Economic history of the United States facts for kids

The economic history of the United States is all about how the U.S. economy has grown and changed from the early days of the colonies until now. It looks at how productive people were, how the economy performed, and how new technologies, changes in different industries, and government rules affected everything.

Contents

- Colonial Economy

- The New Nation

- Early 19th Century

- Middle 19th Century

- Late 19th Century

- Early 20th Century

- Great Depression and World War II: 1929–1945

- Post-World War II Prosperity: 1945–1973

- Late 20th Century

- 21st Century

- Images for kids

- See also

Colonial Economy

In colonial times, America had lots of land and natural resources. But there weren't enough workers. This was different from Europe, and it attracted many immigrants, even though diseases in the New World could be dangerous.

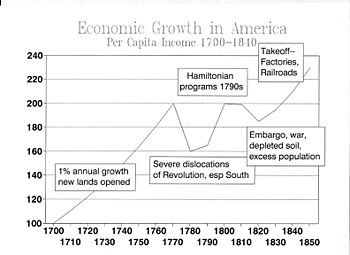

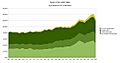

Between 1700 and 1774, the colonies' economy grew 12 times bigger! By the time they became independent, their economy was about 30% the size of Britain's. Most of this growth was because the population grew so fast. White colonists had a very good standard of living.

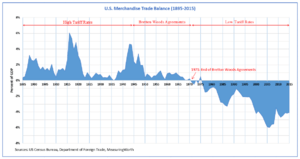

Britain used a system called mercantilism. This meant they controlled what products the colonies could make and who they could trade with. The goal was to make Britain rich.

People and Growth

Life was hard for early settlers, and many died at first. But after 1629, the population grew very fast. Families had many children (about 8, compared to 4 in Europe). People also lived longer in the colonies because there was plenty of food and wood, and fewer diseases spread due to lower population density.

The white settler population grew from 40,000 in 1650 to 235,000 in 1700. By 1775, it reached 2.6 million, including 540,000 black people (many enslaved). The colonies had about one-third of Britain's population.

What the Economy Was Like

The colonial economy was mostly about farming for survival. Families also made handicrafts, mostly for their own use.

The main economy involved taking natural resources and farm products. These were used locally or exported. Important exports included grains (like wheat and corn) and tobacco. Tobacco was a huge crop in places like Virginia. Rice was big in South Carolina. Fish and naval stores (like tar and turpentine for ships) were also important.

The colonies bought many finished goods from Britain. Laws like the Navigation Acts of 1660 stopped colonists from making many types of finished goods. This helped Britain have a trade surplus. However, American shippers earned money by carrying goods, which helped balance the trade.

Shipbuilding was a big industry, employing 5% to 20% of workers. About 45% of American-made ships were sold to other countries.

Before the Revolution, exports made up about one-sixth of income. Tobacco was about a quarter of all exports. The colonies also produced about 15% of the world's iron. Britain encouraged iron production but tried to stop new iron factories in the colonies, though colonists often ignored this rule.

Transportation was difficult because there were few good roads. Towns were usually near coasts or rivers. Moving goods by wagon was very expensive. So, most trade happened by water.

By the 1700s, different regions had different economies:

- New England focused on shipbuilding, fishing, and trade.

- Southern Colonies (Maryland, Virginia, Carolinas) grew tobacco, rice, and indigo, often using enslaved labor.

- Middle Colonies (New York, Pennsylvania, New Jersey, Delaware) shipped general crops and furs.

People in the colonies (except enslaved people) generally had a higher standard of living than in England.

New England's Economy

New England's economy grew steadily, even without one main export crop. Local governments helped by building roads, bridges, and mills. They also created laws that helped businesses. People in New England, especially the Puritans and Yankees, believed in hard work.

Wealth was shared widely, from merchants to farmers. As the population grew, good farmland became scarce, so many people moved west. In towns, more people became specialized workers. Wages for men went up, and new jobs like weaving and teaching opened for women.

City Life

Five major cities were Boston, Newport, New York City, Philadelphia, and Charleston. They grew from small towns to important centers for trade, immigration, and new ideas. They also brought English goods to America and started American education and welfare systems.

Before the Revolution, most Americans (95%) lived outside cities. The British could capture cities but struggled to control the countryside. City workers and artisans played a big role in starting the American Revolution.

Government and Economy

Mercantilism: Old and New

Colonial economies followed mercantilism. This meant countries tried to export more than they imported to gain gold. Colonies provided raw materials and bought finished goods. They were often stopped from making their own goods.

