OPEC facts for kids

Quick facts for kids

Organization of the Petroleum Exporting Countries

|

|

|---|---|

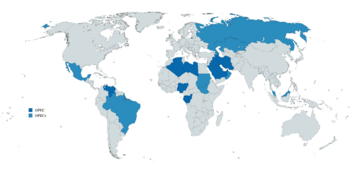

OPEC and OPEC+ members

|

|

| Headquarters | Vienna, Austria |

| Official languages | English |

| Type | Organization |

| Membership | 12 OPEC members 11 OPEC+ members 5 observer states |

| Leaders | |

|

• Secretary General

|

Haitham al-Ghais |

| Establishment | Baghdad, Iraq |

|

• Statute

|

September 1960 |

|

• In effect

|

January 1961 |

The Organization of the Petroleum Exporting Countries (OPEC /ˈoʊpɛk/ OH-pek) is a group of countries that produce and export a lot of oil. They work together to influence the global oil market. Their main goal is to get the best prices for their oil.

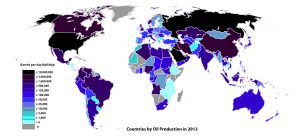

OPEC was started on September 14, 1960, in Baghdad, Iraq. The first five members were Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Today, OPEC has 12 member countries. In 2022, these countries produced about 38 percent of the world's oil. They also hold almost 80 percent of the world's known oil reserves. Most of these reserves are in the Middle East.

In the 1960s and 1970s, OPEC changed how oil was produced and sold worldwide. Before OPEC, a few big oil companies, called the "Seven Sisters", controlled most of the oil market. OPEC helped oil-producing countries take more control over their own natural resources. In the 1970s, OPEC limited oil production. This caused oil prices to rise sharply. This had big effects on the world's economy. Since the 1980s, OPEC's influence on oil prices has been less strong. This is because members sometimes produce more oil than they agreed to.

OPEC's creation was a big step for countries to control their own natural resources. OPEC's decisions are important for the global oil market. They also affect how countries interact with each other. Many experts see OPEC as an example of a cartel. A cartel is a group that works together to reduce competition. This helps its members make more money.

As of June 2018, the OPEC members are Algeria, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia, the United Arab Emirates, and Venezuela. Some countries have left OPEC in the past, like Angola, Ecuador, Indonesia, and Qatar. OPEC+ is a larger group. It includes OPEC members and other oil-producing countries. This group was formed in late 2016 to better manage the global oil market. Countries like Canada, Egypt, Norway, and Oman sometimes attend OPEC meetings as observers.

Contents

- How OPEC Works

- OPEC's Journey Through Time

- After World War II

- 1959–1960: Growing Anger

- 1960–1975: Starting and Growing

- 1973–1974: The Oil Embargo

- 1975–1980: Helping Poorer Nations

- 1975: Hostage Situation

- 1979–1980: Oil Crisis and Price Drop

- 1990–2003: Stable Supply and Small Problems

- 2003–2011: Changing Prices

- 2008: Production Disagreements

- 2014–2017: Too Much Oil

- 2017–2020: Production Cuts and OPEC+

- 2020: Saudi-Russian Price War

- 2021: Saudi-Emirati Disagreement

- 2021–Present: Global Energy Challenges

- 2022: Oil Production Cut

- OPEC Membership

- New and Former Members

- Oil Market Information

- See also

How OPEC Works

In the 1960s and 1970s, OPEC helped oil-producing countries gain more power. They took control of oil production from big Anglo-American oil companies. Working together made it easier for these countries to nationalize their oil. Nationalizing means the government takes control of an industry. This also helped them set oil prices that were better for them. Before OPEC, countries that tried to change oil agreements faced problems. They could be punished by Western governments or big oil companies. For example, oil companies might slow down production in one country. Then they would increase it somewhere else.

OPEC's main idea is that limiting the world's oil supply helps members get higher prices. However, a challenge for OPEC is that each member might want to produce as much oil as possible. This can make it hard to stick to agreements.

