, Sarah Jane Negley, had eight children, and Andrew was born in 1855.

In 1869, Thomas Mellon started his own bank, T. Mellon & Sons. Andrew joined his father at the bank when he was still a teenager and quickly became very important to the business. He also went to Western University (now the University of Pittsburgh) but didn't finish his degree. After a short time working in lumber and coal, Andrew joined T. Mellon & Sons full-time in 1873. That same year, a financial crisis called the Panic of 1873 hit the economy. However, with Andrew's help, the bank quickly recovered.

Building a Business Empire

Andrew Mellon's role at T. Mellon & Sons grew steadily. In 1876, he was put in charge of the bank's daily operations. His father gave him full ownership of the bank in 1882. Five years later, Andrew's younger brother, Richard B. Mellon, joined the bank as a co-owner.

During the 1880s, Mellon started to expand the bank's activities. He and his friend Henry Clay Frick took control of the Pittsburgh National Bank of Commerce. Mellon also acquired or helped start several other companies, including insurance and trust companies. He also got involved in industrial businesses, like natural gas companies. By the 1890s, Mellon was managing all of his family's properties and assets.

Investing in New Industries

In 1889, Mellon loaned money to a new company called Pittsburgh Reduction Company. This company aimed to be the first to successfully produce aluminum. Mellon became a director of the company in 1891. He and his brother Richard helped set up aluminum factories. This company later became Alcoa in 1907 and was one of the most profitable investments for the Mellons.

The Mellon family also got into the oil business, creating the Crescent Oil Company. By 1894, their oil companies produced a lot of the oil exported by the United States. However, they sold their oil interests to Standard Oil in 1895. Around the same time, Andrew and Richard invested in the Carborundum Company, which made silicon carbide.

Mellon and Henry Clay Frick were close friends and business partners. They were both members of the Duquesne Club. They also joined the South Fork Fishing and Hunting Club, which built the South Fork Dam. In 1889, the dam broke, causing the terrible Johnstown Flood that killed over 2,000 people. Mellon donated money to a relief fund after the flood.

Expanding Financial Power

By the late 1890s, Mellon had become very wealthy. The Union Trust Company became one of his most important and profitable businesses. With money from Union Trust, Mellon helped fund many other companies, including construction and coal companies. He also co-founded Union Steel Company, which made nails and barbed wire. Mellon and Frick also became major owners in the New York Shipbuilding Corporation after the Spanish–American War.

In 1902, Mellon changed T. Mellon & Sons into the Mellon National Bank. Andrew, Richard, and Frick worked together to control Union Trust Company, which then controlled Mellon National Bank. They also started Union Savings Bank. Mellon's financial empire grew even more with successful investments in companies like the Standard Steel Car Company. The Mellons also helped start the Guffey Company, which later became Gulf Oil in 1907. Mellon's success made him a very important person in the economy of western Pennsylvania.

The Panic of 1907, a financial crisis, affected some of Mellon's investments, but most recovered quickly. He also invested in Westinghouse Electric Corporation and helped prevent it from going bankrupt. By 1913, Mellon National Bank was the largest bank in Pittsburgh. In 1914, Mellon became a co-owner of Koppers, which made advanced coking ovens. He also served as a director for the Pennsylvania Railroad. Mellon was very involved in financing World War I, as his banks provided millions of dollars in loans to the United Kingdom and France.

Early Political Involvement

Like his father, Mellon always supported the Republican Party and often donated money to its leaders. He used his influence to help pass laws that protected American industries. In the early 1900s, Mellon was concerned about the rise of progressivism and government actions against large companies. He especially opposed investigations into Alcoa. After World War I, he helped financially support Republicans who opposed the Treaty of Versailles. Mellon attended the 1920 Republican National Convention and was a key fundraiser for Warren G. Harding, who became the Republican presidential nominee.

Serving the Country

Harding's Treasury Secretary

After Harding won the 1920 election, he considered many people for Secretary of the Treasury. Andrew Mellon was strongly supported by bankers and Republican leaders. Mellon was hesitant to join public life because he valued his privacy and worried about conflicts of interest with his businesses. However, he also wanted to step back from actively running his companies, and a cabinet position was a prestigious way to end his career.

