History of Chinese currency facts for kids

The history of Chinese currency is a fascinating journey that spans more than 3000 years! People in China have used different kinds of money since the Neolithic age, which was about 4500 to 3000 years ago. One of the earliest forms of money in Central China was cowry shells.

Around 210 BC, the first emperor of China, Qin Shi Huang, made a big change. He got rid of all the different local currencies and introduced one standard copper coin for everyone. Later, in the 7th century, China invented paper money, but copper coins remained the main type of money for a long time. They were used until the modern Chinese yuan was introduced.

Today, the renminbi is the official money of the People's Republic of China. It's used everywhere in mainland China, but not in Hong Kong or Macau. These special regions use their own money: Hong Kong has the Hong Kong dollar, and Macau uses the Macanese pataca. In Taiwan, the New Taiwan dollar has been the official money since 2000.

Contents

Ancient Money

Did you know that the old Chinese words for 'goods', 'buy/sell', and 'exchange' all include a symbol that looks like a shell? This shows how important shells were as early money! We don't know exactly how much shell money was used, but people even made copies of cowry shells from bone, wood, stone, and copper, which suggests they were used for trading.

The Chinese might have invented the first metal coins! Coins found in Anyang are from before 900 BC. These early metal coins looked like the cowry shells they replaced, so they were sometimes called "Bronze shells."

During the Shang dynasty (1500–1046 BC), bronze shells were found in the ruins of Yin, the old capital. Later, in the Zhou dynasty, bronze became the main material for money. During the Warring States period (5th century BC to 221 BC), Chinese money came in three main shapes:

- Some states used "spade-shaped" coins.

- Others used "knife-shaped" coins.

- The Chu state used "ant nose" coins.

Unifying China's Money

When Qin Shi Huang (260 BC – 210 BC) united China, he also unified the money system. He introduced a standard copper coin called "Ban Liang". This coin was round with a square hole in the middle, a design that stayed common for Chinese copper coins until the 20th century! Because each coin had a low value, people often strung a thousand copper coins together on a string.

Paper Money Appears

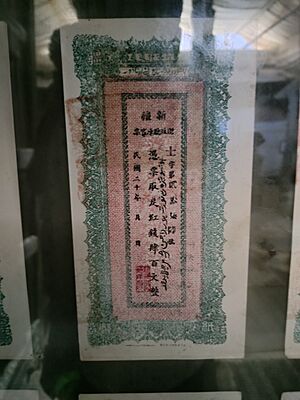

In the Tang dynasty, merchants in Sichuan started using early forms of paper money called "flying money" (feiqian). These were like promissory notes. They were so useful that the government started printing its own paper money in 1024. By the 12th century, paper money became very common in China, known by different names like jiaozi or huizi.

During the early Song dynasty (960–1279), China reunited its money system. The government minted a huge number of copper coins, especially around 1073, producing an estimated six million strings of a thousand coins each! These coins were even sent to places like Japan and South-East Asia.

The Mongol-led Yuan dynasty (1271–1368) also tried to use paper money. They created the world's first "fiat currency" called Jiaochao, which wasn't backed by silver or gold. The Yuan government even tried to stop people from owning silver or gold, making them turn it over to the government. However, printing too much money caused a lot of inflation, which was a big problem for the Yuan dynasty until its end.

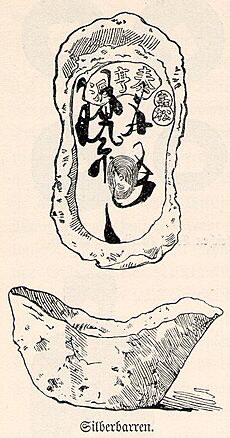

The early Ming dynasty (1368–1644) also tried paper money, but it quickly lost value, so they stopped issuing it in 1450. For most of the Ming period, China used a private system for important transactions, mainly with silver. Silver started flowing into China from overseas, especially from the Spanish colonial empire in the Americas (like Potosí in Peru and Mexico). This silver was traded for Chinese goods like chinaware. It came as minted Spanish silver dollars or as silver ingots called sycee (yuanbao). These Spanish dollars sometimes had Chinese "chop marks" on them, showing they had been checked by a merchant.

Modernizing Money (Qing Dynasty)

During the Qing dynasty, China used both a silver and a copper money system. The copper system was based on the copper cash coin. The silver system had units like the tael, which was divided into 10 mace, 100 candareens, and 1000 lí.