Some experts say that OPEC has not always met its goals since the 1980s. They point out that members often produce more oil than they agreed to. This happens because OPEC does not usually punish members for not following the rules.

In June 2020, the OPEC+ group agreed on a "Compensation Mechanism." This helps make sure everyone follows the agreed oil production cuts. This effort helps OPEC keep the oil market stable.

Leadership and Decisions

The OPEC Conference is the highest authority in the organization. It includes representatives, usually oil ministers, from member countries. The main leader of OPEC is the OPEC Secretary General. The conference usually meets at least twice a year in Vienna, Austria. They also have extra meetings if needed. Decisions are usually made with everyone agreeing, and each country has one vote. All countries pay the same membership fee.

Saudi Arabia is the world's largest oil exporter. It has a lot of power to influence the global oil market. Because of this, Saudi Arabia is often seen as OPEC's main leader.

OPEC as a Group of Countries

OPEC members have sometimes acted like a cartel. They make agreements about how much oil to produce and what prices to set. This is done to reduce competition in the market. The OECD (a group of countries working together) describes OPEC as an example of an "international cartel." This means it's an agreement between different national governments.

However, OPEC members prefer to say they help stabilize the oil market. They argue that OPEC was formed to balance the power of the "Seven Sisters" oil companies. Also, other oil suppliers outside OPEC keep the market competitive. It can be hard for OPEC to control prices. This is because each member might try to sell more oil than their agreed limit. This is like a "prisoner's dilemma" in economics. It makes it hard for the group to work together perfectly.

OPEC has not faced legal issues related to competition rules from the World Trade Organization. This is because its meetings are seen as "governmental" actions by states. This means they are protected under international law.

Challenges and Conflicts

OPEC countries often have trouble agreeing on policies. This is because they are very different. They have different amounts of oil, different costs to produce it, and different populations. Their economies and political situations also vary greatly. Sometimes, oil wealth itself can cause problems. This is known as the "natural resource curse."

Conflicts in the Middle East, where much of OPEC's oil is, also add to the challenges. Important conflicts in OPEC's history include the Six-Day War (1967) and the Yom Kippur War (1973). There was also a hostage situation in 1975. The Iranian Revolution (1979) and the Iran–Iraq War (1980–1988) also caused disruptions. Other events like the Iraqi occupation of Kuwait (1990–1991) and the American occupation of Iraq (2003–2011) also impacted oil. More recently, the Arab Spring (2010–2012) and the Libyan Crisis (2011–present) have caused instability. These events can temporarily affect oil supplies and prices. But frequent disagreements and instability often limit OPEC's long-term unity.

OPEC's Journey Through Time

After World War II

In 1949, Venezuela started the idea of forming OPEC. It invited Iran, Iraq, Kuwait, and Saudi Arabia to talk about oil. They wanted to work together more closely. At that time, new large oil fields were being found in the Middle East. The world oil market was controlled by the "Seven Sisters" oil companies. These companies had a lot of power. Oil-exporting countries wanted to form OPEC to balance this power.

1959–1960: Growing Anger

In February 1959, big oil companies lowered their oil prices. They did this without asking the oil-producing countries. This made countries like Venezuela and Saudi Arabia very angry. Their oil ministers met and agreed to form an "Oil Consultation Commission." They wanted oil companies to discuss price changes with them first. In August 1960, the oil companies again cut prices. They ignored the warnings from the oil-producing countries.

1960–1975: Starting and Growing

The next month, from September 10–14, 1960, the Baghdad Conference took place. Representatives from Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela met. They discussed how to increase oil prices. They also wanted to respond to the oil companies' actions. Despite strong opposition from the United States, OPEC was formed. Its goal was to get better prices from the major oil companies.

OPEC first chose Geneva, Switzerland, as its headquarters. But in 1965, it moved to Vienna, Austria. Switzerland did not want to give OPEC special diplomatic rights. Austria, however, welcomed international organizations.

