Economy of the Republic of Ireland facts for kids

The International Financial Services Centre in Dublin

|

|

| Currency | Euro (EUR, €) |

|---|---|

| Calendar year | |

|

Trade organisations

|

EU, WTO and OECD |

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

|

GDP growth

|

|

|

GDP per capita

|

|

|

GDP per capita rank

|

|

|

GDP by sector

|

|

|

|

|

Population below poverty line

|

|

| ▼ 28.9 low (2018, Eurostat) | |

|

|

|

Labour force

|

|

|

Labour force by occupation

|

|

| Unemployment |

|

|

Average gross salary

|

€4,002 monthly (2023-Q1) |

|

Average net salary

|

€3,086 monthly (2023-Q1) |

|

Main industries

|

|

| External | |

| Exports |

|

|

Export goods

|

|

|

Main export partners

|

|

| Imports |

|

|

Import goods

|

|

|

Main import partners

|

|

|

FDI stock

|

|

|

Gross external debt

|

▲ €2.954 trillion (June 2022) |

|

Net international investment position

|

|

| Public finances | |

|

Public debt

|

|

| Revenues |

|

| Expenses |

|

| Economic aid |

|

|

Credit rating

|

|

|

Foreign reserves

|

|

|

All values, unless otherwise stated, are in US dollars. |

|

The economy of the Republic of Ireland is a very advanced and modern economy. It focuses on services like high-tech and financial services. It also includes life sciences and agribusiness, which means farming and food production. Ireland is known as an open economy, meaning it trades a lot with other countries. It's also a top spot for big international companies to invest their money.

After a long period of growth, Ireland faced a tough economic time from 2008 to 2013. This was due to a worldwide financial crisis and problems with its own housing market. However, the country worked hard to recover. By 2013, experts predicted that Ireland's economy would start growing again.

Sometimes, the way Ireland's economy is measured can seem a bit strange. This is because many large international companies have their offices there. These companies can make Ireland's economic numbers look much bigger than they actually are for the average person. To get a clearer picture, the Central Bank of Ireland created a special way to measure the economy called "modified GNI" (or GNI*). This helps show the true size of Ireland's economy.

Big foreign companies are still very important to Ireland. They make up many of the top businesses, employ a lot of people, and pay a large share of the country's taxes.

Contents

How Ireland's Economy Works

Ireland's economy is strongly influenced by large international companies. These companies often use special tax rules in Ireland. This can make the country's economic numbers, like its GDP, seem much higher.

Understanding Economic Measures

To get a better idea of Ireland's true economic health, a special measure called modified GNI (or GNI*) was created. This helps to show the actual wealth created within Ireland, not just by international companies. For example, in 2016, Ireland's GDP was much higher than its GNI*. This shows how much big companies affect the numbers.

Impact of International Companies

Many large companies, especially from the United States, have offices in Ireland. They employ many people and contribute a lot to the economy. However, their tax strategies can make Ireland's economic statistics look different from what they really are.

A Look at Ireland's Economic Past

Ireland's economy has changed a lot over time. For many years, especially after it became the Irish Free State in the 1920s, Ireland had high taxes on imported goods. This was meant to protect local businesses.

From Tough Times to Growth

In the 1950s, many people left Ireland to find work. It became clear that the old economic rules weren't working. In 1958, a new plan was introduced. It suggested free trade and inviting foreign companies to invest in Ireland.

The 1970s saw some growth, but government spending and debt also increased. By the 1980s, Ireland faced serious problems. Unemployment was high, and many people were still leaving the country.

In 1987, the government made big changes. They cut spending, lowered taxes, and encouraged more competition. This helped companies like Ryanair grow. Soon, big tech companies like Intel, Microsoft, and Google started investing in Ireland. This led to a period of strong economic growth.

The Celtic Tiger Years (1995–2007)

The period from 1995 to 2007 is known as the "Celtic Tiger." This was a time of very fast economic growth in Ireland. It was similar to the "tiger economies" of East Asia.

Several things helped this growth:

- Low taxes: Ireland offered low taxes to businesses.

- Business-friendly rules: The government made it easy for companies to operate.

- Skilled workers: Ireland had a young workforce good with technology.

- EU membership: Being part of the European Union gave Ireland access to new markets and financial support.

During this time, people spent more, construction boomed, and businesses invested a lot. However, prices also went up, especially for houses.

Economic Challenges (2008–2013)

In 2008, Ireland was one of the first countries in Europe to enter a recession. This was a difficult time for the economy. Many people had borrowed a lot of money for houses, and when the housing market crashed, it caused big problems for banks.

