Nestlé facts for kids

|

|

Nestlé's headquarters in Vevey, Switzerland

|

|

|

Formerly

|

List

|

|---|---|

| Public | |

| Traded as | SIX: NESN |

| ISIN | ISIN: [https://isin.toolforge.org/?language=en&isin=CH0038863350 CH0038863350] |

| Industry | Food processing |

| Founded | 1866 (for the Anglo-Swiss Condensed Milk Company branch) |

| Founder | Henri Nestlé (for the Farine Lactée Henri Nestlé branch) |

| Headquarters | Vevey, Switzerland |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Brands | List of Nestlé brands |

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

275,000 (2023) |

| Subsidiaries | Cereal Partners Worldwide (50%) |

Nestlé S.A. is a huge food and drink company from Vevey, Switzerland. It's one of the biggest food companies in the world. Nestlé makes many different products that you might know. These include coffee, tea, candy, bottled water, baby food, dairy products, ice cream, and even pet food.

Many of Nestlé's brands are very popular. Some of them, like Nespresso, Nescafé, Kit Kat, and Maggi, sell over 1 billion Swiss francs each year. Nestlé has factories in many countries and employs hundreds of thousands of people around the world. The company also owns a part of L'Oréal, which is the world's largest cosmetics company.

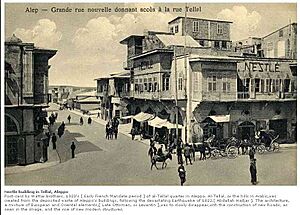

Nestlé started in 1905 when two Swiss companies joined together. One was the "Anglo-Swiss Milk Company," which began in 1866. The other was "Farine Lactée Henri Nestlé," started in 1867 by Henri Nestlé. The company grew a lot during and after the World Wars. It started making more than just condensed milk and baby formula. Over the years, Nestlé has bought many other well-known companies, like Findus, Libby's, Rowntree Mackintosh, and Gerber.

Contents

History of Nestlé

How Nestlé Began (1866–1900)

Nestlé's story started in the 1860s with two different Swiss businesses. These companies later came together to form Nestlé. Over the next few decades, both companies grew and sold their products across Europe and the United States.

- 1866: Brothers Charles and George Page from the US started the Anglo-Swiss Condensed Milk Company in Cham, Switzerland.

- 1867: In Vevey, Switzerland, Henri Nestlé created a special milk-based baby food. He soon began selling it.

- 1875: Henri Nestlé retired, but the company kept his name: Société Farine Lactée Henri Nestlé.

- 1877: Anglo-Swiss started making milk-based baby foods too.

- 1878: The Nestlé Company began selling condensed milk. This made the two companies direct competitors.

- 1879: Nestlé joined forces with Daniel Peter, who invented milk chocolate. Nestlé helped Peter solve a problem with removing water from milk for his chocolate.

Growing Through Mergers (1901–1989)

In the early 1900s, Henri Nestlé and those who followed him helped develop the Swiss chocolate industry. They worked with other chocolate makers like Peter, Kohler, and Cailler families. In 1929, these chocolate companies officially joined the Nestlé group.

In 1905, Nestlé and Anglo-Swiss merged. They became the Nestlé and Anglo-Swiss Condensed Milk Company. This name was used until 1947. That year, they bought another company called Maggi, which made seasonings and soups. The company's current name, Nestlé S.A., was adopted in 1977.

By the early 1900s, Nestlé had factories in the United States, the United Kingdom, Germany, and Spain. During World War I, there was a high demand for dairy products. Nestlé's production more than doubled because of government orders.

After World War I, the demand for Nestlé's products from governments decreased. People started buying fresh milk again. However, Nestlé quickly adjusted. They made their operations more efficient and reduced their debts. In the 1920s, Nestlé started making new products. Chocolate became their second most important business. They even created white chocolate in the 1930s.

World War II affected Nestlé right away. Profits dropped significantly. However, Nestlé built factories in developing countries, especially in South America. The war also helped introduce a new product: Nescafé (Nestlé's Coffee). It became a very popular drink for the US military. Nestlé's production and sales actually increased during the war.