In OPEC's early years, oil-producing countries shared profits 50/50 with oil companies. OPEC tried to bargain with the "Seven Sisters." But it was hard for OPEC members to stick together. If one country asked for too much, the oil companies could just produce more oil in another country. In 1970, Libya negotiated a better deal. This led other OPEC members to ask for more. In 1971, the Tripoli Agreement was signed. This raised oil prices and increased the profit share for producing countries.

Between 1961 and 1975, many new countries joined OPEC. These included Qatar (1961), Indonesia (1962), Libya (1962), United Arab Emirates (1967), Algeria (1969), Nigeria (1971), Ecuador (1973), and Gabon (1975). By the early 1970s, OPEC members produced more than half of the world's oil. OPEC has continued to grow. Angola joined in 2007, and Equatorial Guinea in 2017. Other oil-exporting countries, like Canada and Russia, often attend OPEC meetings as observers. This helps them coordinate their oil policies.

1973–1974: The Oil Embargo

In the early 1970s, the oil market was tight. This made it easier for OPEC members to take control of their oil production. They were less worried about oil prices dropping. Many countries like Libya, Algeria, and Saudi Arabia nationalized their oil industries. With more control, OPEC members raised oil prices in 1973. This led to the 1973 oil crisis.

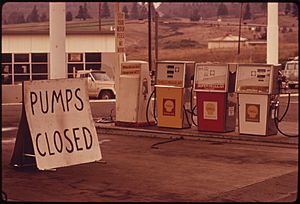

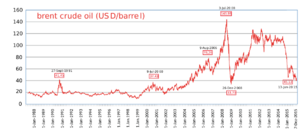

In October 1973, Arab oil-producing countries (OAPEC) cut oil production. They also stopped selling oil to the United States and other countries that supported Israel in the Yom Kippur War. This caused oil prices to jump from $3 to $12 per barrel. It led to an energy crisis. Gas stations limited how much gas people could buy. Some countries banned driving on Sundays.

Even after the embargo ended in March 1974, prices kept rising. The world faced an economic slowdown. There was high unemployment and rising prices at the same time. This period showed that OPEC countries could use oil as a powerful tool.

After this, countries like the United States started to save energy. They lowered speed limits and made cars more fuel-efficient. They also looked for other energy sources like coal and nuclear power. These efforts helped reduce the world's reliance on OPEC oil over time.

1975–1980: Helping Poorer Nations

OPEC countries have also provided international aid. For example, Kuwait started its aid fund in 1961. After the 1973 oil price increase, some Arab nations became major aid providers. OPEC added a goal to help poorer nations grow. The OPEC Special Fund was created in 1975. It aimed to strengthen cooperation with other developing countries. In 1980, it became the OPEC Fund for International Development. It helps countries fight poverty and develop their economies.

1975: Hostage Situation

On December 21, 1975, OPEC oil ministers were taken hostage. This happened at their meeting in Vienna, Austria. A group led by a terrorist known as "Carlos the Jackal" carried out the attack. Three non-ministers were killed. The group wanted to free Palestine. Carlos planned to kill two ministers, but this did not happen.

Carlos and his team traveled with some hostages by bus and plane. They stopped in Algiers and Tripoli. Eventually, all hostages were released. Carlos and his group also left the plane safely. Later, it was revealed that the attack was planned by a group called the Popular Front for the Liberation of Palestine. Some believed the funding came from an Arab president, possibly Muammar Gaddafi of Libya. Carlos was captured in 1994 and is serving life sentences for other crimes.

1979–1980: Oil Crisis and Price Drop

In the late 1970s, oil prices reached new highs. This was due to the Iranian Revolution and the Iran–Iraq War. These events disrupted oil supplies. In response, industrial nations tried to reduce their dependence on OPEC oil. Power plants switched from oil to coal or nuclear power. Governments invested in new energy sources. New oil fields were found outside OPEC, like in Siberia and the North Sea.

By 1986, the world needed less oil. Non-OPEC countries produced more. OPEC's share of the market dropped from 50 percent in 1979 to less than 30 percent in 1985. This led to a six-year drop in oil prices. In 1986, prices fell by more than half. As one expert said, when oil prices go up, people find more oil and use less of it.

