Economy of Puerto Rico facts for kids

|

|

| Currency | United States dollar (US$) |

|---|---|

| 1 July – 30 June | |

|

Trade organizations

|

CARICOM (observer), IOC, ITUC, UNWTO (associate), hUPU |

| Statistics | |

| Population | |

| GDP |

|

| GDP rank | |

|

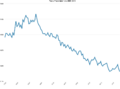

GDP growth

|

|

|

GDP per capita

|

|

|

GDP per capita rank

|

|

|

GDP by sector

|

|

| 1.0% (2020 est.) | |

|

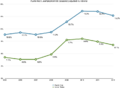

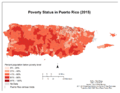

Population below poverty line

|

45% |

| 0.537 high (2010) | |

| 0.845 high (2015) (n/a rank) | |

|

Labor force

|

|

|

Labor force by occupation

|

|

| Unemployment | ▼ 5.5% (October 2024) |

|

Average gross salary

|

|

|

Main industries

|

Pharmaceuticals, electronics, apparel, food products, tourism |

| External | |

| Exports | |

|

Export goods

|

Chemicals, electronics, rum, beverage concentrates, medical equipment, canned tuna, apparel |

|

Main export partners

|

|

| Imports | $43.32 billion CIF (2016 est.) |

|

Import goods

|

chemicals, machinery and equipment, food, petroleum products, clothing, fish |

|

Main import partners

|

|

|

Gross external debt

|

▲ $56.82 billion (31 December 2010, est.) |

| Public finances | |

|

Public debt

|

▲ 51.6% of GDP (2017 est.) |

| Revenues | 9.268 billion (2017 est.) |

| Expenses | 9.974 billion (2017 est.) |

|

Credit rating

|

Standard & Poor's D |

|

All values, unless otherwise stated, are in US dollars. |

|

The economy of Puerto Rico is one of the strongest in Latin America. Puerto Rico is a territory of the United States, so it uses the United States dollar as its currency. The island is considered a high-income economy, which means people generally earn more money compared to many other places in the world.

The most important businesses in Puerto Rico are factories that make things like medicines, electronics, and clothing. This is called manufacturing. Another very important part of the economy is the service industry, which includes banks, real estate, and tourism. Many people visit Puerto Rico to see its beautiful beaches and historic sites.

Even though the economy is strong in some ways, Puerto Rico faces some big challenges. The island does not have many natural resources like oil or coal, so it has to buy them from other countries. Also, because it is a small island, it has to import (buy from outside) most of its food. The government has also borrowed a lot of money, leading to a large debt that it is trying to pay back.

Contents

History of the Economy

Early History

Long ago, before Europeans arrived, the Taíno people lived in Puerto Rico. Their economy was based on nature. They fished, hunted small animals, and gathered fruits. They also were farmers who grew crops like corn, squash, and cassava (a root vegetable). They did not use money; instead, they worked together to produce food for their villages.

Spanish Rule

When the Spanish arrived in 1493, the economy changed completely. At first, the Spanish looked for gold, but there was not very much of it. Later, they set up large farms. They forced the native Taíno people and enslaved people brought from Africa to work on these farms. They grew sugar cane, coffee, and tobacco to sell to Europe. For a long time, farming was the main way people made money.

United States Rule and Modern Times

In 1898, the United States took control of Puerto Rico. In the beginning, sugar was still the most important product. However, in the mid-1900s, the government started a plan called "Operation Bootstrap." This plan helped build many factories on the island. People moved from the countryside to the cities to work in these new industries.

Because of this change, Puerto Rico stopped relying only on farming and started making products to sell to the United States and other countries. Today, Puerto Rico is known for making medicines and high-tech equipment.

Main Industries

Manufacturing

Manufacturing is the biggest part of Puerto Rico's economy. It makes up almost half of the island's total production value. The most famous products are pharmaceuticals (medicines). Puerto Rico has many factories that make pills and other medical treatments used all over the United States. They also make medical devices, like pacemakers and surgical tools.

