Tariff in United States history facts for kids

Tariffs are like special taxes on goods that come into a country from other places. For a long time, these taxes were super important for the United States. They helped the government make money and also protected new American businesses. This protection meant that goods made in the U.S. could compete better with cheaper products from other countries.

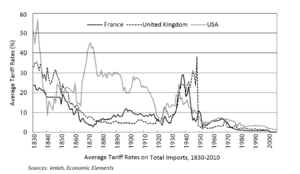

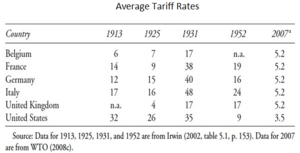

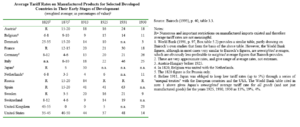

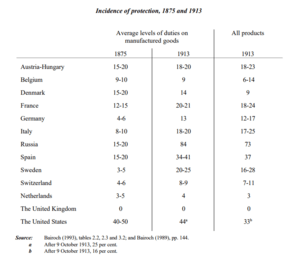

From the early 1800s until the mid-1900s, the U.S. used these protective tariffs a lot. Between 1861 and 1933, the U.S. had some of the highest average tariff rates in the world on manufactured goods. But after 1942, the U.S. started to support free trade around the world, which means fewer tariffs.

According to an expert named Douglas Irwin, tariffs have three main jobs:

- To collect money for the government.

- To limit imports and protect local businesses from foreign competition.

- To make agreements with other countries to lower trade barriers for everyone.

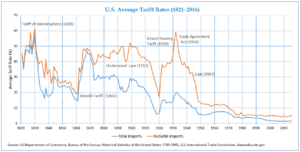

From 1790 to 1860, average tariffs went up from 20% to 60%, then dropped back to 20%. From 1861 to 1933, they stayed around 50%. After 1934, tariffs dropped a lot and settled at about 5%.

Contents

How Tariffs Made Money for the Government

For a long time, tariffs were the main way the U.S. government made money. Sometimes, they brought in almost 95% of all federal income! This changed after 1913 when the federal income tax started.

By 1865, after the American Civil War, other taxes (called excise taxes) brought in more money than tariffs. In 1915, during World War I, tariffs only made up about 30% of government money. Since 1935, the money from tariffs has become a smaller and smaller part of the government's total income.

A Look at Tariff History

After the U.S. became independent in 1783, the first government under the Articles of Confederation couldn't collect taxes directly. This was a big problem! The new U.S. Constitution, created in 1787 and started in 1789, fixed this. It gave the United States House of Representatives the power to create tax and tariff laws.

The new government needed an easy way to collect money from all states without making citizens feel like they were being unfairly taxed again (they had just fought a war over "Taxation without Representation"). So, the Tariff of 1789 was signed by President George Washington. It put a tax of about 5% on almost all imported goods. In 1790, the United States Revenue Cutter Service was created to collect these tariffs. This service later became the United States Coast Guard.

Many American thinkers and politicians believed that free trade (where there are no tariffs) wasn't good for their young country. They thought the U.S. needed to build its own factories and industries, just like Britain had done. They believed the government should protect these new industries with tariffs and sometimes even give them money.

Alexander Hamilton, the first Secretary of the Treasury, was a big supporter of this idea. He argued that new industries needed temporary protection from foreign companies. He said this protection could be import taxes or even banning some imports. Hamilton believed that if a new American industry was protected, it would eventually become cheaper and better than foreign products. He also thought that political independence depended on being economically independent.

Britain had tried to stop American colonies from developing their own industries. This was one reason for the American Revolutionary War. After winning independence, the U.S. quickly used tariffs to protect its new businesses.

The average tariff was about 12.5% between 1792 and 1812. In 1812, all tariffs were doubled to 25% to help pay for the war with Britain. After the war, a new law in 1816 kept tariffs high, especially for cotton, wool, and iron goods. American businesses that grew because of these tariffs pushed to keep them high. By 1820, the average U.S. tariff was 40%.

In the 1800s, leaders like Senator Henry Clay continued Hamilton's ideas. They called it the "American System", which meant protecting industries and building roads and canals. This was different from Britain's idea of free trade.

