Equinor facts for kids

|

|

|

Formerly

|

Statoil (until 15 May 2018) |

|---|---|

| Public | |

| Traded as |

|

| Industry | Petroleum industry |

| Founded | 14 June 1972 |

| Headquarters | Stavanger, Norway |

|

Key people

|

Jon Erik Reinhardsen (chair) Anders Opedal (CEO) |

| Products | |

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

| Owner |

|

|

Number of employees

|

25,155 (2024) |

Equinor ASA is a big energy company from Norway. Its main office is in Stavanger, Norway. It used to be called Statoil and StatoilHydro.

Equinor mostly works with petroleum (oil) and natural gas in 36 countries. It also invests in renewable energy, like wind and solar power. In 2023, Equinor was ranked as the 52nd largest public company in the world. As of 2021, the company had 21,126 employees.

The company we know today was created in 2007. This happened when Statoil merged with the oil and gas part of another company called Norsk Hydro. The Government of Norway owns most of Equinor, about 67% of its shares. The rest of the shares are owned by the public.

The name Equinor was chosen in 2018. It combines "equi," which means things like "equal" or "balance," with "nor," which shows it's from Norway. The old name, Statoil, meant "state oil" in Norwegian. This showed that the oil company was owned by the government.

Contents

Company History

Equinor's story comes from three important Norwegian oil companies. These were Statoil, Norsk Hydro, and Saga Petroleum. Saga Petroleum joined Norsk Hydro in 1999.

Early Days of Statoil

Den Norske Stats Oljeselskap A/S was started by the Norwegian government on July 14, 1972. The government wanted Norway to be involved in the oil industry. They also wanted to build up Norwegian skills in the oil business. This helped create a local oil industry. Statoil had to talk about important plans with the government. It also had to give a yearly report to the Norwegian parliament.

In 1973, Statoil began working in the petrochemical industry. This led to building processing plants in places like Rafnes and Mongstad. In 1981, Statoil became the first Norwegian company to operate an oil field on the Norwegian continental shelf. This was the Gullfaks field. In the late 1980s, Statoil faced a big challenge known as the Mongstad scandal. This led to the CEO, Arve Johnsen, stepping down.

During the 1980s, Statoil decided to become a full oil company. It started building its own fuel station brand. It bought stations in Norway, Denmark, and Sweden. It also bought stations in Ireland. In the 1990s, Statoil opened stations in parts of Eastern Europe.

In 1991, Statoil had a disagreement with environmental groups. These groups protested against building a new research center in Trondheim. The area was a wetlands important for birds. Even with protests, the center was built.

In 2001, Statoil became a public company. Its shares were listed on the Oslo Stock Exchange and the New York Stock Exchange. Its name changed to Statoil ASA. The government still owned most of the shares, about 81.7%. By 2005, the government's share was reduced to 70.9%.

In 2006, Statoil paid a fine for improper business practices in Iran in 2002–2003. This was related to trying to get oil contracts.

In September 2007, Statoil and the Brazilian oil company Petrobras made a deal. They planned to explore for oil and gas and work on biofuels together. Statoil also bought a large share of the Peregrino oil field in 2008.

In 2007, Statoil bought a large area in the Athabasca Oil Sands in Canada. This was after buying North American Oil Sands Corporation. In 2009, Statoil launched Hywind, the world's first floating wind turbine in deep water. It was tested near Stavanger, Norway.

Hydro's Role

In 1965, Hydro joined other companies to look for oil and gas in the North Sea. Hydro became a big company in the North Sea oil industry. It operated several oil fields, like Oseberg.

In the late 1980s, Hydro bought Mobil's service stations in Norway, Sweden, and Denmark. In 1999, Hydro bought Saga Petroleum, another large Norwegian oil company. Saga Petroleum had big operations in Norway and the United Kingdom.

The Big Merger

A plan to merge Statoil and Hydro's oil and gas parts was announced in December 2006. The merger was approved in 2007. Statoil's shareholders owned 67.3% of the new company. Hydro's shareholders owned 32.7%. The Norwegian government, which owned shares in both companies, held 67% of the new company. The Norwegian Prime Minister, Jens Stoltenberg, said the merger was "the start of a new era." He believed it would create a global energy company.

Experts thought the merger would make the company stronger against bigger rivals like BP and Shell. It would also help the company buy other businesses. The new company became the ninth largest oil company in the world.

The new company was first called StatoilHydro. This was a temporary name. In May 2009, it was decided to change the name back to Statoil ASA. The name officially changed on November 2, 2009.

The Norwegian government wanted to own 67% of the company. By 2009, the government reached this goal.

New Investments and Growth

In 2010, Statoil separated its fuel station business into a new company called Statoil Fuel & Retail. This company was later sold in 2012.

Statoil continued to make new oil and gas discoveries. In 2010, it found oil and gas near the Norne oil field. In 2011–2012, it made large new finds in the North Sea and the Barents Sea.

