Economy of New Zealand facts for kids

Auckland's central business district

|

|

| Currency | New Zealand dollar (NZD, NZ$) |

|---|---|

| 1 July – 30 June | |

|

Trade organisations

|

APEC, CPTPP, RCEP, WTO and OECD |

| Statistics | |

| Population | 5,223,100 (June 2023 estimate) |

| GDP | |

| GDP rank | |

|

GDP growth

|

|

|

GDP per capita

|

|

|

GDP by sector

|

|

|

Population below poverty line

|

11.0% (relative, 2014) |

| 33.9 medium (2019) | |

|

|

|

Labour force

|

|

|

Labour force by occupation

|

|

| Unemployment |

|

|

Average gross salary

|

NZ,882 / ,456 monthly (2022) |

|

Average net salary

|

NZ,698 / ,759 monthly (2022) |

|

Main industries

|

Food processing, Agriculture, Forestry, Wool, Tourism, Financial Services |

|

Ease-of-doing-business rank

|

|

| External | |

| Exports | .8 billion (FY 2022/23) |

|

Export goods

|

Dairy products, meat, logs and wood products, fruit, wine, machinery and equipment, fish and seafood |

|

Main export partners

|

|

| Imports | .8 billion (FY 2022/23) |

|

Import goods

|

Petroleum, vehicles, machinery and equipment, electronics, textiles, plastics |

|

Main import partners

|

|

|

FDI stock

|

|

|

Gross external debt

|

NZ6.181 billion (53% of GDP) (December 2018) NZ.342 billion (30.5% of GDP) (Feb 2018) |

| Public finances | |

|

Public debt

|

▼ 31.7% of GDP (2017 est.) |

| Revenues | 74.11 billion (2017 est.) |

| Expenses | 70.97 billion (2017 est.) |

| Economic aid | As donor: .7 million (FY99/00) |

|

Credit rating

|

|

|

Foreign reserves

|

|

New Zealand has a strong and modern economy. It is a developed nation with a free-market economy. This means that businesses and individuals have a lot of freedom to make their own economic choices. New Zealand's economy is very globalised, meaning it relies a lot on trading with other countries. Its main trading partners are China, Australia, the European Union, the United States, and Japan.

New Zealand's economy is quite varied. It has a large service sector, which includes things like tourism, finance, and healthcare. This sector makes up most of the country's economic activity. Even though New Zealand is an island nation, it has good natural resources. Important industries include making aluminum, processing food, and creating wood and paper products. The tech sector is also growing quickly.

The main stock market in New Zealand is the New Zealand Exchange (NZX). The New Zealand dollar (also called the "Kiwi dollar") is used in New Zealand and some Pacific Island territories. It is one of the most traded currencies in the world.

New Zealand's Economic Story

For many years, New Zealand's economy depended on a few farm products. These included wool, meat, and dairy. From the 1850s to the 1970s, these products were New Zealand's most important exports. They helped the country have one of the highest standards of living in the world for about 70 years.

In the 1960s, prices for these farm products started to fall. Then, in 1973, New Zealand lost its special trading deal with the United Kingdom. This happened when the UK joined the European Economic Community. Because of this, New Zealand's economy faced challenges.

Between 1984 and 1993, New Zealand changed its economy a lot. It went from being quite controlled by the government to being very open. This process is often called "Rogernomics." The government made big changes to free up the economy. By 2005, the World Bank even called New Zealand the most business-friendly country. Tourism also became a very important part of the economy.

Early Beginnings

Before Europeans arrived, Māori had a way of life where they produced what they needed. From the 1790s, ships from Britain, France, and America visited New Zealand. Their crews traded European goods like guns and metal tools for Māori food and other items.

In 1840, the Treaty of Waitangi was signed, and New Zealand became a colony. Early settlers relied on Māori for food. Later, immigrants started farming and mining for minerals like gold. The Otago Gold Rush in 1861 made towns grow, and Dunedin became a very rich city.

Sheep farming grew quickly. By the 1850s, there were a million sheep in New Zealand. Wool became the first main export. In 1882, refrigeration was introduced. This allowed New Zealand to send frozen meat and other products all the way to the United Kingdom. This invention changed the economy and made New Zealand very dependent on trade with Britain.

Around 1900, dairy farming became important, especially in the North Island. As more land was farmed, Britain became the main buyer for New Zealand's farm products.