After World War II, Nestlé grew rapidly. They bought many other companies. In 1947, Nestlé merged with Maggi, a company that made seasonings and soups. They also acquired Crosse & Blackwell in 1950, Findus in 1963, Libby's in 1971, and Stouffer's in 1973. Nestlé also started investing in other types of businesses. They bought shares in L'Oréal in 1974 and acquired Alcon Laboratories Inc. in 1977.

In the 1980s, Nestlé's strong financial position allowed it to buy even more companies. They acquired Carnation in 1984, which brought brands like Coffee-Mate and Friskies to Nestlé. In 1986, the company started Nestlé Nespresso S.A.. In 1988, they bought the British candy company Rowntree Mackintosh. This added popular brands like Kit Kat, Rolo, Smarties, and Aero to Nestlé's lineup.

Global Expansion (1990–2011)

The early 1990s were a good time for Nestlé. It became easier to trade across countries, and world markets became more connected. Since 1996, Nestlé has made many more acquisitions. These include San Pellegrino (1997), D'Onofrio (1997), Spillers Petfoods (1998), and Ralston Purina (2002).

In 2002, Nestlé made two big purchases in North America. In June, they combined their US ice cream business with Dreyer's. In August, they bought Chef America, the company that created Hot Pockets. Nestlé also tried to buy Hershey's, a major candy competitor, but the deal did not happen.

In December 2005, Nestlé bought the Greek company Delta Ice Cream. In January 2006, they took full ownership of Dreyer's. This made Nestlé the world's largest ice cream maker. In June 2006, Nestlé bought the weight-loss company Jenny Craig. In July 2007, Nestlé acquired the Medical Nutrition division of Novartis Pharmaceutical. This included products like Ovaltine and nutritional supplements.

In April 2007, Nestlé returned to its roots by buying the US baby-food maker Gerber. In December 2007, Nestlé partnered with a Belgian chocolate maker, Pierre Marcolini.

In January 2010, Nestlé agreed to sell its part of Alcon to Novartis. On March 2, 2010, Nestlé bought Kraft Foods's North American frozen pizza business. This included brands like DiGiorno and Tombstone.

Since 2010, Nestlé has been working to become a company focused on nutrition, health, and wellness. This is to help with changing food trends. The Nestlé Institute of Health Sciences is working to create foods that can help prevent or correct health problems. They have already made products like drinks and protein shakes to help with malnutrition, diabetes, and other conditions.

In August 2010, Nestlé bought the British pharmaceutical company Vitaflo. This company makes nutritional products for people with genetic disorders. In July 2011, Nestlé agreed to buy 60 percent of Hsu Fu Chi International Ltd. On April 23, 2012, Nestlé agreed to buy Pfizer Inc.'s infant-nutrition unit, formerly Wyeth Nutrition.

Recent Developments (2012–Present)

In recent years, Nestlé Health Science has bought several companies. These include CM&D Pharma Ltd., which makes products for people with chronic conditions like kidney disease. They also acquired Prometheus Laboratories, which focuses on treatments for stomach diseases and cancer.

Nestlé sold its Jenny Craig business in 2013. In February 2013, Nestlé Health Science bought Pamlab, which makes medical foods for depression, diabetes, and memory loss. In February 2014, Nestlé sold its PowerBar sports nutrition business.

In December 2014, Nestlé announced it would open 10 skin care research centers worldwide. This showed their increased focus on healthcare products. The first of these centers opened in New York in 2015.

In January 2017, Nestlé announced it was moving its US headquarters from California to Virginia. In March 2017, Nestlé announced they would reduce the sugar in some of their chocolate bars, like Kit Kat and Aero, by 10% by 2018. They also announced sugar reductions in their UK breakfast cereals.

In June 2017, Nestlé announced a large share buyback. This followed suggestions from a major investor, Daniel S. Loeb. The company decided to focus more on coffee and pet care.