In 2011, Statoil bought Brigham Exploration to get into oil shale operations in North Dakota. In 2016, Statoil sold its oil sand operations in Canada.

In June 2013, Statoil started a joint project with Petrofrontier Corp. in Australia. In 2016, Statoil bought a large share of the Carcará field in Brazil.

In October 2014, Statoil sold its share in the Shah Deniz gas field in Azerbaijan. Since October 2014, Statoil also supplies natural gas to Ukraine.

Statoil started investing more in renewable energy. In 2016, it bought a share in a US wind turbine leasing company. Statoil believed that oil demand would start to decrease in the 2020s.

Even after not finding oil in the Arctic in 2017, Statoil said it would keep exploring there. In October 2017, Statoil opened the Hywind Scotland floating wind farm off Peterhead, Scotland. Equinor also got a contract to build a wind tower assembly farm in New York City.

In March 2018, Statoil bought a 50% share in two offshore wind farms in Poland. In February 2024, Equinor made a 15-year deal to supply natural gas liquids to an Indian company.

Becoming Equinor

On March 15, 2018, Statoil announced it would change its name to Equinor. This change was approved by the company's owners.

Between 2007 and 2019, the company had some financial losses from its US businesses. In 2019, it sold some of its assets in Eagle Ford, Texas.

In August 2020, Anders Opedal became Equinor's new CEO. That year, the company announced it would reduce its number of employees and contractors. This was due to falling oil prices.

In January 2021, Equinor won a contract to provide offshore wind power to New York City. This was in partnership with BP. It was the largest offshore wind deal offered by an American state at that time.

In February 2021, Equinor sold its shale assets in North Dakota. A company spokesperson said Equinor was thinking about selling more energy assets in the US.

In May 2021, Equinor and an Italian energy company, Eni, teamed up. They planned to develop floating wind farms in the North Sea. Equinor also partnered with a Norwegian renewable energy company in 2021. They aimed to get wind areas in the North Sea.

How Equinor Operates

Oil and Gas Work

Equinor is the biggest operator on the Norwegian continental shelf. It handles 60% of the total oil and gas production there. It operates many fields, including Brage, Heimdal, and Gullfaks. The company also has processing plants in Norway.

Besides Norway, Equinor operates oil and gas fields in many other countries. These include Australia, Algeria, Brazil, Canada, and the United States. Equinor also has offices looking for new projects in countries like Mexico and Qatar. The company has processing plants in Belgium, Denmark, France, and Germany. In 2006, Statoil got approval for the world's largest carbon sequestration project. This project stores carbon underground to help the environment.

Equinor is a partner in Brazil's Peregrino oil field. It also has a share in the Deep Blue well in the Gulf of Mexico.

Equinor has tried to get involved in the Russian oil business for a long time. It partnered with companies like Gazprom and Rosneft. However, it did not have major success there. After international rules were put in place against Russia, Equinor left Russia in September 2022. It sold its Russian assets for one euro.

Some experts have discussed if Equinor's work with natural resources affects Norway's economy. They point out that natural resources can be good for countries with strong political systems, like Norway. But they can be negative for countries with weaker systems.

Pipelines

Equinor is involved in many pipelines. These include Zeepipe and Europipe I and Europipe II. These pipelines carry oil and gas from the Norwegian continental shelf to Western Europe. Equinor also operates pipelines in the North Sea.

The company has offices in London, Stamford, Connecticut, and Singapore. These offices trade crude oil, refined petroleum products, and natural gas liquids.

Solar Power

Equinor has investments in solar power projects. These projects are in Brazil, Argentina, Poland, and other places.

Wind Energy

Equinor owns and runs the 30-MW Hywind Scotland floating wind farm. This farm is off the coast of Peterhead, Scotland. Equinor owns a 50% share in two large offshore wind farms in Poland. It also owns a 25% share in the Arkona wind farm off Germany. Equinor operates the Sheringham Shoal Offshore Wind Farm. It also has a 50% share in parts of the Dogger Bank Wind Farm in the United Kingdom.

In February 2025, Equinor announced it would reduce its investments in renewable energy. It plans to invest $5 billion over the next two years, down from about $10 billion.

Petrol Stations (Past Operations)

In the past, the company operated fuel stations. These were under the main brand Statoil. It also had automated stations called 1-2-3 and some under the Ingo brand. After merging with Norsk Hydro in 2007, it also operated Hydro and Uno-X stations in Sweden. These were later sold.

In 2010, the fuel station business became a separate company, Statoil Fuel & Retail. Statoil had about 2,300 fuel stations in many countries. These included Denmark, Estonia, Ireland, Latvia, Lithuania, Norway, Poland, Russia, and Sweden.

In 2012, a Canadian company bought Statoil Fuel & Retail. In 2016, the new owner decided to change all the fuel stations to the Circle K brand.