The British Navigation Acts (1651-1673) controlled colonial trade:

- Only British ships could trade within the British Empire.

- European goods for the colonies had to go through England first.

- Certain colonial products (like tobacco and furs) could only be exported to Britain.

These laws were enforced, but they didn't hurt trade much. By 1770, illegal trade to other places was almost as big as trade with Britain.

Britain was starting its Industrial Revolution, making many finished goods. Half of Britain's iron, hats, and textiles were bought by the American colonies.

Free Enterprise

The American colonies had a lot of economic freedom, partly because Britain didn't always enforce its rules strictly. Adam Smith, a famous economist, used the colonies as an example of how free enterprise helps. Colonists paid very low taxes.

Some colonies, like Virginia, started as business ventures. Groups of investors, called charter companies, funded them. The king gave them charters with economic and political rights. But the colonies didn't make quick profits, so investors often gave control to the settlers. This meant colonists had to build their own governments and economies.

Taxes

Colonial governments had few expenses, so taxes were very low.

Britain spent money protecting the colonies from pirates and other military threats. They tried to raise money with taxes like the Molasses Act of 1733.

In the 1760s, London tried to raise more money with new taxes. This caused a huge outcry and led to the American Revolution. The problem wasn't how much the taxes were, but who had the right to tax the colonists: Parliament or the colonial assemblies. New taxes included the Sugar Act of 1764 and the Stamp Act of 1765.

The American Revolution

Americans in the Thirteen Colonies wanted their rights as Englishmen. They believed they should choose their own representatives to make laws and taxes. Britain refused. Americans boycotted British goods, and Britain responded with harsh laws. This led to the American Revolutionary War (1775-1783) and American independence.

The war emphasized individual freedom and economic opportunity. It also promoted ideas of liberalism and republicanism, focusing on natural rights, equality, and public good.

Financing the war was very hard for the American Congress and states. There wasn't much gold in the colonies. Britain's blockade stopped almost all imports and exports. Americans relied on volunteers and donations. They also paid soldiers and suppliers with paper money that lost value, promising to pay them back later. In 1783, soldiers received land grants instead of wages.

The Second Continental Congress printed paper money, but it quickly became almost worthless. This paper money was like a hidden tax. The inflation hurt people with fixed incomes, but most farmers weren't directly affected. Debtors benefited by paying off old debts with cheap paper money. Soldiers suffered the most as their wages lost value.

Starting in 1776, Congress tried to borrow money from rich individuals, promising to pay them back with bonds. France also secretly helped by sending money and supplies. When France officially joined the war in 1778, they and Dutch bankers loaned large sums to America. These loans were fully repaid later.

States didn't have good tax systems, so they couldn't help Congress much. By 1780, Congress had to ask states for specific supplies like corn and beef, which was very inefficient.

Cities were important in starting the Revolution, but they suffered during the war. The British navy blockaded ports, and the British occupied cities like New York. When the British left in 1783, many wealthy merchants moved away.

Confederation: 1781–1789

A short economic slowdown happened after the war, but things improved by 1786. Many Loyalists (Americans who supported Britain) left the U.S., taking their enslaved people but leaving their land.

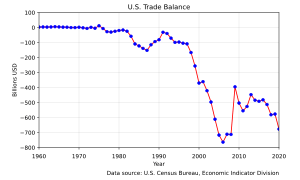

Trade with Britain restarted, but exports didn't fully recover. The U.S. expanded trade with France, the Netherlands, and other European countries. States had high taxes on trade between themselves, which hurt business. Many people who had loaned money during the war weren't paid back.

Despite some growth, many felt worried about the economy. Congress was blamed for not making the economy stronger. On the positive side, states gave Congress control of western lands. A system was created for new areas to become states, and slavery was banned in the Northwest Territory.

The New Nation

The Constitution of the United States, adopted in 1787, created a single market across the nation. This meant no internal taxes on trade between states. Alexander Hamilton, the first Secretary of the Treasury, believed the federal government had "implied powers" to do what was needed for the country. He created a strong national credit by combining state and national debts and selling new bonds to wealthy people. He funded this with taxes on imports and a controversial tax on whiskey.

Hamilton wanted the U.S. to grow through shipping, manufacturing, and banking. He helped create the First Bank of the United States in 1791. New local banks also started in cities.

