Income tax in the United States facts for kids

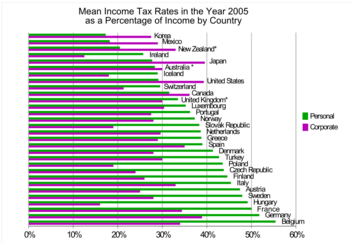

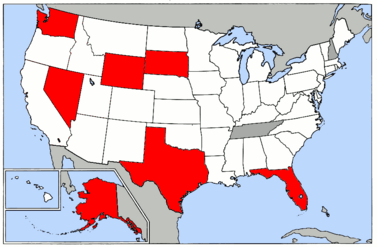

In the United States, people pay income taxes to the U.S. government, most state governments, and many local governments. This means people pay taxes based on how much money they earn.

Contents

What are Income Taxes?

Income taxes are based on what a person earns in one calendar year. This is usually between January 1 and December 31.

When the government takes income taxes, it takes a percentage of a person's income. This percentage is called an income tax rate. It is the part of your money that the government collects.

The U.S. government and most states use progressive tax rates. This means that as a person earns more money, their income tax rate gets higher. So, if you earn more, you pay a higher percentage in taxes.

Every year, the government puts incomes into groups. These groups are called tax brackets. Each tax bracket has a range of incomes. This shows the lowest and highest amounts a person can earn to be in that group.

Tax brackets are important because each one has a different tax rate. People in a higher income group pay a larger percentage of their income in taxes. These different rates for each tax bracket are called marginal tax rates.

For example, in 2016, here are the tax brackets and marginal tax rates for single people:

| If a person earns this much income (They are in this tax bracket): |

The government can take this percentage of their income (This is their marginal tax rate): |

|---|---|

| $0 – $9,275 | 10% |

| $9,276 – $37,650 | 15% |

| $37,651 – $91,150 | 25% |

| $91,151 – $190,150 | 28% |

| $190,151 – $413,350 | 33% |

| $413,351 – $415,050 | 35% |

| $415,051 and above | 39.6% |

How Marginal Tax Rates Work

This does not mean that someone earning $415,051 pays 39.6% of all their money in taxes. Tax rates in the United States are marginal. This means different parts of a person's income are taxed at different rates.

For example, if someone earns $9,276 in a year, they do not pay 15% on the whole amount. The first $9,275 they earned is in the first tax bracket ($0 – $9,275). This bracket has a 10% tax rate. They pay 10% tax on that part of their income.

They have only $1 left that falls into the next tax bracket ($9,276 – $37,650). They only pay that bracket's 15% tax rate on that one dollar.

So, the chart above means that in 2016, for a single person:

| A person will have to pay this tax rate: | For this part of their income ONLY: |

|---|---|

| 10% | Anything between $0 – $9,275 |

| 15% | Anything above $9,275, up to $37,650 |

| 25% | Anything above $37,650, up to $91,150 |

| 28% | Anything above $91,150, up to $190,150 |

| 33% | Anything above $190,150, up to $413,350 |

| 35% | Anything above $413,350, up to $415,050 |

| 39.6% | Anything above $415,050 |

Not All Income is Taxed

The government usually uses a person's gross income to decide how much they should be taxed. Gross income is all the money a person earned in a year.

However, some types of income are not taxed.

What are Deductions?

Deductions are certain costs that the government does not tax. The government will lower (or "deduct") these costs from a person's gross income. This means the government taxes the person on less money.

There are many kinds of deductions. Some deductions are available to anyone who pays taxes. For example, if a person paid to move, saved money in a retirement fund, or paid student loan interest, they can deduct these costs. The government will not tax these amounts.

The federal government also gives a standard deduction to most people. For example, in 2015, a single person's standard deduction was $6,300. The government does not tax this amount.

Sometimes people have other deductions that add up to more than the standard deduction. These can also lower the amount of income the government can tax.

Personal Exemptions

The federal government allows each person who files taxes to take a "personal exemption." When the United States Congress made tax rules in 1954, they decided a certain amount of money should not be taxed. This money is for basic needs like food and housing.