To fight falling income, Saudi Arabia pushed OPEC to set production limits in 1982. This was to raise prices. But other OPEC nations did not follow the rules. So, Saudi Arabia cut its own production. When that did not work, Saudi Arabia flooded the market with cheap oil. This caused prices to fall below $10 per barrel. It made it unprofitable for other countries to produce oil.

These actions by Saudi Arabia had a big economic impact. Saudi Arabia's income from oil dropped from $119 billion in 1981 to $26 billion in 1985. This led to large budget problems for the country.

Facing economic hardship, other oil exporters finally started to limit production. They agreed to national quotas in 1986. These quotas helped balance oil and economic needs. When OPEC reduces its production targets, oil prices usually go up.

1990–2003: Stable Supply and Small Problems

Before the Invasion of Kuwait in August 1990, Iraqi President Saddam Hussein wanted OPEC to stop overproducing. He wanted higher oil prices to help OPEC members financially. He also wanted to rebuild Iraq after the Iran–Iraq War. But these wars between OPEC founders weakened the organization. Oil prices quickly went down after the short supply problems. The September 11 attacks in 2001 and the US invasion of Iraq in 2003 had even smaller effects on oil prices. This was because Saudi Arabia and other exporters worked to keep the world supplied with oil.

In the 1990s, two newer OPEC members left. Ecuador left in 1992 because it did not want to pay the $2 million annual fee. It also wanted to produce more oil than its quota allowed. Ecuador rejoined in 2007. Gabon also left in 1995 for similar reasons. It rejoined in 2016. Iraq remained an OPEC member. But its production was not part of OPEC quotas from 1998 to 2016 due to its political problems.

The Asian financial crisis in 1997–1998 caused oil prices to fall back to 1986 levels. After oil dropped to about $10 per barrel, OPEC, Mexico, and Norway worked together. They slowly reduced oil production. When prices dropped again in November 2001, OPEC and other countries agreed to cut production in 2002.

In June 2003, the International Energy Agency (IEA) and OPEC held their first joint meeting. They have met regularly since then. They work to understand oil market trends and make the market more predictable.

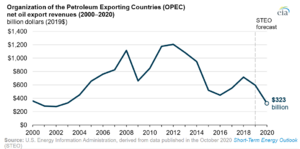

2003–2011: Changing Prices

From 2003 to 2008, there was a lot of violence during the American occupation of Iraq. At the same time, China's demand for oil grew quickly. There was also violence in the Nigerian oil industry. These factors caused oil prices to rise sharply. Prices became very unstable in 2008. WTI crude oil reached a record $147 per barrel in July. Then it dropped to $32 per barrel in December during the Great Recession. OPEC's oil export income also reached a record high in 2008, about $1 trillion. It stayed high until 2014 before dropping again. By the time of the 2011 Libyan Civil War, OPEC started saying that financial speculation was making oil prices too unstable.

In May 2008, Indonesia announced it would leave OPEC. It had become an oil importer and could not meet its production quota. OPEC accepted Indonesia's decision in September 2008. They hoped Indonesia would rejoin later.

2008: Production Disagreements

OPEC member countries have different economic needs. This often causes disagreements over oil production limits. Poorer members want production cuts to raise oil prices and their income. But Saudi Arabia wants to keep a steady flow of oil to support global economic growth. Saudi Arabia worries that very high oil prices or unreliable supply will make countries use less oil. This could lead to less demand for oil in the future. As Saudi Oil Minister Yamani famously said in 1973, "The Stone Age didn't end because we ran out of stones."

In 2024, Saudi Energy Minister Prince Abdulaziz bin Salman talked about balancing the global energy transition. He stressed the importance of different energy sources. He also mentioned investments in natural gas, petrochemicals, and renewables. These efforts help developing countries and meet global climate objectives. He also noted that future energy security problems might be about renewables, not oil.