Peace lasted only ten years. From 1793, wars between Britain and France began. As a neutral country, the U.S. traded with both sides. This led to conflicts, including the Quasi-War with France and economic warfare with Britain (1807-1812). The War of 1812 stopped imports, which helped American manufacturing grow.

Industry and Commerce

Transportation

There were very few roads and no canals. In 1792, it cost a lot to transport crops to seaports. Water transport was the cheapest. In 1816, it cost $9 to ship a ton of goods 3000 miles from Europe, but only 30 miles within the U.S. for the same price.

New Inventions

In the 1780s, Oliver Evans invented a fully automatic flour mill. This was revolutionary because it used conveyor belts and governors (early automation).

Cotton farming grew rapidly after Eli Whitney improved the cotton gin. This machine was 50 times faster at removing seeds. Large cotton plantations, using enslaved labor, spread across the South. Raw cotton was sent to textile mills in Britain, France, and New England.

Textile Manufacturing

In the late 1700s, Britain was starting its Industrial Revolution. They tried to keep their textile machinery designs secret. But Samuel Slater, a mechanic, memorized the designs and came to the U.S. In 1793, Slater and his partner opened the first successful water-powered cotton spinning factory in Pawtucket, Rhode Island.

Later, in 1815, Francis Cabot Lowell built the first factory that did both spinning and weaving in Waltham, Massachusetts. This was a large, efficient factory that helped American textiles compete with British ones.

Large factory towns, especially in New England, grew around these new manufacturing plants. Some were "company towns" where the factory owned everything.

The U.S. started exporting textiles in the 1830s, focusing on coarse fabrics. Textile machinery became important for developing other advanced machines.

Money and Banking

The First Bank of the United States was created in 1791 by Alexander Hamilton. Some, like Thomas Jefferson, didn't trust banks and opposed it. The bank closed in 1811.

Early 19th Century

Most Americans still lived on farms and made their own goods. The U.S. mainly exported farm products. The country built excellent ships.

The textile industry grew in New England, using water power. Steam power started to be used, but water power was still dominant until the Civil War.

Roads, canals, steamboats, and early railroads began a transportation revolution.

Government and Economy

Alexander Hamilton first suggested the "American System" which included a government-sponsored bank and tariffs to help industry. Later, Henry Clay and the Whig Party supported these ideas.

Government programs included creating the Patent Office (1802), improving navigation, and Army expeditions that provided information for pioneers. Army engineers also helped build early railroads and canals.

Thomas Jefferson and James Madison initially opposed a strong central government. But after the War of 1812 showed the need for a national bank, Madison changed his mind. The Second Bank of the United States was created in 1816.

In 1803, Jefferson bought the Louisiana Territory from Napoleon for $15 million. This greatly expanded the U.S., adding rich farmland and the important city of New Orleans.

The wars in Europe (1793-1814) made foreign shipping risky for the U.S. Jefferson's Embargo Act of 1807 stopped most foreign trade. The War of 1812, by cutting off trade, created a market for American-made goods. This led to more protectionism (tariffs to protect home industries).

States built roads and canals, like the Erie Canal (1825), which opened up markets for western farm products. The Whig Party wanted to build more roads, canals, and protect industry.

The Supreme Court case Gibbons v. Ogden established that the federal government could regulate trade between states.

President Andrew Jackson (1829-1837) opposed the Second Bank of the United States, believing it favored the rich. He stopped its charter from being renewed. Jackson also disliked paper money and wanted the government to be paid in gold and silver. The Panic of 1837 caused business growth to stop for three years.

Farming, Business, and Industry

Population Growth

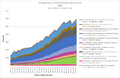

The U.S. population grew very fast due to high birth rates and cheap land. The average age was under 20. Population grew from 5.3 million in 1800 to 17 million in 1840.

New cities like Pittsburgh, Cincinnati, and New Orleans grew quickly. Steamboats, after 1810, made it cheap to move goods upstream on major rivers. The Erie Canal made Buffalo a key trading center for the Great Lakes.

Labor Shortage

The U.S. had a shortage of workers because land was cheap and farming was profitable. Wages were 30-50% higher than in Britain. This encouraged investment in machinery to save on labor.

Farming

Farming was the main part of the U.S. economy. New canals and steamboats opened up new farming areas. Cotton production boomed in the Mississippi valley. Cotton became the U.S.'s biggest export.

Sugarcane was grown in Louisiana. Southern plantations used enslaved African labor for cotton, sugarcane, and tobacco.