The government had to step in to help the banks, which cost a lot of money. This led to higher national debt. Unemployment also rose significantly.

To fix the economy, the Irish government created a plan in 2010. This plan included:

- Cutting public spending: Less money was spent on government services.

- Increasing taxes: People paid more in taxes, including a new property tax.

- Introducing water charges: People started paying for their water use.

These changes were tough, but they helped reduce the government's debt. Unemployment also started to fall.

Signs of Recovery (2014–2016)

By late 2013, Ireland officially finished its financial bailout program. The economy began to recover in 2014, becoming one of the fastest-growing in the European Union.

Things that helped the recovery included:

- More construction: The building sector started to grow again.

- Low oil prices: This made things cheaper for businesses and people.

- Weak euro: This made Irish exports more affordable for other countries.

Unemployment continued to fall, though it was still higher for young people. House prices also started to rise again, especially in Dublin, due to a shortage of homes.

In 2015, Ireland's GDP showed a huge jump, which was nicknamed "leprechaun economics" by an economist. This big jump was mainly because some large international companies, like Apple Inc., changed how they managed their money in Ireland for tax reasons. This made the economic numbers look much bigger than the actual activity on the ground.

Because of this, the Central Bank of Ireland created the "Irish GNI*" measure. This new way of counting helps to show a more accurate picture of Ireland's economy, without the big effects of these international company tax strategies.

Key Economic Areas

Ireland's economy is made up of many different parts. Here are some of the most important ones:

Aircraft Leasing

Ireland is a global leader in aircraft leasing. This means that companies in Ireland own and rent out airplanes to airlines around the world. Irish companies manage a huge portion of the world's leased aircraft fleet.

Drinks Industry

The drinks industry, including beer, cider, spirits, and whiskey, is a big part of the economy. It employs many people in farming, brewing, and distilling.

Engineering

The engineering sector in Ireland involves many international companies. They work in areas like industrial products, aerospace, and automotive parts.

Energy Production

Ireland uses natural gas for much of its electricity. It also has some peat-fired power plants, but these are being used less. The country is looking into more renewable energy sources.

Exports and Trade

Exports are very important for Ireland's economy. The country sells a lot of pharmaceuticals (medicines), medical devices, and software to other countries. Ireland is also a major producer of zinc and lead.

Financial Services

Ireland has a strong financial services sector. Many banks and financial companies are based in places like the International Financial Services Centre (IFSC) in Dublin. They provide services to businesses all over Europe.

Technology and Communication

The ICT sector is huge in Ireland. Many of the world's top tech companies, like Google, Facebook, Twitter, and Microsoft, have their European headquarters in Ireland, especially in areas like Silicon Docks in Dublin.

Medical Technologies

The MedTech sector is growing fast. Companies here make medical devices and other health-related products.

Pharmaceuticals

Ireland is a major hub for pharmaceuticals companies. These companies make medicines and other health products, and their exports are a big part of Ireland's trade.

Software Development

Ireland is one of the world's largest exporters of software. Many global tech companies have large software operations in the country.

Farming and Natural Resources

- Further information: Natural resources of the Republic of Ireland

Farming, fishing, and mining make up a smaller but important part of Ireland's economy. Ireland has fertile land, especially for raising cattle and producing dairy.

Ireland is a big exporter of beef and dairy products. While much of the country was deforested in the past, there are now efforts to plant more trees. Ireland also has natural gas fields and mines for minerals like zinc and lead.

Money and Taxes

Welfare Benefits

Ireland provides financial support to people who are unemployed or retired. For example, a single person who is unemployed receives a weekly payment called Jobseeker's Allowance. There are also state pensions for older people.

Wealth and Taxes

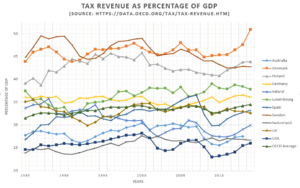

The amount of tax collected in Ireland has changed over the years, usually staying around 30% of the country's GDP.

Ireland's Currency

Before 2002, Ireland used its own money called the Irish pound. In January 1999, Ireland joined many other European countries in using the euro.

Euro banknotes (paper money) are the same across Europe. However, each country in the eurozone has its own unique design on one side of the euro coins. Ireland's euro coins feature a Celtic harp, which is a traditional symbol of the country. The coins also show the year they were made and the word Éire, which means "Ireland" in the Irish language.

Images for kids

-

A glassblower at the Waterford Crystal factory.

See also

In Spanish: Economía de Irlanda para niños

In Spanish: Economía de Irlanda para niños

| Mary Eliza Mahoney |

| Susie King Taylor |

| Ida Gray |

| Eliza Ann Grier |