In 2016, Nestlé and PAI Partners created a joint company called Froneri. This company combines their ice cream businesses in Europe and other countries. In March 2017, Nestlé and Coca-Cola ended their joint venture, Beverage Partners Worldwide. This was partly because Nestlé wanted to expand Nestea on its own.

In July 2017, Nestlé introduced a new type of infant formula in Spain. It contained special ingredients found in breast milk, which had not been in formula before. In September 2017, Nestlé S.A. bought a majority share of Blue Bottle Coffee. Nestlé USA also agreed to buy Sweet Earth, a company that makes plant-based foods.

In January 2018, Nestlé USA announced it was selling its US candy business. This included brands like 100 Grand, BabyRuth, and Butterfinger. The business was sold to Ferrara Candy Company for about $2.8 billion.

In May 2018, Nestlé and Starbucks made a big deal. Nestlé can now sell and distribute Starbucks coffee globally. This helps both companies reach more customers around the world. In September 2018, Nestlé announced it would sell Gerber Life Insurance.

In 2019, Nestlé started publishing Nutri-Score on its products in European countries. This label helps consumers understand the nutritional value of food. In 2020, Nestlé announced it would invest more in plant-based foods. This includes meat-free products to appeal to younger and vegan consumers.

On February 16, 2021, Nestlé announced it would sell its water brands in the US and Canada. This included spring water and purified water brands. However, it did not include brands like Perrier and S.Pellegrino. The sale was completed in April 2021.

The COVID-19 pandemic actually helped Nestlé. People bought more packaged foods, coffee, dairy, and pet products during lockdowns. This led to Nestlé's strongest sales growth in 10 years.

In April 2021, Nestlé agreed to buy the vitamin company Bountiful Company for $5.75 billion. This showed Nestlé's focus on health and wellness products. In July 2021, Nestlé Health Science bought the Mevalia and ComidaMed brands from Dr. Schär. These brands are used for special dietary needs.

In January 2022, Nestlé announced a program to pay African cocoa farmers if they send their children to school. In May 2022, Nestlé's Health Science unit bought Puravida, a Brazilian company making organic, plant-based foods. Also in May 2022, Nestlé sent baby formula supplies from Europe to the U.S. to help with a shortage.

In September 2023, Nestlé acquired a majority share in Grupo CRM, a premium chocolate maker in Brazil. In February 2024, Nestlé announced it would invest a lot more money in India to expand its manufacturing. Laurent Freixe became the new CEO of Nestlé on September 1, 2024. In May 2025, Nestlé bought a small part of Drools Pet Food in India.

How Nestlé is Organized

Nestlé is the largest food company in the world. Its value was over US$247 billion in May 2015. Nestlé's shares are mainly traded on the SIX Swiss Exchange.

In 2014, Nestlé's total sales were 91.61 billion Swiss francs. They invested 1.63 billion Swiss francs in research and development.

- Sales by Product Type (2014):

- 20.3 billion Swiss francs from powdered and liquid beverages

- 16.7 billion Swiss francs from milk products and ice cream

- 13.5 billion Swiss francs from prepared dishes and cooking aids

- 13.1 billion Swiss francs from nutrition and health science products

- 11.3 billion Swiss francs from pet care products

- 9.6 billion Swiss francs from candy and chocolate

- 6.9 billion Swiss francs from water

- Sales by Region (2014):

- 43% from the Americas

- 28% from Europe

- 29% from Asia, Oceania, and Africa

Financial Information

| Year | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 83.642 | 92.186 | 92.158 | 91.612 | 88.785 | 89.469 | 89.791 | 91.439 | 92.568 | 84.343 | 87.088 |

| Net income | 9.487 | 10.611 | 10.015 | 14.456 | 9.066 | 8.531 | 7.183 | 10.135 | 12.609 | 12.232 | 17.196 |

| Assets | 114.091 | 126.229 | 120.442 | 133.450 | 123.992 | 131.901 | 130.380 | 137.015 | 127.940 | 124.028 | 139.142 |

| Employees | 328,000 | 339,000 | 333,000 | 339,000 | 335,000 | 328,000 | 323,000 | 308,000 | 291,000 | 273,000 | 276,000 |

Capital ownership of Nestlé by country of origin as of 2023: Switzerland (46.6%) United States (31.2%) All others (22.2%)

Joint Ventures and Leadership

Nestlé works with other companies in joint ventures. These partnerships help them create and sell products together.