The American Civil War (1861-1865) was partly about tariffs. The Southern states, which mostly farmed, didn't like tariffs because they made imported goods more expensive. The Northern states, which had more factories, wanted tariffs to protect their businesses. Abraham Lincoln, a leader of the Republican Party, strongly supported tariffs. He said, "Give us a protective tariff, and we shall have the greatest nation on earth." During the Civil War, he put a 44% tariff on imports to help pay for the war and protect industries. The North's victory meant that the U.S. continued to use high tariffs for its industries.

From 1871 to 1913, the average U.S. tariff on imported goods never fell below 38%. During this time, the U.S. economy grew very fast.

In 1896, the Republican Party promised to keep tariffs high. They said it would protect American jobs and businesses, and keep money in the U.S.

In 1913, the average tariff on manufactured goods was lowered from 44% to 25%. However, World War I started soon after, which changed trade patterns a lot. New tariff laws were put in place in 1922.

Some historians say that while the U.S. used tariffs, it was the fastest-growing economy in the world until the 1920s. It was only after World War II that the U.S. truly opened up its trade more.

Tariffs in the Early Years (1789-1828)

The U.S. Constitution gave the federal government the power to tax imports. This meant that states could no longer tax goods coming from other states. The Tariff of 1789 was the first national tax. It was meant to raise money for the government and protect new American industries.

Alexander Hamilton believed that paying off the country's debts was important for its financial future. He also wanted to use tariffs to help new factories grow. At this time, Britain had much better textile (cloth-making) factories and tried to keep their technology secret.

In 1789, a man named Samuel Slater illegally left Britain because he knew how to build textile machines. He came to the U.S. and built the first successful textile factory in Pawtucket, Rhode Island. At first, American textiles were a bit more expensive, but the tariff helped protect this new industry.

During and after the War of 1812, tariffs were raised again. Leaders like Henry Clay and John C. Calhoun saw that having American industries was important, especially during wartime, to avoid shortages. Factory owners in the Northeast also wanted higher tariffs to protect them from cheaper British goods after the war.

As factories grew, manufacturers and workers wanted even higher tariffs. They believed their businesses and higher wages needed protection from countries with lower wages and more efficient factories. The Tariff of 1828, nicknamed the "Tariff of Abominations" by those who opposed it, raised import taxes to over 25%.

Southern states, especially South Carolina, were very angry about these high tariffs. They had few factories and imported many goods, so the tariffs made things more expensive for them. They even threatened to ignore the federal law. President Andrew Jackson said he would use the army to enforce the law, and a compromise was reached to slowly lower tariffs over ten years.

Tariffs and Political Parties (1829-1859)

During this time, the Democrats generally wanted low tariffs, just enough to pay for the government. Their opponents, the Whigs, wanted high tariffs to protect industries.

When the Democrats were in power, they lowered tariffs. When the Whigs won, they raised them. In 1834, the U.S. paid off its national debt, and President Andrew Jackson cut tariffs by about half.

Henry Clay and the Whigs wanted high tariffs to help factories grow quickly. They argued that new "infant industries" were less efficient than European ones and that American workers earned higher wages. These arguments convinced people in industrial areas.

The Democrats won in 1845, and President James K. Polk passed the Walker tariff of 1846. This tariff lowered rates to about 25% and aimed to only raise enough money for the government, without favoring any specific industry. This actually increased trade and brought in more money.

In 1857, tariffs were lowered even more to 18%. This made many Northern factory owners and workers angry, especially in Pennsylvania, who wanted protection for their iron industry. The new Republican Party, formed in 1854, also supported high tariffs to help industries grow.

Tariffs and the Civil War (1860-1912)

The Morrill Tariff, which significantly raised tariff rates, became law in March 1861, just before the Civil War began. This was possible because Southern Senators left Congress when their states seceded from the Union, leaving Republicans in charge.

During the Civil War, the government needed a lot more money. Tariffs were raised again and again, along with other taxes. However, most of the money for the war came from loans, not taxes or tariffs.

The Southern states, forming the Confederate States of America, also tried to collect tariffs, but the Union Navy blocked their ports, so they didn't get much money from them.

After the Civil War, high tariffs stayed in place because the Republican Party remained in power. Supporters said tariffs helped the whole country become rich.