Roads

Few roads existed at first, but turnpikes (toll roads) were being built. Transporting goods by wagon was very expensive. Thomas Jefferson started building the Natchez Trace and the Cumberland Road to connect eastern areas with the West. Building roads greatly lowered transportation costs.

Canals

Water transport was much cheaper than wagons. A horse could pull a barge with 50 tons of cargo, compared to one ton by wagon. Canals cost 2-3 cents per ton-mile, compared to 17-20 cents by wagon.

By 1816, only 100 miles of canals existed. The 325-mile Erie Canal, opened in 1825, was a huge success. It connected the Hudson River to Lake Erie, drastically cutting shipping costs. Its success led to a canal-building boom, but many later canals were not profitable.

Steam Power

In 1780, the U.S. had only three major steam engines. Most power came from water wheels. By 1807, there were fewer than a dozen steam engines. Steam power didn't become more common than water power until after 1850.

Oliver Evans developed a high-pressure steam engine that was more practical for steamboats and locomotives. He opened factories to produce these engines. Steam engines became common in water supply, sawmills, and flour mills.

Shipbuilding

Shipbuilding remained a big industry. U.S.-built ships were well-designed, needed smaller crews, and cost less than European ships. Britain took the lead later with iron-hulled ships.

Steamboats and Steam Ships

Commercial steamboat operations began in 1807. The first steamboats used large, low-pressure engines. Later, high-pressure engines were developed.

The New Orleans was the first steamboat to travel down the Ohio and Mississippi Rivers in 1811-1812. By 1815, there were 30 steamboats in the U.S. The number grew to hundreds, especially in the Mississippi valley. Steamboats cut travel times and freight costs significantly.

The SS Savannah was the first steamship to cross the Atlantic in 1819. Early ocean steamships carried more coal than cargo.

Railroads

Railroads were invented in England. The U.S. imported British equipment in the 1830s, but by the 1850s, Americans developed their own technology. Early lines connected nearby cities or farms to waterways. They mostly carried freight.

Matthias W. Baldwin inspected a British locomotive and built his first one in 1832, founding Baldwin Locomotive Works. By 1838, three-fourths of U.S. locomotives were American-made.

Ohio built more railroads in the 1840s than any other state, which put canals out of business. Railroads cost more to build than canals but could carry much more traffic.

Manufacturing

Factories, starting with textiles in the 1790s, were built to supply regional and national markets. They used power from waterfalls, mostly in rural New England.

Before 1800, most clothing was made at home. By the 1820s, housewives bought cloth from stores and sewed it. The American textile industry grew during the wars (1793-1815) when British imports were unavailable.

In 1815, Francis Cabot Lowell built the first factory that combined spinning and weaving. This was a large, efficient mill that competed well with British textiles.

Large factory towns, like Lowell, Massachusetts, grew around manufacturing plants. Some were "company towns" where the company owned workers' housing and stores.

The U.S. started exporting textiles in the 1830s. Textile machinery helped develop other advanced mechanical devices. The shoe industry also began using factories.

Interchangeable Parts

The idea of making parts that could be easily swapped out (interchangeable parts) was important for U.S. economic growth. This idea came from France for weapons.

Fears of war in 1798 led the U.S. to offer contracts for small arms. Eli Whitney and Simeon North worked on making guns with interchangeable parts. North developed the first known milling machine around 1816.

The War of 1812 showed the need for interchangeable parts in firearms. This forced the development of modern metal-working machines like milling machines and grinders. This system became known as the "American system of manufacturing". Machinists from armories spread this technology to other industries like clocks and watches.

Money and Banking

The First Bank of the United States closed in 1811, making it hard to finance the War of 1812. President James Madison then supported a new national bank, and the Second Bank of the United States was created in 1816. It closed in 1836 under President Andrew Jackson.

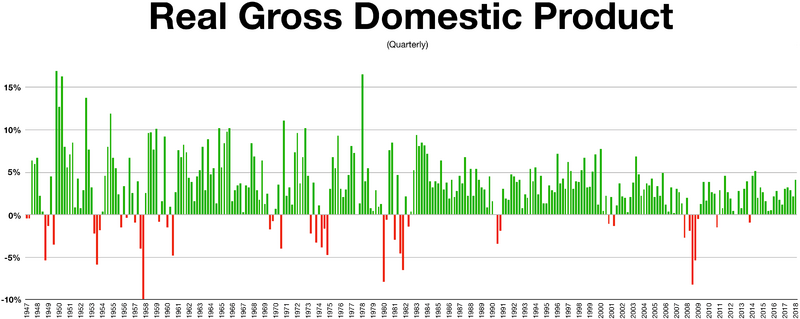

There were three economic downturns in the early 19th century. The first was due to the Embargo Act of 1807, which hurt trade. The second was a depression from 1818-1821, where farm prices fell by almost 50%. The third was a depression from the late 1830s to 1843, following the Panic of 1837. The money supply shrank, and prices fell.