Some of Nestlé's joint ventures include:

- Cereal Partners Worldwide with General Mills

- Froneri with PAI Partners (for ice cream)

- Lactalis Nestlé Produits Frais with Lactalis

- Nestlé Colgate-Palmolive with Colgate-Palmolive

Here are the Chief Executive Officers (CEOs) of Nestlé over the years:

- 1981-1997: Helmut Maucher

- 1997-2008: Peter Brabeck-Letmathe

- 2008-2016: Paul Bulcke

- 2017-2024: Ulf Mark Schneider

- Since 2024: Laurent Freixe

Nestlé Brands and Products

Nestlé has more than 2,000 brands. They offer a huge variety of products in many different markets. These include coffee, bottled water, milkshakes, breakfast cereals, infant foods, sports nutrition, seasonings, soups, sauces, frozen foods, and pet food. In 2019, the company started making plant-based foods like the Incredible and Awesome Burgers. In 2020, Nestlé announced even more plant-based products, such as soy-based sausages.

Sponsorships and Partnerships

Music and Entertainment

In 1993, Nestlé began sponsoring "The Land" pavilion at Walt Disney's EPCOT Center. They helped update the pavilion. Nestlé continued this sponsorship until 2009.

Nestlé has also supported music festivals. In 2010, Nestlé and the Beijing Music Festival extended their partnership. Nestlé had been a sponsor of this international music festival since 2000. They also partnered with the Salzburg Festival in Austria for 20 years. Together, they created the "Nestlé and Salzburg Festival Young Conductors Award." This award helps find and support young music conductors from around the world.

Sports Sponsorships

Nestlé started sponsoring the Tour de France bicycle race in 2001. This partnership continued for many years. Nestlé Waters, a part of Nestlé, also sponsored the UK part of the Tour de France in 2014.

In 2012, Nestlé became a main sponsor for the International Association of Athletics Federations's Kids' Athletics Programme. This program helps develop young athletes around the world. Nestlé also supported the Australian Institute of Sport (AIS). They funded nutrition programs and research to help athletes.

Company Initiatives

In March 2011, Nestlé became the first infant formula company to meet the standards of the FTSE4Good Index. This index includes companies that show strong environmental, social, and governance practices.

Nestlé created the Creating Shared Value Prize. This award is given every two years. It recognizes companies that find ways to create value for both their business and society. These projects focus on challenges in nutrition, water, or rural development. The winner can receive a large prize to support their work. Nestlé also hosts a global forum to discuss creating shared value.

In 2012, Nestlé started the Rural Development Framework program. This program helps farmers and cocoa-growing communities. It invests in improving local facilities, providing access to clean water, and improving working conditions.

Awards Received

| Year | Brand | Award | Result |

|---|---|---|---|

| 2010 | Nestlé Purina | Malcolm Baldrige National Quality Award | Won |

| 2010 | N/A | IUoFST Gold Food Industry Award | Won |

| 2011 | N/A | World Environment Center Gold Medal Award | Won |

| 2014 | N/A | Henry Spira Corporate Progress Award | Won |

See also

In Spanish: Nestlé para niños

In Spanish: Nestlé para niños

- Big Chocolate

- Controversies of Nestle

- Farfel the Dog

- List of Nestlé brands

- Nestlé Smarties Book Prize

- Nestlé Tower

- Ultra-processed food

Competitors

- Coca-Cola Company

- Danone

- Ferrero SpA

- General Mills

- The Hershey Company

- Highland Spring

- Kellogg's

- Kraft Heinz

- Lactalis

- Mars, Inc.

- Mondelez International

- Müller

- PepsiCo

- Post Holdings

- Unilever