Barnett Shale facts for kids

Quick facts for kids Barnett Shale |

|

|---|---|

| Country | United States |

| Region | Bend Arch-Fort Worth Basin, Texas |

| Offshore/onshore | Onshore |

| Operators | Devon, Total, GEV Group, EOG, XTO, Range Resources, EnCana, ConocoPhillips, Quicksilver, Chief Oil and Gas, Denbury |

| Field history | |

| Discovery | 1980s |

| Start of production | 1999 |

| Production | |

| Estimated gas in place | 2.1–30×1012 cu ft (59–850×109 m3) |

| Producing formations | Barnett Shale |

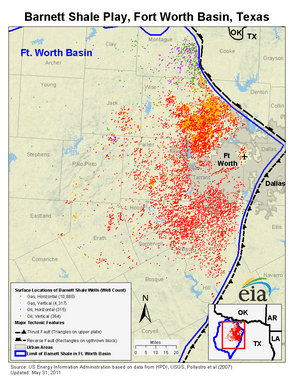

The Barnett Shale is a special type of rock formation found deep underground in Texas. It's made of sedimentary rocks that formed a very long time ago, between 354 and 323 million years ago. This formation is huge, covering about 5,000 square miles (13,000 square kilometers) and stretching across at least 17 counties, including the city of Fort Worth.

The Barnett Shale is known for holding a lot of natural gas. Some experts believe it might have the largest amount of natural gas that can be taken out of the ground in the United States. It's estimated to have billions of cubic feet of natural gas. There's also some oil, but not as much as gas.

This rock formation is called a "tight" gas reservoir. This means the gas is trapped very tightly inside the rock. It was hard to get the gas out until companies learned how to use special methods. These methods include hydraulic fracturing (often called "fracking") and horizontal drilling. These techniques helped unlock the gas from the rock.

Developing this gas field can be tricky because much of it is under cities. This includes the busy Dallas-Fort Worth Metroplex. Local governments are looking for ways to drill without disturbing people. They also want to make sure roads are not damaged by heavy equipment. There are also discussions about how drilling might affect the environment, especially water sources.

Contents

What's in a Name?

The Barnett Shale is named after John W. Barnett. He settled in San Saba County in the late 1800s. He named a nearby stream the Barnett Stream.

Later, in the early 1900s, scientists were making a geological map. They found a thick, dark, organic-rich rock layer near the stream. Because of its location, they decided to call this rock layer the Barnett Shale.

This shale layer has also acted like a natural cap. It helped trap oil and gas in other rock layers nearby.

How the Newark, East Gas Field Grew

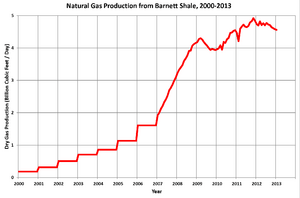

The gas wells that produce from the Barnett Shale are part of something called the Newark, East Gas Field. This field is named by the Texas Railroad Commission. For many years, from 2002 to 2010, the Barnett was the top producer of shale gas in the US. Now, it's the third largest. In 2013, it still produced a big part of all the natural gas in the US.

Early Days and Mitchell Energy

The gas field was first discovered in 1981. A company called Mitchell Energy drilled a well near Newark, Texas. This first well didn't produce much gas.

But the owner of Mitchell Energy, George P. Mitchell, believed in the Barnett Shale. He kept trying to find better ways to get the gas out. Many people in the industry say that few other companies would have kept going. Mitchell is given a lot of credit for making the Barnett Shale a success. His methods helped start a big gas production boom. Other companies then copied his techniques.

Mitchell Energy slowly found ways to get more gas. They tried different methods for "fracking" the wells. In 1986, they used a "massive hydraulic frac" for the first time in the Barnett Shale.

In 1991, Mitchell Energy drilled the first horizontal well in the Barnett. This was done with some help from the government. But it wasn't a big success at first. It took until 1998 for Mitchell to drill more horizontal wells that worked better.

A major breakthrough happened in 1997. A Mitchell Energy engineer named Nick Steinsberger had an idea. He suggested trying a "slickwater frac." This method used more water and higher pressure. It was working well in other areas. When Mitchell Energy tried it in the Barnett Shale, it worked! This new method made it cheaper to complete wells. It also helped them get much more gas out. Soon, other companies heard about this success. They started buying land and drilling wells in the Barnett too.

More Companies Join In

For a while, Mitchell Energy was almost the only company drilling in the Barnett Shale. In 1995, they drilled 70 wells, while all other companies drilled only three. This was because it was hard to make money from the Barnett at first. Mitchell Energy had invested a lot of money without getting it back.

But after 1997, other companies saw that Mitchell had found a way to make a profit. They started buying land and drilling wells quickly. By 2001, Mitchell Energy drilled fewer than half of the new wells.

In 2002, George Mitchell sold his company to Devon Energy.

With better technology and higher gas prices, horizontal wells became more common. By 2005, more new horizontal wells were drilled than vertical ones. In 2008, almost all new wells were horizontal.

