Usury facts for kids

Usury (say: YOO-zhuh-ree) is when someone lends money and charges a very high or unfair amount of extra money back. This extra money is called interest. Sometimes, usury means charging any interest at all, especially in old times. It can be seen as wrong because it takes advantage of people who need money. Someone who practices usury is called a usurer, or sometimes a loan shark today.

Many old societies and religions, like ancient Christian, Jewish, and Islamic groups, thought charging any interest was wrong or even illegal. In ancient India, some higher social groups were not allowed to practice usury. Religious books from Buddhism, Judaism, Christianity, and Islam all speak against it. Even ancient Greece and Rome sometimes made loans with interest illegal. Later, the Roman Empire allowed interest, but with strict rules. In medieval Europe, the Catholic Church and other Christian churches believed charging any interest was a sin. They thought it was wrong to make money just from lending money.

Contents

History of Usury

Many wise people and religious leaders in ancient times spoke out against usury. This included Moses, Plato, Aristotle, and Muhammad. They saw it as an "unjust" way of lending money.

Some historians say that in ancient Near East societies, charging interest was allowed. They thought money or goods could "reproduce" like plants or animals. So, if you lent "food money" (like olives or seeds), it was okay to ask for more back. In places like Mesopotamia and Egypt, interest was legal and often set by the government. But the Hebrew people (Jews) had a different idea.

Roman Empire and Loans

Banking in the Roman Empire was different from today. Rich people often lent money. Interest rates usually ranged from 4% to 12% a year. Sometimes they were much higher, like 24% or 48%. They often talked about rates monthly.

Most loans were private, given to people who were always in debt or just needed money until harvest time. Very rich people took these risks if the profit looked good. Interest rates were set privately and had few laws. Over time, as the Empire faced money problems, this kind of banking declined. Rich people became the main moneylenders. It became clear that usury often meant taking advantage of the poor.

The Roman writer Cicero shared a story about Cato, a famous Roman. Someone asked Cato what was the best way to manage property. He listed good grazing land, then tolerable grazing, then bad grazing, then farming. When asked about lending money with interest (usury), Cato replied, "What do you think of murder?" This shows how strongly some Romans felt against usury.

Usury in Judaism

In Judaism, it is forbidden to charge interest when lending money to another Jew. Lending money should be seen as tzedakah, which means "righteousness" or "charity." This is not just a kind act, but a duty. However, there are rules that allow charging interest to non-Jews, especially if it's the only way for Jewish people to make a living.

The Torah (Jewish scriptures) says:

- "If you lend money to any of My people, even to the poor with you, you shall not be to him as a creditor; neither shall you lay upon him interest."

- "Take no interest from him or increase; but fear your God; that your brother may live with you."

- "You shall not lend upon interest to your brother... Unto a foreigner you may lend upon interest; but unto your brother you shall not lend upon interest."

Some Jewish scholars in the Middle Ages worked to make business dealings fair. During the Middle Ages, Jewish people were often kept out of many jobs by rulers and guilds. This pushed them into jobs like tax collecting and moneylending. This caused problems between lenders and borrowers.

Later, some Jewish law rulings said that the rule allowing interest from non-Jews might not apply to Christians or Muslims. This is because their religions share similar ethical ideas with Judaism.

Usury in Christianity

Bible Teachings

The Old Testament (part of the Christian Bible) says it's wrong to charge interest to a poor person. A loan should be an act of kindness. Making a profit from a loan to a poor person is seen as taking advantage of them. The book of Ezekiel and Deuteronomy also speak against charging interest or taking clothes as a promise for a loan.

The New Testament also teaches about giving rather than just lending: "And if you lend to those from whom you expect repayment, what credit is that to you? Even sinners lend to sinners, expecting to be repaid in full. But love your enemies, do good to them, and lend to them, expecting nothing in return." - Luke 6:34-36

Church Rules Against Usury

Early Christian councils made rules against usury. The First Council of Nicaea in 325 AD said that church leaders (clergy) could not practice usury. At that time, usury meant charging any interest. Later, these rules applied to all Christians.