The 20th Century Economy

The Reserve Bank of New Zealand was set up in 1934. This meant New Zealand could control its own money policies for the first time. Before this, Britain had a big say in New Zealand's money matters.

By the mid-1900s, farm products made up over 90% of New Zealand's exports. Most of these went to Britain. Having a sure market with guaranteed prices allowed New Zealand to put high taxes on imported goods. This helped local businesses grow and created more jobs.

This good time ended in 1955 when Britain stopped giving guaranteed prices for New Zealand's exports. From then on, prices were set by the open market. As a result, New Zealand's standard of living started to drop.

In 1973, Britain joined the European Economic Community. This ended most of New Zealand's special trade deals with Britain. By the end of that year, only a small part of New Zealand's exports went to Britain. This greatly affected the country's standard of living. New Zealand had to find new markets and different types of exports.

The 1973 oil crisis made things even harder. The cost of transport and imported goods went up a lot. This caused prices to rise and living standards to decline.

"Think Big" Projects

After the 1979 oil crisis, Prime Minister Robert Muldoon started a plan called "Think Big." This plan involved building large industrial factories. These factories used New Zealand's natural gas to make products like fertilizer and petrol for export. The goal was to rely less on imported oil.

Other projects included building the Clyde Dam for electricity and expanding the New Zealand Steel plant. The Tiwai Point Aluminium Smelter, which opened in 1971, was also upgraded. It now earns about NZ$1 billion in exports each year.

However, many of these projects finished just as oil prices dropped in the 1980s. These projects cost a lot of money, and New Zealand's public debt grew very high. Prices also kept rising. When the Labour government took over in 1984, many of these projects were sold to private companies.

Rogernomics Reforms

The government elected in 1984 made big changes to the economy. These reforms were called "Rogernomics," named after the Minister of Finance, Roger Douglas. The government wanted the free market to guide the economy, not government rules.

Changes included making the Reserve Bank independent. This meant it could focus on keeping prices stable without political interference. The government also stopped giving money to many industries, especially farming. Rules for imports were relaxed, and the New Zealand dollar's value was allowed to float freely. Taxes on income were lowered, but a new tax on goods and services (GST) was introduced.

Many government-owned businesses were turned into State Owned Enterprises. They were told to make a profit. This led to thousands of job losses.

A stock market crash in 1987 also affected New Zealand. The economy went into a recession in the early 1990s. Unemployment rose, and foreign debt increased. To control rising prices, the Reserve Bank focused on keeping inflation low.

Later, in 1991, the new government under Ruth Richardson cut government spending. They reduced welfare payments and increased rents for state houses. These changes were very tough for many people.

Despite the challenges, these reforms made New Zealand a very business-friendly country. In 2008, the World Bank said New Zealand was the second-best country in the world for doing business. However, some people blame these changes for problems like the "leaky homes crisis," where many houses were built poorly due to relaxed rules.

The 21st Century

Unemployment fell after 1994 but rose again during the 1997 Asian financial crisis. By 2016, it was much lower.

From 2000 to 2007, New Zealand's economy grew steadily. This was helped by people spending more and a strong housing market. However, in 2008, the economy slowed down. This happened before the big global financial crisis hit later that year.

Finance Company Problems

During the global financial crisis, many finance companies in New Zealand collapsed. To protect people's savings, the government created a special scheme. Even with this, many companies failed, costing taxpayers a lot of money. The directors of some of these companies were later found guilty of fraud.

To help the economy, the Reserve Bank lowered interest rates. This made it cheaper to borrow money.

"Rock Star" Economy

Compared to many other countries, New Zealand's recession was not as bad. The economy started to recover in 2009. This was helped by strong demand from China and Australia for New Zealand's dairy and wood exports. The rebuild after the Christchurch earthquakes also boosted the economy.

In 2013, the economy grew well. An economist from HSBC even called New Zealand the "rock star economy of 2014." However, some experts worried about low living standards and growing differences between rich and poor.

Economic Overview

New Zealand's economy is generally seen as successful. It has been ranked high for "Social Progression," which looks at things like basic human needs and opportunities for people. However, there are still challenges. New Zealand's income levels, which used to be higher than many European countries, have not fully recovered since the 1970s. This has led to more people living in poverty and a bigger gap between rich and poor.

