JPMorgan Chase facts for kids

|

|

| Public | |

| Traded as | |

| ISIN | ISIN: [https://isin.toolforge.org/?language=en&isin=US46625H1005 US46625H1005] |

| Industry | Financial services |

| Predecessors |

|

| Founded | December 1, 2000 |

| Headquarters | 383 Madison Avenue (temporary) 270 Park Avenue, , United States

|

|

Area served

|

Worldwide |

|

Key people

|

|

| Services |

|

| Revenue | |

| AUM | |

| Total assets | |

| Total equity | |

|

Number of employees

|

317,233 (2024) |

| Subsidiaries |

|

| Capital ratio | Tier 1 16.8% (2024) |

JPMorgan Chase & Co. is a huge American company that offers many financial services. It is based in New York City. It is the largest bank in the United States. It is also the world's largest bank based on its market value in 2024.

JPMorgan Chase is one of the "Big Four" banks in America. This means it is very important to the financial system. The company has a strong financial base. Its main office is in Midtown Manhattan. It will move back to its new building at 270 Park Avenue in November 2025.

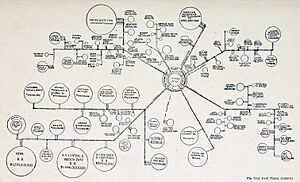

JPMorgan Chase was formed in 2000. This happened when two New York City banks, J.P. Morgan & Co. and Chase Manhattan Company, merged. The company's history goes back to 1799. That is when the Bank of the Manhattan Company was founded. J.P. Morgan & Co. was started in 1871 by J. P. Morgan. He created a major banking business.

Today, JPMorgan Chase offers many services. These include helping companies with big deals and managing money for people. Its retail banking and credit cards are known as the Chase brand. This is used in the United States and the United Kingdom.

JPMorgan Chase is the world's fifth largest bank by total assets. In 2024, it had over $4 trillion in assets. It also has the largest investment bank in the world by revenue. The company is ranked highly on lists of the largest U.S. corporations. For example, it was #1 on the Forbes Global 2000 list in 2023.

How JPMorgan Chase Started

JPMorgan Chase was created from many large U.S. banks joining together. These mergers happened since 1996. Key banks that joined include Chase Manhattan Bank and J.P. Morgan & Co.. Other important additions were Bank One, and parts of Bear Stearns, Washington Mutual, and First Republic.

The company's oldest part, The Bank of the Manhattan Company, started on September 1, 1799. It was one of the oldest banks in the United States. It was founded by Aaron Burr.

Chase Manhattan Bank's Story

The Chase Manhattan Bank was formed in 1955. This happened when Chase National Bank (started in 1877) bought The Bank of the Manhattan Company (started in 1799). The Bank of the Manhattan Company was first created by Aaron Burr. He changed a water company into a bank.

A writer named John Steele Gordon explained how this happened. Back then, you needed a special law to start a bank. Aaron Burr found a way to create a bank. He added a small rule to a law for a company called The Manhattan Company. This company was supposed to bring clean water to New York City. The rule allowed the company to invest extra money in any legal business. Soon after, the company opened a bank. This bank is now part of JPMorgan Chase.

Under David Rockefeller in the 1970s and 1980s, Chase Manhattan became a very big bank. It was a leader in many banking areas. In 1996, Chemical Bank bought Chase Manhattan. But they kept the more famous "Chase" name. Before joining J.P. Morgan & Co., the new Chase also bought other companies. These included Hambrecht & Quist and Robert Fleming & Co..

Chemical Bank's Story

The New York Chemical Manufacturing Company started in 1823. It made different chemicals. In 1824, it changed its rules to also do banking. This led to the Chemical Bank of New York. Over time, the bank grew by itself and by merging with others. Important mergers included Corn Exchange Bank in 1954 and Manufacturer's Hanover Trust Company in 1991.

Chemical Bank became known for helping to finance large company buyouts. In 1996, Chemical Bank bought Chase Manhattan. Even though Chemical was the buyer, it took the Chase name. JPMorgan Chase still uses Chemical's old stock history. It also uses Chemical's former headquarters site at 270 Park Avenue. A new, larger building is being built there now.

J.P. Morgan and Company's Story

The "House of Morgan" began from a partnership called Drexel, Morgan & Co. In 1895, it became J.P. Morgan & Co.. This company helped create the United States Steel Corporation. This was the world's first company worth a billion dollars. In 1895, J.P. Morgan & Co. even helped the U.S. government with gold to fix its finances.

The bank's headquarters for many years was at 23 Wall Street. On September 16, 1920, a bomb exploded there. It injured 400 people and killed 38. The case was never solved.

During the 1930s, a law called the Glass–Steagall Act made banks separate their different types of business. J.P. Morgan & Co. chose to be a commercial bank. Later, in 1935, some J.P. Morgan partners started a new company called Morgan Stanley. This company focused on investment banking. In 1959, J.P. Morgan merged with Guaranty Trust Company of New York. They formed Morgan Guaranty Trust Company.