It was once thought that only small, thick parts of the shale near Fort Worth would be worth drilling. But new horizontal drilling methods changed this. Techniques like "fracking" made large-scale production possible. Still, a lot of drilling didn't start until gas prices went up in the late 1990s.

Today's Status

As of 2012, the Newark, East Field had spread into 24 counties. There were over 16,000 wells producing gas. In 2011, it produced a huge amount of gas. It was the biggest gas producer in Texas. It made up almost a third of all gas production in the state.

How Wells Are Completed

Two main things helped make drilling in the Barnett Shale possible. These are horizontal drilling and hydraulic fracturing.

Horizontal Drilling

Horizontal drilling has greatly increased the amount of natural gas that can be taken from the Barnett Shale. This method allows drillers to reach gas in thin rock layers. These layers would be too hard to reach with only vertical drilling. A lot of the gas in the Barnett Shale is under the city of Fort Worth. This new technology has attracted many gas companies.

Horizontal drilling also helps get more gas out. In "tight" rock like the Barnett Shale, gas moves through tiny cracks into the well. These cracks can be natural or made by people. A horizontal well goes through more rock. This means it can reach more cracks. So, more gas can flow into the well.

From 2005 to 2007, horizontal drilling in the Barnett Shale moved south. It reached counties like Johnson and Hill. Almost every well drilled there was successful. Even though horizontal wells are now common, some vertical wells are still drilled today.

Hydraulic Fracturing (Fracking)

Hydraulic fracturing is a key process used in the Barnett Shale. It involves pumping a mix of water, sand, and special chemicals into the well. This is done at very high pressure. The pressure creates and widens cracks in the rock deep underground.

This is very important for "tight" rock. It creates more pathways for the gas to flow out of the rock. Without fracking, the wells would not produce enough gas to be worth the effort.

In 1997, Nick Steinsberger from Mitchell Energy tried the "slickwater fracturing" method. This method used more water and higher pump pressure. It proved very successful in 1998. The first 90 days of gas production from one well were better than any other well the company had.

Scientists who work with gas companies have noted something important. The large amount of water needed for fracking could compete with other uses. For example, water is also needed for drinking and farming.

The process of hydraulic fracturing has also received some criticism. Some people are concerned about its effects on water and air quality. They point to cases where methane has been found in nearby water wells.

Money and Jobs

Drilling for gas in the Barnett Shale has brought money to the area. Gas companies pay landowners for the right to drill on their land. They also pay "royalties" based on the gas found. These payments can be a good source of income for landowners.

For example, in 2007, over 100,000 new land leases were signed in Tarrant County. Homeowners in some areas received payments and a percentage of the gas value.

People who support the oil industry say that the Barnett Shale could create many jobs. By 2015, it was thought to be responsible for over 108,000 jobs in Texas. Most of these jobs were in the Fort Worth area.

However, some critics say that the money from gas production might be offset. This is because there could be costs for cleaning up any pollution. Environmental groups have asked regulators to make sure cleanups happen.

A bigger network of gas pipelines is also being built. This helps transport the gas to where it's needed. New pipelines can open up even more areas for drilling.

Gas Reserves

- In 2010, the US Energy Information Administration estimated 31.0 trillion cubic feet of gas.

- In 2011, this estimate increased to 32.6 trillion cubic feet of gas. They also found 118 million barrels of oil.

Who Drills in the Barnett?

As of 2012, there were 235 companies managing gas wells in the Barnett Shale. These are called "operators." Here are some of the top operators, based on how much gas they produced:

- BKV Corporation

- Chesapeake Energy

- XTO Energy

- EOG Resources

- Enervest Operating, L.L.C.

- Quicksilver Resources

- Carrizo Oil & Gas, Inc.

- Legend Natural Gas IV

- Premier Natural Resources II

- Barnett Shale Operating

Where is the Barnett Shale?

The Barnett Shale is divided into "Core" and "Non-Core" areas. The "Core" areas are where the shale is thicker. It's easier and less risky to drill there. This means wells can be drilled even if gas prices are a bit lower.

Core Areas (Active Drilling)

Non-Core Areas (Active or Potential Drilling)

- Dallas (active)

- Bosque (potential)

- Comanche (potential)

- Cooke (active)

- Ellis (potential)

- Erath (active)

- Hamilton (potential)

- Hill (active)

- Hood (active)

- Jack (potential)

- Montague (active)

- Palo Pinto (active)

- Parker (active)

- Somervell (active)

Companies like EOG Resources and Devon Energy have said that a large part of the land in these counties will likely have wells. Few "dry holes" (wells with no gas) are drilled. This is because technology like 3D Seismic helps companies find good spots. It also helps them avoid problems like faults (cracks in the earth) or karst features (like sinkholes). These can make drilling harder or less effective.

Barnett Shale's Impact

The success of the Barnett Shale has inspired companies. They are now looking for other sources of shale gas all over the United States. This includes places like the Antrim Shale in Michigan and the Marcellus Shale in Appalachia. The Barnett Shale showed that it was possible to get gas from these "tight" rock formations.

|