In 2015, the personal exemption for one person was $4,000. Most people can take another exemption for their spouse. They can also take one for each child in their home.

State Deductions

Many states have their own deductions. For example, if a person in Massachusetts pays rent, they can deduct half of their rent (up to $3,000). This lowers the income the government can tax them on.

What are Credits?

The federal government also offers tax credits. If a person spends money on certain things and meets all the rules, the government will give them back that money.

For example, the Child and Dependent Care Credit helps parents who work. It helps if they pay over $3,000 a year for childcare while they are working. Each credit has specific rules. If parents meet them, the federal government will reduce their taxes by $3,000. This helps them continue to work.

Filing Taxes

Every year, most people in the United States must report their income. They also report their deductions, credits, and other tax information. This report is called a tax return.

The tax return helps figure out what a person might owe the government. Or, if a person has already paid too much tax, the government might owe them money. This is called a tax refund.

Usually, all tax returns are due by April 15. However, because of holidays in Washington, D.C., "Tax Day" sometimes moves a few days later.

Filing Status Options

There are five different ways a person or a couple can file their tax returns:

- Single: People file this way if they are not married and do not fit other categories.

- Married Filing Jointly: A married couple can file one tax return together. Both people put their income and information on the same form. This is called a "joint return."

- Married Filing Separately: A married couple can file two different tax returns. One for each person, if they want to pay their taxes separately.

- Head of Household: A person can file this way if they are not married. They must pay most of the costs for their home. Also, a certain type of relative must have lived with them for more than half of the year.

- Qualified Widower with Dependent Child: If a person's spouse died during the tax year, they can still file a joint return. This is as if their spouse was still alive. A widower can only do this in the year their spouse died.

Sometimes a person fits into more than one category. If this happens, they can choose the category that lets them pay the least amount of taxes.

Why Filing Status Matters

Filing status is important because many things change based on how a person files. For example:

- Tax brackets and marginal income tax rates are different for each filing status.

- The standard deduction is different for different filing statuses.

- People in some tax brackets may not be able to get certain deductions and tax credits.

- A person's filing status may even affect if they have to file a tax return at all.

Example of a Tax Calculation

Here is a simple example of how someone would figure out their taxes. This is based on their income, filing status, and deductions.

- Gross (total) income: $20,000

- Filing Status: Single

- Deductions: Standard deduction ($6,300) and one personal exemption ($4,000)

First, the person needs to find their taxable income. This is the amount of income the government can tax. It does not include deductions. To get their taxable income, the person needs to subtract their deductions from their gross income.

$20,000 (gross income) – $6,300 (standard deduction) – $4,000 (personal exemption) = $9,700 taxable income

Now the person can use the tax brackets and marginal tax rates. Here are the rates that apply to this person:

| Tax bracket | Marginal tax rate | Which means... | A person will have to pay this tax rate: | For this part of their income ONLY: |

|---|---|---|---|---|

| $0 – $9,275 | 10% | 10% | Anything between $0 – $9,275 | |

| $9,276 – $37,650 | 15% | 15% | Anything above $9,275, up to $37,650 |

- Out of $9,700 in taxable income:

- The first $9,275 will always be taxed at 10%. $9,275 x 10% = $927.50.

- The person has $425 of income above $9,275 ($9,700 - $9,275). This $425 will be taxed at 15%. $425 x 15% = $63.75.

- Total income tax is $927.50 + $63.75 = $991.25

This person is paying only 4.9% of their total income to the government in income taxes.