To stop land speculation, Andrew Jackson required government land sales to be paid in gold and silver in 1836. This led to the Panic of 1837.

Middle 19th Century

This period was a transition to industrialization, especially in the Northeast (textiles, shoes). The West (Ohio to Missouri) grew fast, producing grain and pork. The South's economy relied on plantations (cotton, tobacco, sugar) with enslaved labor.

The factory system grew along transportation routes. Steamboats and railroads became widespread. The telegraph was introduced in 1844.

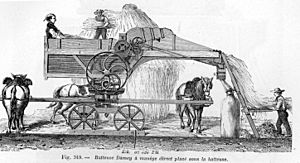

A machine tool industry developed, and machinery became a major industry. Sewing machines and mechanized shoe production began. Horse-drawn reapers greatly increased farming productivity.

Steam engines were used more in manufacturing, and coal replaced wood as the main fuel. Railroads, the telegraph, and factories started to create an industrial economy.

The U.S. had its longest economic expansion from 1841 to 1856, partly due to gold discovery in California.

Commerce, Industry, and Farming

The depression that started in 1839 ended in 1843.

Railroads

Railroads opened up remote areas and greatly cut the cost of moving goods and people. By 1860, long-distance shipping costs fell by 95%. This created a "major revolution in domestic commerce."

Railroads were expensive to build. Private money wasn't enough, so states gave charters, funding, tax breaks, and land grants. A mix of local and foreign investment, plus gold from California, helped build a large railroad system.

Railroad leaders created modern ways to run large businesses, like different departments and career paths. They were the first to deal with complex management and labor unions.

Iron Industry

A key invention in iron production was the hot blast (1828), which saved fuel and allowed higher furnace temperatures. This meant furnaces could use lower-grade coal. Iron was used for many things, including stoves and railroad tracks.

Coal Replaces Wood

Coal became the main fuel in the mid-19th century. In 1840, wood was the main fuel. By 1880, wood was only 5% of fuel use. Cast iron stoves replaced fireplaces. Railroads and canals made coal much cheaper than wood.

Manufacturing

Manufacturing grew strong. Because labor was expensive, industries used a lot of machinery. Woodworking machines amazed British visitors.

Machines were increasingly made of iron, allowing higher speeds and precision. This created a machine tool industry that made lathes, metal planers, and other precision tools.

The shoe industry became mechanized in the 1840s. Sewing machines were developed for leather.

By the 1850s, sewing machines were improving. To avoid lawsuits over patents, companies pooled their patents in 1856. The sewing machine industry benefited from machine tools developed at federal armories. By 1860, some sewing machine makers used interchangeable parts. Sewing machines increased productivity by 5 times.

In 1860, the textile industry was the largest manufacturing industry.

Steam Power

In 1838, there were about 2,000 steam engines in the U.S., mostly for transportation. The Corliss steam engine, patented in 1848, was a major improvement. It was more efficient and kept a more even speed, making it good for many industries, especially cotton spinning.

Steam power greatly expanded in the late 19th century with large factories, railroads, and early electric lighting.

Steamboats and Ships

The number of steamboats on western rivers grew from 187 in 1830 to 735 in 1860. U.S. ships were known for being well-designed and cheaper to build.

The screw propeller was tested in 1841. It caused vibrations, which was a problem for wooden ships. The SS Great Britain (1845) was the first iron ship with a screw propeller. Britain became the leader in shipbuilding after iron ships became common.

Telegraph

The first telegraph line from Baltimore to Washington D.C. opened in 1844. Railroads quickly adopted the telegraph for coordinating train schedules and tracking freight. By 1852, there were 22,000 miles of telegraph lines.

City Growth

By 1860, 16% of Americans lived in cities. One-third of the nation's income came from manufacturing. Industry was mostly in the Northeast. Most factory workers were immigrants or their children. Between 1845 and 1855, about 300,000 European immigrants arrived each year.

Farming

Before the Civil War, the U.S. supplied 80% of Britain's cotton. Cotton was 61% of all U.S. exports just before the war.