On September 10, 2008, with oil prices near $100 per barrel, a disagreement happened. Saudi Arabia reportedly left a meeting where members voted to cut OPEC output. Although Saudi delegates officially agreed to the new quotas, they said they would not follow them. One delegate said Saudi Arabia would meet the market's demand and not leave customers without oil. Over the next few months, oil prices fell to the $30s. They did not return to $100 until the Libyan Civil War in 2011.

2014–2017: Too Much Oil

From 2014 to 2015, OPEC members produced more oil than their agreed limits. Also, China's economy slowed down. At the same time, US oil production almost doubled from 2008 levels. This was due to new "fracking" technology for shale oil. These changes led to the US needing less imported oil. It also caused a lot of oil to be stored worldwide. As a result, oil prices fell sharply until early 2016.

On November 27, 2014, Saudi oil minister Ali Al-Naimi refused to cut production. Poorer OPEC members wanted cuts to support prices. Naimi argued that the oil market should balance itself at lower prices. This would make high-cost US shale oil production unprofitable. He wanted to regain OPEC's market share in the long run. He explained that efficient producers should have more market share. He also said that current prices (around $60 per barrel) were too low for all producers.

A year later, in December 2015, OPEC met again. They had been producing over their limit for 18 months. US oil production had only slightly decreased. The world market had at least 2 million barrels per day of extra oil. Many oil producers were preparing for prices as low as $40. Indonesia was rejoining OPEC. Iraqi production had increased. Iranian oil output was expected to rise as international sanctions were lifted. Also, world leaders at the Paris Climate Agreement were committing to reduce carbon emissions. Solar energy was also becoming cheaper.

Given these market pressures, OPEC decided to remove its production limit until June 2016. By January 20, 2016, the OPEC oil price was down to $22.48 per barrel. This was less than a quarter of its high in June 2014. It was also below its price in April 2003.

As 2016 continued, the oil surplus decreased. This was because of production cuts in the United States, Canada, Libya, Nigeria, and China. The oil price slowly rose back into the $40s. OPEC gained a small percentage of market share. Many competing drilling projects were canceled. OPEC kept its policy at its June conference. It supported "prices at levels that are suitable for both producers and consumers." However, many producers still faced serious economic problems.

2017–2020: Production Cuts and OPEC+

OPEC members were tired of the long competition over supply. Their financial reserves were shrinking. So, the organization tried its first production cut since 2008. Despite political challenges, they decided in September 2016 to cut about 1 million barrels per day. This was made official at the November 2016 OPEC conference. The agreement covered the first half of 2017. Russia and ten other non-members also promised to reduce production. However, US shale oil production, Libya, and Nigeria were expected to increase output. Also, OPEC production surged in late 2016 before the cuts began.

Indonesia announced another "temporary suspension" of its OPEC membership. It did not want to accept the requested 5 percent production cut. Oil prices stayed around $50 per barrel. In May 2017, OPEC extended the new quotas until March 2018. Oil analyst Daniel Yergin said that OPEC and shale oil producers were learning to "mutually coexist." Both sides had to live with lower prices than they wanted. These production cut deals with non-OPEC countries are called OPEC+.

In December 2017, Russia and OPEC agreed to extend the production cut of 1.8 million barrels per day until the end of 2018.

Qatar announced it would leave OPEC on January 1, 2019. This was a strategic move due to the Qatar diplomatic crisis. Qatar wanted to focus on natural gas production. It is the world's largest exporter of liquified natural gas (LNG).

On June 29, 2019, Russia and Saudi Arabia agreed to extend the 2018 production cuts for six to nine months.

In October 2019, Ecuador announced it would leave OPEC on January 1, 2020. This was due to financial problems in the country.

In December 2019, OPEC and Russia agreed to one of the biggest output cuts yet. This was to prevent too much oil supply in the first three months of 2020.

2020: Saudi-Russian Price War

In early March 2020, OPEC asked Russia to cut production by 1.5% of the world's supply. Russia refused. It expected more cuts as American shale oil production grew. This ended the three-year partnership between OPEC and non-OPEC producers. Another reason was the weakening global demand due to the COVID-19 pandemic. This also meant that the "OPEC plus" agreement to cut 2.1 million barrels per day was not extended.