What Federal Income Taxes Pay For

According to the White House, in 2014, the United States government spent federal income taxes on these things:

| Percentage of Taxes |

Spent On | For Example |

|---|---|---|

| 27.49% | Health care | Medicare and Medicaid (help paying medical costs for elderly ex-workers and for very poor, often disabled people) |

| 23.91% | National defense | Defending the country; paying soldiers' salaries; paying for new weapons for the U.S. military |

| 18.17% | Job and family security | Programs to give free food, tax credits, and other help poor families |

| 9.07% | Net interest | The total amount of interest the U.S. had to pay to other countries who have given the U.S. loans |

| 5.93% | Veterans' benefits | Pays for health care, home loans, pensions, education, and help with disabilities for veterans |

| 3.59% | Education and job training | Financial aid (which helps students pay for university); job training programs; special education |

| 2.00% | Immigration, law enforcement, and administration of justice | Making the borders secure, paying for lawsuits, other court-related costs |

| 1.85% | International affairs | Spending on humanitarian aid for other countries; spending on U.S. Embassies across the world |

| 1.64% | Natural resources, energy, and environment | Controlling pollution, making energy, making the environment cleaner |

| 1.13% | Science, space, and technology programs | Spending on science, scientific research, and the space program |

| 0.97% | Agriculture | Money paid to farmers to help them grow crops; agricultural research; crop insurance |

| 0.43% | Community, area, and regional development | Spending on things to make communities stronger, like building housing and community centers |

| 0.39% | Responding to natural disasters | Costs of helping Americans (and American businesses) who have survived a major natural disaster |

| 3.42% | Other government programs | All other government programs, like controlling trade and making the government work |

-

Federal income taxes help pay for poor children to get health care through Medicaid

-

They help pay soldiers like these Marine Corps firefighters

-

They help pay the FBI and other federal law enforcement agencies

What State and Local Income Taxes Pay For

Every state decides how to spend the income tax it collects. This money is called its income tax revenue. Different states use this money for different things.

Education and Health Care Spending

In 2015, a report looked at what states spent their income tax revenue on. It found that most state income tax dollars went to education and health care.

States spent over half of their income tax revenues on three main things:

- Public elementary and secondary schools. State and local governments pay 90% of public school costs. This includes paying teachers, buying books, and other school needs. On average, states paid one-fourth of their income tax revenues for public education.

- Higher education. States paid about 13% of their income tax revenues to support community colleges, state (public) universities, and vocational schools.

- Health care. States help the federal government pay for health care programs like Medicaid. These programs help pay for health care for poor people, the elderly, and people with disabilities. States spent about 16% of their income tax revenues on these programs.

Other Important Services

The 2015 report found that states spent the other half of their income tax revenues on many different things. Here are some examples.

Transportation makes up about 5% of state spending. Income taxes pay for things like:

- Building roads, highways, and bridges.

- Making sure roads and bridges are safe, and fixing them.

- Public transportation.

- Cleaning snow and ice off the roads in the winter to make them safe.

States spend about 4% of their income tax revenue on corrections. These income taxes pay for things like:

- Prisons (including paying guards and keeping prisoners safe).

- Treatment programs in prison (for example, for people with addictions).

- Educational and job training programs in prison.

- Programs for children who commit crimes.

Public Services in Your Community

Many states also use income tax revenues to pay for important "public services," like:

- Public safety

- Police departments, and some fire departments and emergency medical services.

- Equipment for these departments, like ambulances.

- Salaries for police officers, firefighters, and Emergency Medical Technicians (EMTs).

- Trash collection and street lighting.

- Free public libraries and public parks.

- Paying the costs to keep the state government working, including salaries for government workers.

Graphs

- Hover over each photo to view its label. Click on the picture to make it bigger.

-

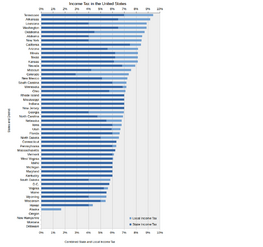

Graph showing average state income tax rates (in dark blue), and local tax rates in those states (in light blue) (2014)

Images for kids

-

The U.S. federal effective corporate tax rate has become much lower than the nominal rate because of various special tax provisions.

-

President Abraham Lincoln and the United States Congress introduced in 1861 the first personal income tax in the United States.

-

Amendment XVI in the National Archives

See also

In Spanish: Impuesto sobre la renta (Estados Unidos) para niños

In Spanish: Impuesto sobre la renta (Estados Unidos) para niños