Railroads helped expand farming into the West. Grain production grew, especially when European harvests were bad (like during the Great Famine in Ireland). But when European harvests improved, U.S. grain prices fell, leading to the Panic of 1857.

Farming prospered during the Civil War due to high prices from army demand and British imports. The war encouraged the use of horse-drawn machinery like reapers and mowers. Many wives took over farm work while men were in the army.

The 1862 Homestead Act gave public land for free. Railroads also sold land cheaply. The government also provided scientific farming information.

Enslaved Labor

In 1860, 4 million of the 4.5 million Americans of African descent were enslaved. They were mostly owned by Southern planters. Enslaved people made up about 60% of the value of farms in some Southern states.

After the Panic of 1857, some supporters of slavery argued that enslaved people were better off than many free workers.

Money and Banking

After the Second Bank of the United States closed, banks were only regulated by states. A big problem was banks printing too many banknotes. If people lost trust, they would rush to redeem notes for gold or silver, causing banks to fail. In 1860, there were over 8,000 state banks.

New York banks created a clearing house in 1853 to manage accounts and detect banks issuing too many notes.

Panic of 1857

The economy recovered from the 1837 depression until the Panic of 1857. This panic started when a well-known Ohio company failed due to embezzlement. This caused a rush to redeem banknotes, leading to many bank failures.

The U.S. had a trade deficit, and gold was leaving the country. A ship carrying $1.5 million in gold from California sank, making things worse. Banks had to stop lending, and many businesses couldn't pay workers.

The end of the Crimean War caused grain prices to fall, hurting U.S. exports. This led to some railroads going bankrupt. The panic caused high unemployment in the North.

Immigration Surge

Immigration to the U.S. increased after the Great Famine in Ireland. About 3 million immigrants arrived in the 1850s, mainly from Germany, Ireland, and England.

Civil War Economy

Union Economy

The Union (North) economy grew during the war. Republicans in Washington wanted an industrial nation with cities, factories, farms, national banks, and railroads. With the South gone from Congress, Republicans passed laws to promote industry and farming. They also raised new taxes and issued bonds to pay for the war.

War Financing

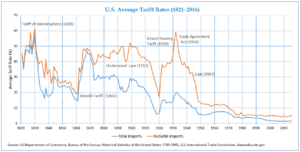

The Treasury Department, led by Salmon P. Chase, found clever ways to finance the war. New excise taxes were put on manufactured items. Tariffs were raised. The nation's first income tax was created for the wealthy.

Government bonds were sold directly to people, using patriotism to encourage buying. State banks lost their power to issue banknotes. Only national banks could do so, and they had to buy federal bonds. The government also printed paper money called "greenbacks", which caused inflation.

The national banking system was very important. New banks had to buy government bonds, which gave the Treasury money for the war.

Tariffs

The Morrill Tariff of 1861 and later acts raised tariffs. This was to raise money for the war and to protect American factories from British competition. It also attracted skilled European workers to high-wage jobs in America.

Land Sales and Grants

The U.S. government owned vast amounts of land, especially from the Louisiana Purchase. They wanted to make this land useful and help pay off war debt. Land grants were given to railroad companies to open up the western plains. The Homestead Act of 1862 gave free land to farmers.

The Pacific Railroad Acts gave land directly to corporations to build transcontinental railroads. This helped finance the railroads and encouraged settlement. The Morrill Land-Grant Acts helped create colleges.

The government also used its power to remove Native Americans from land for settlers.

Farming

Farming prospered during the war due to high prices from army demand and British imports. The war sped up the use of horse-drawn machinery like reapers. Many farm wives took over work while men were in the army.

The Union Army bought many animals. The Treasury also bought cotton from Southern planters during the war.

Collapse of the South

The South's economy was devastated by the war, leading to poverty. Incomes for white people dropped, but incomes for former enslaved people rose. After the war, railroad construction was heavily funded (with some corruption). Former enslaved people became wage laborers or sharecroppers. The South remained dependent on cotton.

The North's industrial strength helped it win the American Civil War (1861-1865). Slavery was abolished. Northern industry grew rapidly and became dominant.

Political Changes

Before the Civil War, Congress often rejected calls for higher tariffs and government involvement in the economy. Southerners feared these policies would strengthen the North. The Civil War changed this.

Treasury

The Treasury Department, led by Salmon P. Chase, found clever ways to finance the war. New excise taxes were put on manufactured items. Tariffs were raised. The nation's first income tax was created for the wealthy.