J.P. Morgan has had offices around the world for a long time. It opened in Japan in 1924 and in China in 1921. It has also been in Saudi Arabia and India since the 1930s.

Bank One Corporation's Story

In 2004, JPMorgan Chase merged with Bank One Corp. This brought Jamie Dimon into the company. He later became the CEO. Dimon made changes to Bank One to make it a good partner for JPMorgan Chase.

Bank One Corporation started as a holding company for banks in Ohio. It grew by buying other banks and renaming them "Bank One." JPMorgan Chase finished its merger with Bank One in 2004.

Helping Out During Tough Times

JPMorgan Chase has helped by acquiring other banks during difficult financial periods.

Bear Stearns

In 2008, Bear Stearns was a large investment bank. But it faced big financial problems. To prevent a wider crisis, the U.S. government helped JPMorgan Chase acquire Bear Stearns. This deal was announced on March 16, 2008. It was completed on May 30, 2008.

Washington Mutual

On September 25, 2008, JPMorgan Chase bought most of Washington Mutual's banking business. Washington Mutual Bank had been taken over by the government. This was the largest bank failure in American history at the time. JPMorgan Chase bought its assets and deposits. This allowed the bank to reopen the next day.

Washington Mutual shareholders lost their investments. JPMorgan Chase raised money to cover costs from this acquisition. The company then changed all Washington Mutual branches to Chase branches.

First Republic Bank

On May 1, 2023, JPMorgan Chase acquired most of the assets and deposits of First Republic Bank. This was the second largest bank failure after Washington Mutual. JPMorgan Chase paid the government and returned funds that other banks had deposited. First Republic Bank shareholders also lost their investments.

Recent Company News

2006–2009

In 2006, JPMorgan Chase bought Collegiate Funding Services. This became Chase Student Loans. It also acquired Bank of New York Mellon's retail banking network. This added many branches in New York, New Jersey, and Connecticut.

In 2008, the U.S. government gave $25 billion to JPMorgan Chase. This was part of a program to help banks during the 2008 financial crisis. JPMorgan Chase was in good financial shape. But it accepted the funds to help the overall banking system.

2013–2014

In 2013, JPMorgan Chase teamed up with the Bill and Melinda Gates Foundation. They launched a $94 million fund. This fund helps develop new drugs and vaccines. It focuses on diseases like malaria and tuberculosis.

In September 2014, JPMorgan Chase announced a data breach. The accounts of over 83 million customers were affected. The bank's security team found the attack in July 2014.

2016–2017

In March 2016, J.P. Morgan decided not to fund new coal mines and coal power plants in wealthy countries. In October 2016, J.P. Morgan launched its own blockchain called Quorum. This is a secure digital ledger.

In December 2017, the Nigerian government sued J.P. Morgan for $875 million. They claimed the bank was careless in transferring money to a former minister.

2019–2021

In February 2019, J.P. Morgan launched JPM Coin. This is a digital token used to settle payments between clients. It was the first cryptocurrency issued by a U.S. bank.

In April 2021, JP Morgan pledged $5 billion to the European Super League. This was a controversial plan by football clubs to create a new league. Many fans and organizations strongly opposed it. The plan failed, and J.P. Morgan apologized for its role.

In September 2021, JPMorgan Chase entered the UK retail banking market. It launched an app-based bank account under the Chase brand. This was its first retail banking operation outside the U.S.

2022–2023

In March 2022, JPMorgan Chase announced it would close its business in Russia. This was to follow rules and laws.

In September 2022, the company announced it was buying Renovite Technologies. This helps expand its payments business. It also bought parts of Volkswagen's payments business.

In May 2023, CNBC reported that JPMorgan Chase was developing a new tool. It uses artificial intelligence called IndexGPT. This tool would help investment advisers choose investments for customers.

2025

In February 2025, Matt Sable and Melissa Smith became co-heads of commercial banking. They will oversee services for over 70,000 clients in North America.

In March 2025, Charlie Javice was found guilty of fraud. This was related to JPMorgan Chase's purchase of her company, Frank. Prosecutors said she lied about how many users her company had. Jamie Dimon, JPMorgan's CEO, called the purchase a "huge mistake."

How JPMorgan Chase is Organized

JPMorgan Chase & Co. has changed its structure over time. This is due to mergers and expanding globally. In the United States, it has two main legal parts:

- Chase Bank

- JPMorgan Securities, LLC.

The modern JPMorgan Chase has three main business groups:

- Asset and Wealth Management (J.P. Morgan)

- Consumer and Community Banking (Chase)

- Commercial and Investment banking (J.P. Morgan & Chase)

JPMorgan in Europe

The company's European headquarters is in London. It also has offices in Bournemouth, Glasgow, and Edinburgh. These offices handle asset management, private banking, and investment banking. In September 2021, JPMorgan Chase launched its retail banking services in the UK.