New Zealand has also often spent more on imports than it earns from exports. This is called a current account deficit. Despite this, the government's debt is relatively low compared to many other developed countries.

Taxation in New Zealand

Taxes in New Zealand are collected by the Inland Revenue Department. These include taxes on personal income, business income, and a tax on goods and services (GST). There is no tax on capital gains (profits from selling assets like property), but local property taxes are collected by local councils.

In 2010, personal tax rates were cut. This made New Zealand's personal tax burden one of the lowest among developed countries. To make up for this, GST was increased from 12.5% to 15%. This change meant that people with lower incomes spent a larger part of their money on GST compared to those with higher incomes.

Fairness in the Economy

New Zealand is known for being one of the least corrupt countries in the world. In 2015, it was ranked 4th on the Transparency International corruption index.

Regional Economies

New Zealand's economy is spread across its different regions. The Auckland region has the largest share of the country's economic activity.

| Region (position on map) | GDP (2015, NZ$ million) | Share of national GDP | GDP per capita (NZ$, 2015) |

|---|---|---|---|

| Northland (1) | 5,869 | 2.4% | 35,103 |

| Auckland (2) | 88,295 | 36.6% | 56,997 |

| Waikato (3) | 19,649 | 8.1% | 45,160 |

| Bay of Plenty (4) | 12,292 | 5.1% | 43,159 |

| Gisborne (5) | 1,688 | 0.7% | 35,769 |

| Hawke's Bay (6) | 6,591 | 2.7% | 41,323 |

| Taranaki (7) | 8,756 | 3.6% | 75,941 |

| Manawatu-Wanganui (8) | 9,197 | 3.8% | 39,372 |

| Wellington (9) | 32,617 | 13.5% | 65,974 |

| North Island | 184,955 | 76.7% | 53,053 |

| Tasman / Nelson (10 / 11) | 4,199 | 1.7% | 42,456 |

| Marlborough (12) | 2,466 | 1.0% | 54,676 |

| West Coast (13) | 1,656 | 0.7% | 50,491 |

| Canterbury (14) | 32,882 | 13.6% | 56,575 |

| Otago (15) | 10,173 | 4.2% | 47,671 |

| Southland (16) | 4,857 | 2.0% | 50,119 |

| South Island | 56,232 | 23.3% | 52,637 |

| New Zealand | 241,187 | 100.0% | 52,953 |

Unemployment

Before 1973, unemployment in New Zealand was very low. But after Britain joined the EEC, it became a bigger problem. After the stock market crash in 1987, unemployment reached a high of 11.2% in 1991.

By 2007, unemployment had dropped to a very low level again. This was a good sign for the economy. However, after the global financial crisis in 2008, unemployment started to rise again. It has since fallen, showing the economy's recovery.

Housing Affordability

For a long time, buying a house in New Zealand was affordable. But in the 21st century, house prices rose a lot. By 2007, an average house cost more than six times the average household income. This makes it very hard for many people, especially young people, to buy their first home.

Prices have gone up a lot in Auckland, making it one of the most expensive cities for housing in the world. This means more people have to rent instead of owning their homes.

Income Inequality

Between 1982 and 2011, New Zealand's economy grew, but most of that growth went to the richest people. The income of the top 10% of earners almost doubled, while the poorest 10% saw only a small increase.

This growing gap between rich and poor is a concern. Experts say that rising inequality can actually slow down economic growth in the long run.

Poverty in New Zealand

There is growing concern about poverty in New Zealand, especially among children. In 2005, a report found that one in six children lived in poverty. By 2013, this number had grown to about 265,000 children, which is a quarter of all children in New Zealand.

The government and other groups are working to understand and reduce poverty. They are trying to find the best ways to measure poverty and create solutions to help families and children.

Retirement Savings (Superannuation)

New Zealand has a system called universal superannuation. This means that everyone aged 65 or older who meets certain rules can receive a regular payment. This payment helps people in their retirement.

However, the number of elderly people is growing. This means the cost of superannuation is also increasing. To help pay for this in the future, the government set up the New Zealand Superannuation Fund.

In 2007, a new savings plan called KiwiSaver was introduced. It's a voluntary plan where people save money for retirement. Younger people can also use it to save for a deposit on their first home. Many New Zealanders are now part of KiwiSaver.