The Third Council of the Lateran (1179 AD) said that people who took interest on loans could not receive church sacraments or a Christian burial. They said that usury was a "crime" that went against both Old and New Testament teachings.

The Council of Vienne in 1311 AD went even further. It said that believing it was okay to charge usury was a heresy (a belief against church teachings). It also condemned any laws that allowed usury.

In 1515, the Fifth Lateran Council finally gave a clear definition of usury: "when, from its use, a thing which produces nothing is applied to the acquiring of gain and profit without any work, any expense or any risk." This means making money just from lending money, without any effort or risk, was usury. However, this council also said it was okay to charge a small fee for services, as long as no profit was made. This was for groups like "Mounts of Piety," which were like credit unions for the poor.

Medieval Christian Thinking

Saint Anselm of Canterbury was an early Christian thinker who said that charging interest was like theft. Before him, it was seen more as a lack of kindness.

Thomas Aquinas, a very important Catholic theologian, explained why charging interest was wrong. He said it was like charging for a bottle of wine and then charging again for someone to drink it. Money, he argued, is used up when it's spent. So, charging for the money and for its use (by spending it) was like charging twice. He also said it was like selling time, which no one owns. Aquinas was influenced by the Greek philosopher Aristotle, who believed money itself doesn't naturally "reproduce." So, making money from money was unnatural.

Outlawing usury didn't stop people from investing. But it meant that if you invested, you had to share the risk. If you just lent money and expected it back no matter what, without any risk or work, that was usury. However, the Church did allow charges for actual services, like administrative fees from a banker.

Later, some thinkers like Cardinal Hostiensis found situations where charging interest might not be wrong. One idea was lucrum cessans (profits given up). This meant a lender could charge interest to make up for profits they would have earned if they had used the money themselves. This is similar to what we call "opportunity cost" today.

From the 15th to 19th Century

Pope Benedict XIV wrote in 1745 that usury was a sin because a loan should only require returning what was given. Any extra gain was wrong, no matter how small, or if the borrower was rich, or if the money was used well.

Martin Luther, a key figure in the Reformation, also spoke strongly against usury. He believed Christians should lend money to help others, expecting nothing in return.

The Westminster Larger Catechism, used by Presbyterian churches, teaches that usury is a sin against the eighth commandment.

Over time, especially with the rise of capitalism, ideas about money changed. The Catholic Church had to update its understanding of usury. By the 20th century, the Church still said usury was a sin, but it recognized that economic conditions had changed.

Today, some Christian groups still teach that charging interest is sinful, especially if it takes advantage of people in need.

Usury in Islam

Riba (usury) is strictly forbidden in Islam. Because of this, special types of Islamic banking have developed. These banks follow Qur'anic law.

The Prophet Muhammad clearly said that usury from the time before Islam was completely abolished. In Islam, lending and borrowing are seen as ways to help others, not to make a profit. A common rule among Islamic scholars is: "Every loan (qardh) which gives additional benefits is called usury." This means if you lend $1000 and ask for $1100 back, that extra $100 is forbidden.

Usury in England

In England, during the Middle Ages, there were terrible events where Jewish people were attacked and killed. This happened partly because they were often involved in moneylending. In 1275, Edward I of England passed a law called the Statute of the Jewry. This law made usury illegal and linked it to blasphemy (insulting God). This allowed the king to take the property of those who broke the law. Many English Jews were arrested, and their property was taken by the Crown. In 1290, all Jews were ordered to leave England. They could only take what they could carry, and the rest of their property went to the king. Usury was given as the official reason for this expulsion.

In the 1500s, interest rates dropped a lot. This was due to better business methods and more money being available. These lower rates made people less worried about lending with interest, though the debate continued.

The 18th-century rule from the Pope against usury meant it was a sin to charge interest on a money loan. This was based on the idea that money is just for exchanging goods, so charging extra for its use was unfair.

A big change in England came with a law in 1545 by King Henry VIII called "An Act Against Usurie." This law allowed charging interest on lent money.