Government bonds were sold directly to people. State banks lost their power to issue banknotes. Only national banks could do so, and they had to buy federal bonds. The government also printed "greenbacks"—paper money—which caused inflation.

Education

British visitors were impressed by the high education level of U.S. workers. Most states had laws requiring child factory workers to attend school for at least three months a year.

Civil War Impact

The Union grew rich during the war, while the Confederate economy was destroyed. The war taught new organizational methods and emphasized engineering skills.

Reconstruction Financial Issues

The Civil War was paid for by bonds, loans, inflation (printing paper money), and new taxes. Prices had more than doubled. After the war, reducing inflation was a priority. The national debt was $2.8 billion.

Wall Street bankers believed the economy would grow rapidly after the war due to farming, railroads, and manufacturing. A compromise was reached to limit currency contraction. By 1868, inflation was minimal.

Late 19th Century

Commerce, Industry, and Farming

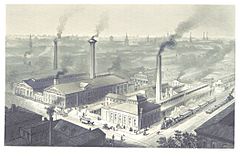

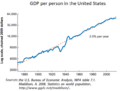

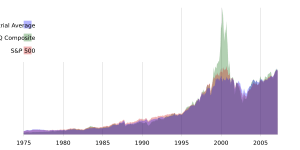

The late 19th century saw rapid economic growth, with per capita income doubling. By 1895, the U.S. surpassed Britain in manufacturing output. Exports of machinery and consumer goods became important.

The expanded railroad network, using cheap steel rails, greatly lowered transportation costs. This allowed large factories to grow. Machinery became a huge industry. Businesses operated over wide areas, and chain stores and mail-order companies appeared.

Companies created new management systems and integrated processes to be more efficient.

A wave of new inventions, called the Second Industrial Revolution, occurred. These included the electric light, telephone, steam turbine, internal combustion engine, automobile, and typewriter. New ways to make steel and chemicals were also invented. Electric street railways became common in the 1890s.

Improvements in transportation and technology caused prices to fall, especially during the "Long Depression".

Railroads

Railroads grew the most in the last three decades of the 19th century. Steel rails, which lasted longer and allowed heavier trains, greatly increased productivity.

Railroads competed fiercely, leading to many bankruptcies. A refrigerated railcar was introduced in 1881, making it possible to ship meat instead of live animals. Gustavus Franklin Swift built a huge business around this.

Steel

Iron and steel became leading industries. The Bessemer process made steel cheaply, mostly for rails. The open hearth process produced stronger steel for buildings, ships, and bridges.

Electric Lights and Street Railways

Early electricity was limited and expensive. By the early 1880s, Thomas Edison patented his incandescent light bulb and a power distribution system. He opened the first central power station in New York in 1882.

Electric street railways became a major mode of transport after 1888. They often generated their own power and also operated as electric utilities.

Communications

A more reliable Transatlantic telegraph cable was completed in 1865. By 1890, there was an international telegraph network.

The telephone was invented in 1876. Long-distance calling developed in the 1890s. Automatic telephone switching, which removed the need for operators, was introduced in 1892 but took decades to become widespread.

Modern Business Management

Railroads were the first to adopt modern business management. They hired professional managers and divided work into departments.

Another innovation was vertical integration, where companies controlled all stages of their business, from raw materials to selling finished products. This happened in the steel and oil industries.

Farming

Farming expanded dramatically. The number of farms tripled from 1860 to 1905. The federal government gave free land to settlers under the Homestead Act. Railroads also sold land cheaply and advertised in Europe to bring farmers over.

Farmers faced challenges from falling world prices for cotton and wheat. They often blamed railroads and bankers for low prices. New harvesting machines greatly increased efficiency.

The Grange movement, started in 1867, helped farmers with social activities and tried to set up cooperatives. They also had some political success, leading to "Granger Laws" that limited railroad fees.

Federal land grants helped states create agricultural colleges and extension agents to teach modern farming techniques.

Oil, Minerals, and Mining

Oil

In the 1850s, kerosene lamps became popular. An industry grew to produce kerosene from coal and crude oil. George Bissell realized that "rock oil" could be a good illuminant. In 1859, Edwin Drake drilled the first oil well in Pennsylvania, starting an oil boom.

The refining industry was very competitive. John D. Rockefeller and his partners formed Standard Oil in 1870. Rockefeller aimed to control all parts of the oil industry, from production to distribution. By 1879, Standard Oil controlled 90% of U.S. refining. They used their large shipping volume to get discounts from railroads. Standard Oil was broken up by the U.S. Supreme Court in 1911.