Key Infrastructure

New Zealand's infrastructure, like roads, railways, and communication systems, is generally well developed. However, there's a need for more investment to keep it modern and working well.

Transport Systems

New Zealand has a good transport network.

Roads

The country has about 11,000 km of state highways, which are maintained by the NZ Transport Agency. There are also many local roads managed by local councils.

Railways

The railway network is owned by KiwiRail, a government company. It has about 3,898 km of railway lines.

Airports

New Zealand has seven international airports and many domestic ones. Air New Zealand, partly owned by the government, is the national airline.

Seaports

There are 14 international seaports in New Zealand, which are important for trade.

Communication Networks

New Zealand has modern communication systems, including phones, radio, television, and the internet. Mobile phone prices are among the lowest in developed countries.

Internet Access

Many New Zealanders use the internet. The government has plans to bring Ultra-Fast Broadband (very fast internet) to most of the population. This involves installing fibre optic cables in towns and cities. There's also a plan to improve broadband in rural areas.

Energy Supply

New Zealand is good at using renewable energy sources. Most of its electricity comes from clean sources like hydropower, geothermal power, and wind energy. This makes New Zealand one of the most sustainable economies in terms of energy.

However, most electricity is produced in the South Island and central North Island, but most people who use it live in the northern North Island, especially Auckland. This means electricity needs to travel long distances through the power grid.

Water Systems

Local councils own most of the water systems in New Zealand, including drinking water, stormwater, and wastewater. There are plans to combine these systems into larger regional utilities. This is to help manage the big costs of maintaining and upgrading water infrastructure, especially with challenges like climate change and population growth.

International Trade

New Zealand is a small country far from many big markets. This makes it challenging to compete globally. However, it trades a lot with other countries. In 2018, its main trading partners were China, Australia, the European Union, the United States, and Japan. These five partners make up a large part of New Zealand's trade.

New Zealand has signed many free trade agreements with other countries. These agreements help reduce barriers to trade and make New Zealand's exports more competitive. They also help ensure that trade rules are clear and fair.

Trade with China

China is New Zealand's biggest trading partner. New Zealand sells a lot of meat, dairy products, and pine logs to China. Trade with China has grown a lot, especially after the New Zealand–China Free Trade Agreement in 2008.

Trade with Australia

Australia used to be New Zealand's biggest trading partner. The "Closer Economic Relations" (CER) agreement allows free trade between the two countries. This agreement has created a single market for goods and services. It also lets New Zealand and Australian citizens live and work freely in each other's country.

Trade with Europe and the US

The European Union is New Zealand's third largest trading partner. Trade with Europe is important, but demand from Asia is growing faster. The United States is also a major trading partner for New Zealand. New Zealand sells beef, dairy, and lamb to the US, and buys machinery and electronics.

Trade with Asia

Japan is New Zealand's fifth largest trading partner. Other Asian economies like Korea, Taiwan, and Singapore are also important. New Zealand has free trade agreements with some of these countries to boost trade.

Trade with Pacific Islands

The Pacific region is New Zealand's sixth largest trading market. New Zealand exports many goods to these islands, including food and building materials. New Zealand also helps Pacific Islands with disaster relief and development funding. This aid helps these smaller nations grow their economies.

Foreign Investment

New Zealand welcomes foreign investment. This is when people or companies from other countries invest money in New Zealand businesses or property. In 2014, foreign investment in New Zealand was over NZ$107 billion.

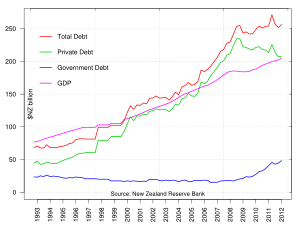

Some people worry about the impact of foreign investment. They argue that when foreign investors buy New Zealand companies, it can sometimes lead to job cuts or lower wages. They also point out that foreign debt has grown a lot over the years.

Images for kids

-

An aerial view of the Kinleith Mill. Forestry exports are an important component of New Zealand's economy.

-

Telephone booths in Dunedin.

-

Tourism, like here on the Milford Sound, is a major export earner for New Zealand.

See also

In Spanish: Economía de Nueva Zelanda para niños

In Spanish: Economía de Nueva Zelanda para niños

| Misty Copeland |

| Raven Wilkinson |

| Debra Austin |

| Aesha Ash |