Usury in Literature

- In The Divine Comedy, Dante puts usurers in the seventh circle of hell, showing how serious the sin was considered.

- In Shakespeare's play "The Merchant of Venice", the story is about loans and the different views on interest held by Jews and Christians. Antonio, a Christian merchant, borrows money from Shylock, a Jew. Shylock charges interest, which he sees as good business, while Antonio thinks it's wrong. When Antonio can't repay, Shylock famously demands a "pound of flesh" as the penalty. This play shows the strong disagreements about loans and interest, and the conflicts between Jewish and Christian cultures.

- By the 1700s, usury was often used as a metaphor in literature, not just a crime.

- In Honoré de Balzac's 1830 novel Gobseck, the main character is a usurer described as both "petty and great."

Usury Laws Today

Laws about usury usually set a maximum legal interest rate for loans. If a lender charges more than this, they might not be able to get the extra money back through a court. In some places, a loan with too much interest can even be canceled.

Charging extremely high interest, especially with threats, is often called loan sharking and is illegal.

Canada

Canada's Criminal Code says that interest rates cannot be higher than 60% per year.

Japan

Japan has laws limiting interest rates. The maximum is usually between 15% and 20% per year. Charging more than 20% can lead to criminal penalties.

United States

In the United States, each state has its own usury laws that set maximum interest rates. However, federal laws have greatly changed this.

- In 1978, the U.S. Supreme Court ruled that nationally chartered banks could charge the interest rate of their home state, no matter where the borrower lived.

- In 1980, a federal law allowed many banks and loan companies to ignore state usury limits. This basically made most state usury laws less powerful.

- The Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 created a Consumer Financial Protection Bureau to regulate some credit practices, but it doesn't set a limit on interest rates.

- It is a federal crime to use violence or threats to collect usurious interest.

Texas

Texas state law has rules against charging more than twice the legal interest rate. If someone does this, they can lose all the money they lent, plus interest, and have to pay the borrower's lawyer fees.

Ways to Avoid Usury and Lend Without Interest

Islamic Banking

In Islamic banking, charging interest (riba) is forbidden. Instead, they use different ways to make money, like partnerships where the lender shares in the profit or loss of a business. This means the lender takes a risk, just like the borrower.

Interest-Free Micro-Lending

With the Internet, it's now easier to do micro-lending. This is where people lend small amounts of money, often with zero interest, to help others start businesses or meet needs. For example, on sites like Kiva, lenders don't get interest, though the people receiving the loans might pay interest to Kiva's local partners.

Non-Recourse Mortgages

A non-recourse loan is a type of loan where the lender can only take the property (like a house) if the borrower can't pay. The borrower is not personally responsible for the debt beyond the value of the property. This means the lender takes the risk if the property's value goes down.

Zinskauf

Zinskauf was a financial tool used in the Middle Ages, similar to an annuity. It was a way to get around the Church's rules against usury. It was seen as buying an annual income rather than taking a loan with interest.

See also

In Spanish: Usura para niños

In Spanish: Usura para niños

- Chrematistics

- Christian finance

- Debt-trap diplomacy

- Greed

- History of banking

- Loansharking

- Money changing

- Payday loans

- Predatory lending

- Credit card interest

- Title loan

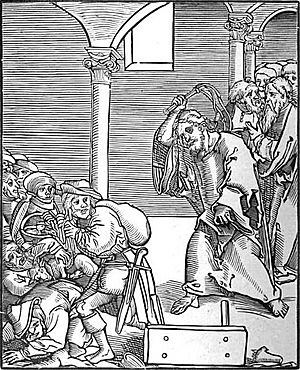

Images for kids

-

St. Bernardino of Siena, treatise on contracts and usury (Tractatus de contractis et usuris), manuscript, 15th century

-

Magna Carta (1215) had rules about debts and usury, especially for heirs who were still children.

| Emma Amos |

| Edward Mitchell Bannister |

| Larry D. Alexander |

| Ernie Barnes |