Where JPMorgan Chase Has Offices

The current temporary world headquarters for JPMorgan Chase & Co. is at 383 Madison Avenue in New York City. In 2018, JPMorgan announced it would tear down its old headquarters building at 270 Park Avenue. A new, taller building is being built there. It will be completed in 2025. The new headquarters will be 1,388 feet tall and have 70 floors. It will fit 15,000 employees.

About 11,050 employees work in Columbus, Ohio. This is at the McCoy Center. It is the largest JPMorgan Chase & Co. building in the world. The bank also has operations in Houston, Wilmington, Delaware, and many other U.S. cities.

Globally, JPMorgan Chase has offices and technology centers in places like Manila, Philippines; Mumbai, India; Buenos Aires, Argentina; São Paulo, Brazil; and Mexico City, Mexico. In late 2017, it opened a new operations center in Warsaw, Poland. Its Asia Pacific headquarters is in Hong Kong.

In the United Kingdom, operations centers are in Bournemouth, Edinburgh, Glasgow, London, Liverpool, and Swindon. London is also the European headquarters.

=Images for kids

-

JPMorgan Chase Temporary World Headquarters

383 Madison Avenue

New York City -

277 Park Avenue

New York City -

28 Liberty Street

New York City -

Chase Tower

Chicago, Illinois -

JPMorgan Chase Building

San Francisco, California -

Chase Tower

Dallas, Texas -

Chase Tower

Phoenix, Arizona -

JPMorgan Chase Tower

Houston, Texas -

25 Bank Street

London, United Kingdom

Climate Change and the Environment

JPMorgan has faced criticism for investing in new fossil fuel projects. These are projects that use coal, oil, and gas. From 2016 to 2021, it provided a lot of money for fossil fuel financing.

On October 21, 2021, JP Morgan Chase joined the Net-Zero Banking Alliance. This group supports moving the world economy to "net-zero emissions." This means reducing greenhouse gases as much as possible.

In May 2023, JPMorgan Chase announced it would buy $200 million in carbon credits. These credits help remove carbon dioxide from the air. This shows the bank's commitment to fighting climate change.

Major Sponsorships

JPMorgan Chase sponsors many well-known places and events:

- Chase Field in Phoenix, Arizona, home of the Arizona Diamondbacks baseball team.

- Chase Center in San Francisco, California, home of the Golden State Warriors basketball team.

- Major League Soccer

- The JPMorgan Chase Corporate Challenge, a large corporate running series around the world.

- The US Open tennis tournament.

- The Jessamine Stakes horse race in Lexington, Kentucky.

- Chase Center on the Riverfront in Wilmington, Delaware.

Who Owns JPMorgan Chase

JPMorgan Chase is mostly owned by large investment firms. Over 70% of its shares are held by these companies. The top 10 largest shareholders in December 2023 included:

- The Vanguard Group

- BlackRock

- State Street Corporation

- Morgan Stanley

- Fidelity Investments

Company Leadership

Jamie Dimon is the chairman and CEO of JPMorgan Chase. He became CEO at the end of 2005. Dimon is known for his leadership during the 2008 financial crisis. Under him, JPMorgan Chase helped two struggling banks during that time.

Board of Directors

As of May 1, 2023, the board includes:

- Jamie Dimon, chairman and CEO of JPMorgan Chase

- Linda Bammann, former JPMorgan and Bank One executive

- Steve Burke, chairman of NBCUniversal

- Todd Combs, CEO of GEICO

- James Crown, president of Henry Crown and Company

- Alicia Boler Davis, CEO of Alto Pharmacy

- Timothy Flynn, former chairman and CEO of KPMG

- Alex Gorsky, former CEO and chairman of Johnson & Johnson

- Mellody Hobson, CEO of Ariel Investments

- Michael Neal, CEO of GE Capital

- Phebe Novakovic, chairwoman and CEO of General Dynamics

- Virginia Rometty, Executive Chairwoman of IBM

Senior Leaders

- Chairman: Jamie Dimon (since January 2007)

- Chief Executive: Jamie Dimon (since January 2006)

Former Chairmen

- William B. Harrison Jr. (2000–2006)

Former Chief Executives

- William B. Harrison Jr. (2000–2005)

Famous Former Employees

Many people who worked at JPMorgan Chase later became famous in business or politics.

Business Leaders

- Henry S. Morgan – co-founder of Morgan Stanley

- David Rockefeller – a leader of the Rockefeller family

- Charlie Scharf – current CEO of Wells Fargo

- Harold Stanley – former JPMorgan partner, co-founder of Morgan Stanley

- Jes Staley – former CEO of Barclays

- C. S. Venkatakrishnan – current CEO of Barclays

Political and Public Service Leaders

- Tony Blair – former Prime Minister of the United Kingdom (1997–2007)

- William M. Daley – U.S. Secretary of Commerce (1997–2000)

- Thomas S. Gates Jr. – U.S. Secretary of Defense (1959–61)

- George P. Shultz – U.S. Secretary of State (1982–89)

- John J. McCloy – former president of the World Bank

See also

In Spanish: JP Morgan Chase para niños

In Spanish: JP Morgan Chase para niños