Mellon accepted the position in February 1921, and the United States Senate quickly approved him. Before joining the cabinet, Mellon sold his banking shares to his brother Richard, but he kept his other business investments. He continued to be involved in major decisions for the Mellon business empire. His wealth continued to grow, and in the 1920s, he paid more federal income tax than almost anyone else in the country.

As Treasury Secretary, Mellon focused on balancing the government's budget and paying off the huge debts from World War I. He was not very concerned with international affairs or the unemployment rate. One of his main goals was to change the federal tax system. Taxes on income had increased a lot during World War I to pay for the war. Mellon believed that lowering taxes on high-income earners would encourage them to invest more, leading to economic growth and more tax revenue. This idea was called the "Mellon Plan."

In 1921, Congress passed the Revenue Act of 1921, which lowered the top income tax rate. Mellon was not completely happy with this bill because it didn't go as far as he wanted. He also strongly opposed a "Bonus Bill" that would give extra money to World War I veterans, fearing it would interfere with his plans to reduce debt and taxes. With Mellon's support, President Harding vetoed the bill.

Working with President Coolidge

As the economy recovered and entered the prosperous Roaring Twenties, Mellon became one of the most respected figures in the Harding administration. After Harding died in 1923, Vice President Calvin Coolidge became president. Mellon had a very close relationship with President Coolidge, and they agreed on most major issues, especially the need for more tax cuts. One journalist noted that Mellon had so much influence during Coolidge's presidency that it could be called "the reign of Coolidge and Mellon."

Coolidge and Mellon worked hard to convince Congress to support Mellon's tax plan. In 1924, Congress passed the Revenue Act of 1924, which further reduced income taxes but not as much as Mellon wanted. Congress also rejected Mellon's idea to ban tax-exempt investments and, despite Coolidge's veto, authorized a bonus for World War I veterans. However, Mellon did succeed in creating the Board of Tax Appeals to handle tax disputes.

Mellon had planned to retire after one term, but he decided to stay to see his tax proposals fully passed. In the 1924 election, Republicans campaigned on further tax cuts. Coolidge won re-election by a large margin, which he saw as a sign that people supported his economic policies.

In February 1926, Coolidge signed the Revenue Act of 1926, which lowered the top income tax rate to 25%. Mellon was very pleased because this act closely matched his original ideas. The act also raised tax exemptions for individuals, removed the gift tax, and reduced the estate tax. The booming economy led to a large budget surplus, and the national debt dropped significantly.

With tax reform achieved, Mellon started letting his deputy, Ogden L. Mills, manage more of the Treasury Department. Mellon also focused on building new federal buildings in Washington, D.C. In 1928, Mellon said that Americans enjoyed a very high level of prosperity.

Mellon also played a role in foreign affairs, especially regarding European debts from World War I. He opposed canceling these debts but knew that countries like Britain needed new payment terms. In 1923, Mellon and British official Stanley Baldwin agreed that Britain would pay off its debts over 62 years. Mellon also reached debt agreements with other European countries.

The Great Depression Years

In 1927, President Coolidge announced he would not seek another term. Herbert Hoover became the leading candidate for the 1928 presidential election. Mellon privately did not trust Hoover and worried he would change Mellon's tax policies. Although some Republicans urged Mellon to run for president, he felt he was too old. Mellon eventually supported Hoover, who won the Republican nomination and the election. Mellon decided to stay on as Secretary of the Treasury.

In October 1929, the New York Stock Exchange experienced the "Black Tuesday", its worst crash ever. Mellon believed that economic downturns were a necessary part of the business cycle to "purge the rottenness out of the system." He was against direct government intervention to fix the stock market crash. However, he did call for lower interest rates and supported temporary tax cuts.