Saudi Arabia had taken on a larger share of cuts to keep Russia in the agreement. On March 7, Saudi Arabia told its buyers it would increase output and lower oil prices in April. This caused Brent crude oil prices to crash by over 30%. It also led to widespread problems in financial markets.

Many experts saw this as a Saudi-Russian price war. Saudi Arabia had $500 billion in foreign exchange reserves in March 2020. Russia had $580 billion. Saudi Arabia's debt was 25% of its GDP, while Russia's was 15%. Some noted that Saudi Arabia can produce oil for as low as $3 per barrel. Russia needs $30 per barrel to cover its costs. One analyst claimed that for Russia, this price war was about hurting the Western economy.

To avoid a price war that could harm shale oil production, the US might pass the NOPEC bill. Meanwhile, Saudi Energy Minister Prince Abdulaziz bin Salman has been friendly towards the U.S. shale industry. He said they never intended to harm the sector. He also looks forward to US producers thriving again when oil demand is higher.

In April 2020, OPEC and other oil producers, including Russia, agreed to extend production cuts. They cut oil production by 9.7 million barrels a day in May and June. This was about 10% of global output. It was an effort to raise prices, which had fallen to record lows.

2021: Saudi-Emirati Disagreement

In July 2021, the United Arab Emirates (UAE), an OPEC+ member, disagreed with Saudi Arabia. Saudi Arabia proposed extending oil output cuts for eight months. These cuts were in place due to COVID-19 and lower oil use. The UAE wanted its recognized maximum oil production to be raised to 3.8 million barrels a day. Its previous limit was 3.2 million barrels.

A compromise deal allowed the UAE to increase its maximum oil output to 3.65 million barrels a day. Russia also agreed to increase its production from 11 million to 11.5 million barrels by May 2022. All members would increase output by 400,000 barrels per day each month starting in August. This would slowly reverse the cuts made during the pandemic. This compromise showed OPEC+ unity. UAE Energy Minister Suhail Al-Mazrouei thanked Saudi Arabia and Russia for helping reach the agreement. He said the UAE is committed to the group. Saudi Energy Minister Prince Abdulaziz bin Salman said the agreement strengthens OPEC+ ties. It also ensures its continued success.

2021–Present: Global Energy Challenges

Russia's invasion of Ukraine in February 2022 changed the global oil trade. EU leaders tried to ban most Russian oil imports. Even before the official ban, imports to Northwest Europe were down. More Russian oil is now sold outside Europe, especially to India and China.

In October 2022, key OPEC+ ministers agreed to cut oil production by 2 million barrels per day. This was the first production cut since 2020. This led to renewed interest in passing the NOPEC bill in the US.

2022: Oil Production Cut

In October 2022, OPEC+, led by Saudi Arabia, announced a large cut to its oil output target. This was done to help Russia. In response, US President Joe Biden promised "consequences." He said the US would "re-evaluate" its long-standing relationship with Saudi Arabia. Robert Menendez, a US Senator, called for stopping cooperation and arms sales to Saudi Arabia. He accused the kingdom of helping Russia fund its war in Ukraine.

Saudi Arabia's foreign ministry said the OPEC+ decision was "purely economic." It was made by all members. They rejected pressure to change their stance on the war. The White House accused Saudi Arabia of pressuring other OPEC nations. It said the US had shown Saudi Arabia that there was no market reason for the cut. US National Security Council spokesman John Kirby said Saudi Arabia knew the decision would "increase Russian revenues." It would also reduce the effect of sanctions against Moscow.

Some reports suggested Saudi Crown Prince Mohammed bin Salman wanted to influence US elections. However, Saudi officials say their decision was about the global economy. They say the cuts were a response to the economic situation and low oil inventories. This could cause oil prices to rise. Saudi Arabia says it is a strategic partner with the US. It focuses on peace, security, and prosperity.