Other things made in Puerto Rico include electronics, clothing, and processed foods.

Tourism

Tourism is very important for Puerto Rico. Millions of visitors come every year. They arrive by airplane or on large cruise ships. Tourists love to visit:

- Old San Juan: A historic city with old forts and colorful buildings.

- El Yunque National Forest: A beautiful tropical rainforest.

- Beaches: Places like Flamenco Beach and Isla Verde are famous for their clear water and sand.

Hotels, restaurants, and shops earn a lot of money from these visitors.

Agriculture

Farming is smaller now than it used to be. It makes up less than 1% of the economy. However, farmers still grow important crops like:

- Plantains and bananas

- Coffee

- Mangoes and other tropical fruits

- Vegetables like peppers and tomatoes

Puerto Rico also has a dairy industry that produces milk. Because there are not enough farms to feed everyone, Puerto Rico has to buy about 85% of its food from other places.

Trade and Money

Currency

Puerto Rico uses the United States dollar (US$). This makes trading with the United States very easy because there is no need to exchange money.

Imports and Exports

- Exports (things sold to others): Puerto Rico sells mostly medicines, medical equipment, computers, and beverages like rum. Most of these go to the United States.

- Imports (things bought from others): Puerto Rico buys chemicals to make medicines, oil for electricity, food, and cars.

The Jones Act

There is a special law called the Jones Act. It says that any goods carried by ship between two U.S. ports (like between Florida and Puerto Rico) must be on a ship that was built in the U.S., is owned by U.S. citizens, and has a U.S. crew. Some people think this law makes things more expensive in Puerto Rico because shipping costs are higher.

Infrastructure

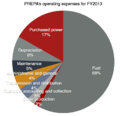

Electricity and Water

Puerto Rico needs a lot of energy to run its factories and homes. Most of this energy comes from burning oil and natural gas, which must be imported. The island is trying to use more renewable energy, like solar and wind power, but it still relies mostly on fossil fuels. The Puerto Rico Electric Power Authority (PREPA) manages the electricity.

Water is managed by the government too. Most people have access to clean water, but the system is old and sometimes needs repairs.

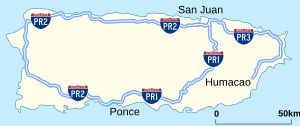

Transportation

People travel around the island using cars on a system of highways. In the city of San Juan, there is a train called the Tren Urbano and buses.

- Airports: The Luis Muñoz Marín International Airport is the busiest airport in the Caribbean.

- Ports: The Port of San Juan is very busy with cargo ships and cruise ships.

Economic Challenges

Debt Crisis

For many years, the government of Puerto Rico spent more money than it collected in taxes. To pay for things, it borrowed money by selling "bonds." Over time, the debt became huge—about $70 billion. In 2017, the island had trouble paying back this money. A special board was created by the U.S. government to help manage Puerto Rico's finances and pay off the debt.

Natural Disasters

Hurricanes can hurt the economy. In 2017, Hurricane Maria caused a lot of damage to homes, roads, and power lines. It took a long time to fix everything, and many businesses had to close for a while.

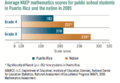

Population Changes

Many people have moved away from Puerto Rico to states like Florida and New York to find jobs. This is called "migration." When people leave, there are fewer workers and fewer people to pay taxes, which can make it harder for the economy to grow.

Recent Updates (2025)

By 2025, the government continued working to fix the debt and improve the economy.

- In April 2025, new rules were proposed to tax money made from digital currencies (like cryptocurrency) to help the island.

- In June 2025, local leaders asked the U.S. government to end the oversight board that manages the island's budget.

- The government is also trying to get special permission to allow more international planes to carry cargo to the island to help businesses.

Images for kids

See also

In Spanish: Economía de Puerto Rico para niños

In Spanish: Economía de Puerto Rico para niños

| Emma Amos |

| Edward Mitchell Bannister |

| Larry D. Alexander |

| Ernie Barnes |