By mid-1930, many, including Mellon, thought the worst of the crash was over. But in late 1930, the economy went into a deep slump, with many workers losing their jobs. Mellon's popularity declined as the economy worsened. In 1931, the country entered a deep depression. Mellon helped create the National Credit Association to assist failing banks, but it was not effective. Later, the Reconstruction Finance Corporation was established to provide federal loans to banks.

With unemployment rising, Mellon became very unpopular. He urged Hoover not to use the government to intervene in the depression. Facing a large budget deficit, Mellon and Mills proposed new taxes and a return to earlier tax rates. Congress passed the Revenue Act of 1932, which included many of their ideas. In early 1932, a Congressman started proceedings against Mellon, claiming he had conflicts of interest. To remove Mellon from this difficult situation, President Hoover appointed him as ambassador to the United Kingdom. Mellon accepted, and Mills became the new Secretary of the Treasury.

Mellon arrived in Britain in April 1932 and was well-received. He saw the collapse of international economic agreements he had helped negotiate. He also convinced the British to allow Gulf Oil to operate in Kuwait. Hoover lost the 1932 election to Franklin D. Roosevelt. Mellon left office in March 1933, ending his twelve years of government service.

Later Life and Legacy

After leaving office, Mellon continued to be criticized by many. He strongly opposed President Roosevelt's New Deal policies, believing they undermined the free market system. New Deal policies, including banking reforms and new taxes on wealthy individuals and corporations, affected Mellon's businesses.

In the 1930s, the government investigated Mellon's tax history. A case about his taxes was widely covered by the media. Mellon revealed many details about his business career during these proceedings.

Mellon was diagnosed with cancer in November 1936. His health declined, and he passed away on August 26, 1937. Newspapers across the country reported his death. Months after his death, the Board of Tax Appeals cleared Mellon of all tax charges.

Family

In 1900, Mellon married Nora McMullen, an Englishwoman. They had a daughter, Ailsa, in 1901, and a son, Paul, in 1907. Nora was unhappy living in Pittsburgh, and they separated in 1909. After a widely publicized divorce process, they agreed to a settlement in 1912.

Mellon never remarried. His children divided their time between their parents. Ailsa married David K. E. Bruce in 1926 in a major social event in Washington. Paul later became a well-known philanthropist. Mellon's nephew, Richard King Mellon, took over the Mellon financial empire after Andrew.

Philanthropy and Art Collection

Mellon started donating to local organizations like the YMCA in the early 1900s. In 1913, he and his brother Richard established the Mellon Institute of Industrial Research at the University of Pittsburgh. This institute later merged with another school in 1965 to form Carnegie Mellon University. Mellon also made several large donations to the University of Pittsburgh, including the land for the Cathedral of Learning. It's estimated he donated over $43 million to the university.

Mellon began collecting art in the late 1890s. Over the years, his art collection grew to be one of the finest in Washington. In the early 1930s, he bought many important paintings from the Soviet Union's Hermitage Museum. He later gave 21 of these high-quality paintings to the National Gallery of Art.

Mellon decided to use his wealth and art collection to create a national art museum in Washington, D.C., similar to the National Gallery in London. In 1936, he offered President Roosevelt his art collection and money to build the museum, with the government paying for its upkeep. The Roosevelt administration accepted his offer, and Congress passed a law to build the National Gallery of Art on Mellon's terms. The museum opened in 1941 and is still operating today. Mellon's friend, David E. Finley Jr., later helped establish the National Portrait Gallery, which also has paintings donated by Mellon.

Memorials

The Andrew W. Mellon Memorial Fountain in Washington, D.C., was dedicated in 1952. Washington, D.C., also has the Andrew W. Mellon Auditorium and the Andrew Mellon Building. The Andrew W. Mellon Foundation, which was created by his children, is named in his honor. The US Coast Guard Cutter Mellon (WHEC-717) is also named after him.

See Also

In Spanish: Andrew William Mellon para niños

In Spanish: Andrew William Mellon para niños

- List of wealthiest historical figures

- List of richest Americans in history

| Leon Lynch |

| Milton P. Webster |

| Ferdinand Smith |