In 2023, the International Energy Agency (IEA) predicted that demand for fossil fuels would reach an all-time high by 2030. OPEC disagreed with the IEA's forecast. They said such predictions are dangerous. This is because they often lead to calls to stop investing in new oil and gas projects.

In November 2024, S&P Global claimed that the UAE ignored OPEC's oil production cuts. It said the UAE produced about 700,000 barrels more than its agreed limit. Analysts said the UAE's actions would undermine Saudi and Russia's efforts to raise oil prices. Russia wanted to fund its war, and Saudi Arabia had plans to diversify its economy.

OPEC Membership

Current Member Countries

As of January 2024, OPEC has 12 member countries. Five are in the Middle East, six in Africa, and one in South America. In 2016, OPEC's oil production was 44% of the world's total. OPEC also holds 81.5% of the world's known oil reserves. More recent reports from 2022 show OPEC countries produced about 38% of crude oil. They hold 79.5% of the world's proven oil reserves. The Middle East alone has 67.2% of OPEC's reserves.

To approve a new member, three-quarters of existing members must agree. This includes all five founding members. In October 2015, Sudan applied to join, but it is not yet a member.

| Country | Region | Duration of membership | Population (2022) |

Area (km2) |

Oil production (bbl/day, 2023) |

Proven reserves (bbl, 2022) |

|---|---|---|---|---|---|---|

| North Africa | Since 1969 | 44,903,220 | 2,381,740 | 1,183,096 | 12,200,000,000 | |

| Central Africa | Since 2018 | 5,970,000 | 342,000 | 261,986 | 1,810,000,000 | |

| Central Africa | Since 2017 | 1,674,910 | 28,050 | 88,126 | 1,100,000,000 | |

| Central Africa |

|

2,388,990 | 267,667 | 204,273 | 2,000,000,000 | |

| Middle East | Since 1960 | 88,550,570 | 1,648,195 | 3,623,455 | 208,600,000,000 | |

| Middle East | Since 1960 | 44,496,120 | 437,072 | 4,341,410 | 145,020,000,000 | |

| Middle East | Since 1960 | 4,268,870 | 17,820 | 2,709,958 | 101,500,000,000 | |

| North Africa | Since 1962 | 6,812,340 | 1,759,540 | 1,225,430 | 48,360,000,000 | |

| West Africa | Since 1971 | 218,541,210 | 923,768 | 1,441,674 | 36,970,000,000 | |

| Middle East | Since 1960 | 36,408,820 | 2,149,690 | 9,733,479 | 267,190,000,000 | |

| Middle East | Since 1967 | 9,441,130 | 83,600 | 3,393,506 | 113,000,000,000 | |

| South America | Since 1960 | 28,301,700 | 916,445 | 750,506 | 303,220,000,000 | |

| OPEC total | 491,757,880 | 10,955,392 | 28,956,906 | 1,240,970,000,000 | ||

| World total | 7,951,150,000 | 510,072,000 | 81,803,545 | 1,564,441,000,000 | ||

| OPEC percent | 6.18% | 2.14% | 35.39% | 79% | ||

OPEC+ Countries

Some countries that are not full OPEC members also work with the organization. They participate in things like voluntary oil supply cuts. This group is called OPEC+. It includes countries like Azerbaijan, Bahrain, Brunei, Brazil, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan, and Sudan.

OPEC+ countries signed the Declaration of Cooperation (DoC) in 2017. This agreement has been extended many times because it has been successful. The DoC helps OPEC and non-OPEC countries work together. OPEC+ members also use the Charter of Cooperation (CoC) for long-term teamwork. The CoC helps them talk about global oil and energy markets. Their goal is to ensure a steady energy supply and stable markets for everyone.

Observer Countries

Since the 1980s, representatives from countries like Canada, Egypt, Mexico, Norway, Oman, and Russia have attended many OPEC meetings. They come as observers. This helps them informally coordinate their oil policies.

New and Former Members

Uganda and Somalia are exploring for crude oil. They might join OPEC in the future. Their new production dates are likely 2024-2025. OPEC might expand with OPEC+ and new countries that meet the crude oil production criteria.