Company Finances

For the year 2018, Equinor reported earnings of US$7.535 billion. Its total income was US$79.593 billion. This was a 30.1% increase from the year before. In October 2018, Equinor's shares were worth over $18 each. The company's total value was over US$55.5 billion. In the last three months of 2021, Equinor made a profit of $15 billion.

Working with the Norwegian Government

The Norwegian government owns 67% of Equinor. This means the government has control over the company. Equinor plays a big role in Norway's politics. It makes money for the government and provides energy to Norwegian citizens.

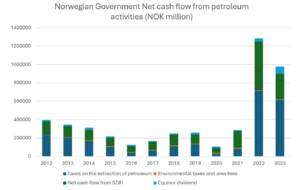

Government Interactions

Equinor generated a lot of money for the Norwegian government. In 2023, it was about $91.83 billion USD. In 2024, it was about $62.52 billion USD. Most of this money comes from taxes. The Norwegian government charges a special tax on oil operations. This means a combined tax rate of 78% on Equinor's oil profits. The government's ownership of Equinor is part of a bigger plan. This plan involves the state owning parts of important industries, especially those with natural resources. The money from Equinor goes into the Government Pension Fund Global. This fund is one of the largest in the world.

Company Changes and Impact

Experts from Yale have noted that the Norwegian Government often focuses on long-term plans for Equinor. Public shareholders, however, tend to focus on quick profits. Because the government owns most of the company, Equinor's policies usually favor long-term sustainability. The Norwegian Ministry in charge of Equinor wants the company to achieve "the highest possible return over time in a sustainable manner." Economists believe this long-term planning helps Equinor move towards renewable energy more easily. Other oil companies with private shareholders might find this harder.

Equinor also operates with a lot of openness. This is because the Norwegian government has a policy for good company management that includes transparency. This openness helped show the impact of a situation in 2014. At that time, Equinor's losses from its North American investments were quickly revealed.

Equinor has also faced public criticism for causing greenhouse gas emissions. In 2014, protests urged Equinor (then Statoil) to reduce these emissions. Groups in Norway, like Equinor Out, want the company to stop exploring for new oil and gas. They want Equinor to fully switch to renewable energy. Other investors have also pressured Equinor to reduce its emissions. As a result, Equinor has started to move towards renewable energy.

Moving to Green Energy

In 2007, Equinor's rules were changed. This allowed the company to work with "other forms of energy" besides oil and natural gas. Then, in 2018, Statoil changed its name to Equinor. This showed its new focus on renewable energy. In 2020, Equinor shared a plan to become carbon neutral by 2050. However, Equinor's profits from oil greatly increased in 2022. This was due to the Russian invasion of Ukraine and the ban on Russian natural gas in Europe. Equinor's income decreased in 2023. This is partly seen as a result of its investments in renewable energy. Still, the Norwegian Prime Minister supported Equinor's continued move towards renewable energy.

Company Leadership

Board of Directors

As of April 2024, the board includes:

- Jon Erik Reinhardsen, former CEO of Petroleum Geo-Services

- Anne Drinkwater, former CEO of BP Canada

- Jonathan Lewis, former CEO of Capita

- Finn Bjørn Ruyter, former CEO of Hafslund

- Haakon Bruun-Hanssen, former Chief of Defence of Norway

- Mikael Karlsson, current Vice Chairman and Partner at Actis Capital

- Fernanda Lopes Larsen, former EVP at Yara International

- Tone Hegland Bachke, former Telenor CFO

- Stig Lægreid, an employee representative

- Per Martin Labråthen, an employee representative

- Hilde Møllerstad, an employee representative

Environmental Impact

From 1988 to 2015, Statoil was responsible for 0.52% of global industrial greenhouse gas emissions.

Equinor and Shell had planned to build a gas power plant in Norway. This plant would have stored CO2 underground. But they stopped the plan for money reasons. Equinor has been injecting CO2 into the Utsira formation since 1996. This is for environmental storage. Natural gas with CO2 is produced from the Sleipner Vest field. The CO2 is removed and injected underground. The gas is then sent to other countries.

Equinor is also a founding member of Methane Guiding Principles. This group aims to reduce methane emissions in the oil and gas industry.

Sponsorships

Equinor supports talented people in art, education, and sports. This is through its program called Morgendagens helter (Tomorrow's heroes).

The program includes two music awards. As of 2013, each award gives 1 million NOK (about $95,000). The Statoil classical music award has been given since 1999. The Statoil award for a Norwegian pop/rock artist or group started in 2008. It helps artists build international careers.

There is also an art prize, Statoils kunstpris. It is given every two years since 2007 to a talented artist in Norway. The prize is 500,000 NOK (about $48,000). This makes it Norway's largest art prize of its kind.

Sports sponsorships include support for football and skiing. Education sponsorship focuses on natural sciences. It includes a yearly competition for high school students in Norway. The Statoils realfagspris is awarded there.

Statoil was an official sponsor of the FIS Nordic World Ski Championships 2011 in Oslo.

See also

In Spanish: Equinor para niños

In Spanish: Equinor para niños