The iron, steel, and wool industries were very good at getting high tariffs because they supported the Republican Party. Factory workers also supported tariffs, believing they led to higher wages.

By the 1880s, American industries and farms were among the most efficient in the world. They were leading the Industrial Revolution. Most imports to the U.S. were luxury goods. In fact, British newspapers complained that cheaper American products were flooding their country.

For example, between 1867 and 1900, U.S. steel production grew over 500 times! Tariffs helped the U.S. steel industry invest in new technology and become very competitive. By 1897, American steel rails were cheaper than British ones, even without the tariff.

Democratic President Grover Cleveland argued in 1887 that high tariffs were unfair to consumers. The election of 1888 was largely about tariffs, and Cleveland lost. Republican William McKinley argued that tariffs kept money, jobs, and factories in the U.S. for the benefit of Americans.

McKinley won the 1896 election by promising that high tariffs would bring prosperity. The Dingley tariff of 1897 raised tariffs back to 50%.

Tariffs in the 1900s to Today

In 1913, with the new income tax bringing in money, Democrats were able to lower tariffs with the Underwood Tariff. But World War I started in 1914, changing trade patterns a lot. The income tax also made tariffs less important for government money.

When Republicans came back to power in 1921, they raised tariffs again. They raised them even higher with the Smoot–Hawley Tariff Act of 1930 at the start of the Great Depression. This made the depression worse because other countries put their own tariffs on American goods, and trade dropped sharply.

By 1936, the issue of tariffs was not as important in politics, and they brought in little money. In World War II, tariffs were not a big deal compared to wartime trade. Low tariffs became the main idea for the rest of the 1900s.

In 2017, President Donald Trump promised to use protective tariffs to help the economy. In 2018, he put tariffs on solar panels, washing machines, steel, and aluminum from many countries. He also put a 25% tariff on many goods from China.

Tariffs and the Great Depression

Many experts now believe that the Smoot–Hawley Tariff Act of 1930 did not cause the Great Depression. They point out that the stock market crash happened before the tariff was signed. Also, trade was only a small part of the world's economy at the time. Even if all international trade stopped, it wouldn't explain the huge drop in the economy.

Economists like Milton Friedman and Paul Krugman have argued that tariffs don't necessarily lead to recessions. They say that while exports might decrease, the increase in demand for home-produced goods can balance it out. The big drop in trade during the Great Depression was mostly a result of the depression itself, not the tariffs.

Opening Up Trade

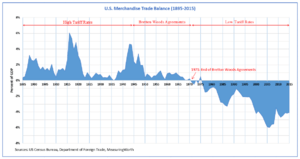

After 1934, the U.S. Congress allowed the President to make agreements with other countries to lower tariffs. The idea was that lowering tariffs would help the economy grow. Between 1934 and 1945, the U.S. made over 32 such agreements.

After World War II, the U.S. helped create the General Agreement on Tariffs and Trade (GATT) in 1947. This agreement aimed to lower tariffs and open up trade among capitalist countries. In 1995, GATT became the World Trade Organization (WTO), which promotes low tariffs worldwide.

Today, only about 30% of goods imported into the U.S. have tariffs. The average tariffs are at a very low level.

Trade After World War II

After World War II, American industries did very well. But after 1970, they faced tough competition from countries with lower production costs. Many American factories, especially in steel, TVs, shoes, and textiles, struggled or closed.

For example, Japanese car companies like Toyota and Nissan started to compete with American carmakers. Instead of high tariffs, the U.S. and Japan agreed to limit the number of Japanese cars imported. This actually encouraged Japanese companies to make more expensive cars, which then competed with larger American cars.

The Chicken tax is another example. In 1964, President Lyndon B. Johnson put a 25% tax on imported light trucks (like Volkswagen vans) because Germany had put tariffs on U.S. chicken. This was also a way to help American auto workers.

1980s to Today

During the 1980s and 1990s, Republican presidents like Ronald Reagan and George H. W. Bush moved away from protectionist policies. They supported agreements like the Canada–U.S. Free Trade Agreement (1987) and the North American Free Trade Agreement (NAFTA) in 1994. NAFTA aimed to create a larger market for American businesses by including Canada and Mexico. President Bill Clinton also supported NAFTA, even though labor unions were against it.