In 1889, the Chinese yuan was introduced. It was similar in value to the Spanish dollar or Mexican peso. The yuan was divided into 10 jiao, 100 fen (like cents), and 1000 wen (cash). The first yuan coins were silver and were made in different parts of China. Copper coins were also made. Later, the central government started issuing its own coins and banknotes.

Republic of China

When the Republic of China was founded in 1912, many provinces started printing their own money. In 1914, the silver dollar became the national currency. Coin designs changed, but the materials stayed mostly the same until the 1930s.

In the 1920s and 1930s, the price of silver went up around the world. This made Chinese money more valuable, but it also meant a lot of silver left China. The government realized it couldn't keep using silver as its standard money.

Fabi Currency

In 1935, the government introduced a new currency called the fabi. This was a "fiat currency," meaning its value wasn't tied to silver or gold. The government could print as much as it needed, especially to pay for military expenses.

However, when World War II started, the government printed a lot of fabi to pay for the war. This caused the currency to lose its value very quickly. The government tried to keep its value stable against foreign money, but it was very difficult.

When Japan took over parts of China, they tried to make people exchange their fabi for new money issued by the Japanese-controlled governments. This often meant people lost half the value of their money.

Gold and Silver Yuan

After Japan's defeat in 1945, the government tried to replace the old currencies. In 1948, they introduced the "gold yuan" to fight the extreme inflation. One gold yuan was worth 3 million old fabi yuan! But even though it was called "gold yuan," it wasn't backed by gold. This currency also failed very quickly, and people started trading goods instead of using money.

Finally, in 1949, the Kuomintang government tried again with the "Silver Yuan Certificate," bringing back the silver standard. But this currency didn't last long because the Chinese Communist Party soon took control of mainland China.

After the Kuomintang moved to Taiwan, the "New Taiwan dollar" became the main money used there. In 2000, it officially became the legal currency of the Republic of China.

Money During Japanese Occupation

During Japan's occupation of China, the Japanese Imperial Government issued different types of money in the areas they controlled.

Manchuria

In northeastern China, after Japan created the puppet state of Manchukuo, they set up the Central Bank of Manchou in 1932. This bank issued the Manchukuo yuan. It was first based on silver, but later its value was tied to the Japanese yen. This currency was used until the end of World War II.

Inner Mongolia

In Inner Mongolia, the Japanese created the Bank of Mengjiang in 1937. This bank issued the Mengjiang yuan, which was tied to the Japanese military yen.

Collaborationist Governments

The Japanese also set up two governments in China that worked with them.

- In the north, the "Provisional Government of China" in Beijing created the Federal Reserve Bank of China. This bank issued notes that were initially equal to the Nationalist fabi, but the Japanese later made them worth more.

- In Nanjing, the Wang Jingwei Government created the Central Reserve Bank of China in 1941. This bank issued the CRB yuan, which also had its value changed by the Japanese.

Japanese Military Yen

The Japanese military yen was used in many areas occupied by Japan. It was first given to soldiers as payment. The idea was that this money couldn't be changed into regular Japanese yen, so it wouldn't cause inflation in Japan. However, it did cause problems for the local economies.

This currency became legal in China in 1937. It was later replaced by the money from the puppet banks.

After Japan Surrendered

After Japan lost World War II, the areas they had occupied had many different currencies. The Nationalist government tried to replace these with their fabi currency. For example, they set a very low exchange rate for the money from the Wang Jingwei regime, which meant people who had that money lost a lot of its value. This made it harder for the economy to recover.

People's Republic of China

Renminbi

The Chinese Communist Party took control of large parts of China in 1948 and 1949. They created the People's Bank of China in December 1948, which started issuing money in the areas they controlled.

After the People's Republic of China was founded, the old gold yuan could be exchanged for the new Renminbi. The first Renminbi notes came in many different values. In 1955, the currency was adjusted, and new notes and coins were issued.

Since October 1999, the fifth and latest versions of the Renminbi have been produced. These notes feature Mao Zedong. Coins are also made in different values.

From Cash to Mobile Payment

Before 2010, most people in China paid for things with physical cash. But China quickly moved past credit cards and became a world leader in mobile payments! This quick change also led to a big increase in online shopping and banking.

See also

- Chinese Silver Panda

- Economic history of China

- List of Chinese cash coins by inscription