Countries That Left OPEC

| Country | Region | Membership years | Population (2022) |

Area (km2) |

Oil production (bbl/day, 2023) |

Proven reserves (2022) |

|---|---|---|---|---|---|---|

| Angola | Southern Africa |

|

35,588,987 | 1,246,700 | 1,144,402 | 2,550,000,000 |

| Ecuador | South America |

|

18,001.000 | 283,560 | 475,274 | 8,273,000,000 |

| Indonesia | Southeast Asia |

|

275,501,000 | 1,904,569 | 608,299 | 2,250,000,000 |

| Qatar | Middle East | 1961–2019 | 2,695,122 | 11,437 | 1,322,000 | 25,244,000,000 |

Countries that export less oil might find OPEC membership too costly. The annual membership fee can be high. Also, OPEC's production limits might prevent them from producing as much oil as they want. Ecuador left OPEC in December 1992 for these reasons. It rejoined in October 2007 but left again in January 2020. Gabon also left in January 1995 for similar reasons. It rejoined in July 2016.

In May 2008, Indonesia announced it would leave OPEC. It had become an oil importer and could not meet its production quota. It rejoined in January 2016. But it announced another "temporary suspension" at the end of that year. This was because OPEC asked for a 5% production cut.

Qatar left OPEC on January 1, 2019. It had been a member since 1961. Qatar decided to focus on producing natural gas. It is the world's largest exporter of liquified natural gas (LNG).

In November 2023, Nigeria and Angola, two big oil producers in Africa, were unhappy with OPEC's quotas. They felt the quotas stopped them from increasing oil production and their foreign reserves. In December 2023, Angola announced it was leaving OPEC. It disagreed with the organization's production quota system.

Oil Market Information

OPEC has greatly improved the amount and quality of information about the international oil market. This is very helpful for the oil industry. It needs careful planning months and years in advance.

Publications and Research

In April 2001, OPEC worked with five other international groups. They wanted to improve oil data. They started the Joint Oil Data Exercise. In 2005, it became the Joint Organisations Data Initiative (JODI). JODI covers over 90% of the global oil market.

Since 2007, OPEC has published the "World Oil Outlook" (WOO) every year. This report analyzes the global oil industry. It includes predictions for oil supply and demand. OPEC also publishes an "Annual Statistical Bulletin" (ASB). It provides more frequent updates in its "Monthly Oil Market Report" (MOMR) and "OPEC Bulletin."

Oil Price Standards

A "crude oil benchmark" is a standard oil product. It helps buyers and sellers set a reference price for crude oil. This includes contracts in major futures markets since 1983. Oil prices can differ based on type, quality, delivery date, and location.

The OPEC Reference Basket of Crudes has been an important oil price standard since 2000. It is an average price of oil blends from OPEC member countries. These include Saharan Blend (Algeria), Girassol (Angola), and Arab Light (Saudi Arabia).

North Sea Brent Crude Oil is a leading standard for Atlantic basin crude oils. It is used to price about two-thirds of the world's traded crude oil. Other well-known standards are West Texas Intermediate (WTI), Dubai Crude, and Urals oil.

Extra Oil Capacity

The Energy Information Administration (EIA) defines "spare capacity" for crude oil. This is the amount of oil that can be produced within 30 days. It must be sustained for at least 90 days. OPEC's spare capacity shows how well the world oil market can handle problems that reduce oil supplies.

In November 2014, the International Energy Agency (IEA) estimated OPEC's "effective" spare capacity. This was about 3.5 million barrels per day. It was expected to increase to 4.6 million barrels per day by 2017. By November 2015, the IEA changed its view. It said OPEC's spare production was low. This was because Saudi Arabia and its neighbors were pumping oil at near-record rates.

|

See also

In Spanish: Organización de Países Exportadores de Petróleo para niños

In Spanish: Organización de Países Exportadores de Petróleo para niños

| Janet Taylor Pickett |

| Synthia Saint James |

| Howardena Pindell |

| Faith Ringgold |