In 2000, China joined the WTO, which meant the U.S. gave China "most favored nation" trading status, leading to lower tariffs on Chinese goods.

Supporters of free trade believed it would lead to lower prices for consumers and a more prosperous future based on skills and knowledge. However, labor unions worried that it would mean lower wages and fewer jobs for American workers who couldn't compete with very low wages in other countries.

Some tariffs have been harder to change. For example, U.S. agricultural subsidies (money given to farmers) have not decreased much, partly due to tariffs from Europe.

In 2002, President George W. Bush placed tariffs on imported steel.

What About Losing Jobs?

Some groups, like the Economic Policy Institute, argue that free trade has led to a large trade deficit in the U.S. for many years. This means the U.S. imports more than it exports. They say this has caused many factories to close and millions of manufacturing jobs to be lost. These lost jobs are often replaced by lower-paying service jobs.

They also argue that trade agreements have actually increased trade deficits. For example, they say China's trade practices, like manipulating its currency and giving subsidies, give it an unfair advantage.

The manufacturing sector is important because it creates high-paying jobs and leads to a lot of research and development. It also supports many other service jobs like accounting and engineering. So, losing manufacturing jobs can hurt the overall economy.

Stopping Smuggling: The Coast Guard's Role

Historically, when tariffs were high, people tried to smuggle goods into the country to avoid paying the taxes. To stop this, the United States Revenue Cutter Service was created in 1790. Today, it's known as the United States Coast Guard, and it's still a main force for enforcing maritime laws.

The U.S. Customs and Border Protection (CBP) is another agency that helps. They regulate international trade, collect customs duties (tariffs), and enforce U.S. trade laws. When goods arrive at a border or port, customs officers check them and collect the tariff before the goods can enter the country. Collecting customs duties is one of the easiest ways for the government to get money.

What American Leaders Said About Tariffs

Many important American politicians have had strong opinions about tariffs throughout history.

George Washington

President George Washington supported buying American-made products. He signed one of the first tariff laws, which aimed to encourage and protect American manufacturing. In 1790, he said that a free country should make its own goods, especially military supplies, to be independent.

Thomas Jefferson

President Thomas Jefferson's views on tariffs changed over time. After the War of 1812, he believed that some level of protection for American industries was needed to keep the nation politically independent. He encouraged people to buy American-made goods, even if they cost a bit more.

Henry Clay

In 1832, Senator Henry Clay strongly opposed "free traders" who wanted no tariffs. He believed that their ideas would make the U.S. dependent on Britain again. Clay said that true free trade should be "fair, equal and reciprocal," and that it had never existed and never would. He warned against buying foreign goods without thinking about how it affected American industries.

James Monroe

In 1822, President James Monroe noted that while free trade might sound good in theory, the conditions needed for it (like everyone agreeing and international peace) rarely happen. He believed there were strong reasons to support American manufacturing.

Abraham Lincoln

President Abraham Lincoln was a big supporter of protective tariffs. He said, "Give us a protective tariff and we will have the greatest nation on earth." He believed that tariffs would eventually make domestic products cheaper and that they were a fair way to raise money because the cost fell mostly on those who bought foreign luxury goods. He also thought tariffs were less intrusive than other taxes.

William McKinley

President William McKinley believed that protectionism was essential for American industry and workers. He argued that free trade would hurt American jobs and homes. He famously said, "Buy where you can pay the easiest," meaning buy where labor earns the most, which he believed was in America with protective tariffs. He thought tariffs made life "sweeter and brighter" for Americans.

Theodore Roosevelt

President Theodore Roosevelt also believed that America's economic growth came from protective tariffs, which helped the country industrialize. In 1902, he said that great prosperity in the U.S. had always happened under a protective tariff system.

Donald Trump

The Trump tariffs were special taxes put in place by President Donald Trump through executive orders. In 2018, he put tariffs on solar panels, washing machines, steel, and aluminum from many countries. He also put a 25% tariff on many goods from China. These actions were part of his economic policy to protect American industries.

Images for kids

| Selma Burke |

| Pauline Powell Burns |

| Frederick J. Brown |

| Robert Blackburn |