Gasoline, a byproduct of refining, became important later as kerosene's market shrank due to electric lighting.

Coal and Iron Ore

Coal was found in the Appalachian Mountains. Large iron ore mines opened in the Lake Superior region. Steel mills grew where coal and iron ore could be brought together.

Money and Banking

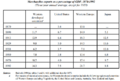

A series of economic downturns happened. The recession of 1869 was short and mild. The Panic of 1873 caused one of the worst and longest depressions in U.S. history, halting railroad expansion. Many businesses and railroads went bankrupt, and unemployment reached 14%.

The end of the Gilded Age coincided with the Panic of 1893, a deep depression that lasted until 1897. Farmers were especially hard hit. The 1896 election committed the nation to the gold standard and industrialization.

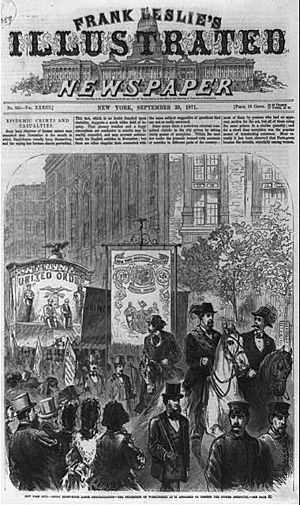

Labor Unions

The American labor movement began with the Knights of Labor in 1869. They were replaced by the American Federation of Labor (AFL) under Samuel Gompers. AFL unions focused on higher wages and better working conditions.

Political Changes

Concerns about unfair railroad practices led to the Interstate Commerce Act of 1887, which created the first regulatory agency.

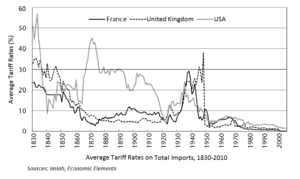

The U.S. had high tariffs from the Civil War to 1913. Republicans supported tariffs to promote growth and high wages.

Early 20th Century

Economic Growth

From 1890 to 1910, the economy grew rapidly. After 1910, growth slowed, but productivity increased. New technologies like electrification and mass production saved capital.

Industry, Commerce, and Farming

Electrification and automobiles were two of the most important technologies. Chain stores grew rapidly. Standardization of goods was encouraged.

Electrification

Electrification was a major driver of growth. Factories became more productive with electric power. The electric utility industry grew, and power became cheaper.

By 1930, about 80% of industrial power was electric. In 1900, only 3% of homes had electricity; by 1940, almost all urban homes did. Electrical appliances slowly became common.

Manufacturing

Rapid growth in manufacturing was due to increased productivity. Factory electrification changed manufacturing. Using individual electric motors for machines removed the need for long line shafts.

Frederick Winslow Taylor pioneered scientific management, finding more efficient ways to work. Henry Ford used these techniques to create the assembly line in 1913. The price of a Ford Model T fell sharply, and production soared. Ford also paid high wages, believing workers should be able to afford the products they made.

Electric Street Railways

Electric street railways became a major way to travel and connected many cities. They also carried freight. But the rise of automobiles and buses in the 1920s stopped their expansion.

Railroads

By the early 20th century, the railroad network had too many unprofitable routes. Congress regulated freight rates, and railroads struggled to cover rising costs. By 1916, many railroad lines were bankrupt.

During World War I, railroads couldn't handle the increased freight. The government took over the railroads from 1917 to 1920 to manage them.

Automobiles and Trucks

By the early 1900s, cars began replacing horse-drawn carriages. Mass production in the 1910s lowered car costs, and sales grew dramatically. By 1919, there were millions of cars and trucks.

Cars and trucks removed horse manure from city streets, improving sanitation. They also freed up farmland previously used to feed horses.

Highway System

In 1900, there were only 200 miles of paved roads outside cities. A national highway system was agreed upon in 1926. It was almost complete by World War II.

Water Supply and Sewers

At the turn of the century, about one-third of urban homes had running water, but it was often untreated. Water treatment plants and sewage systems were built in the early 1900s. Chlorination of drinking water became common by the 1930s, greatly reducing diseases.

Farming

Tractors and trucks appeared on farms in the 1910s. Combined harvester-threshers reduced labor costs. The number of farms in the U.S. decreased significantly from the 1930s to 2000, as new technology allowed fewer, larger farms to produce more.

Money and Banking

The Panic of 1907 led to the creation of the Federal Reserve Bank in 1913. Inflation rose sharply during World War I due to shortages. After the war, the Federal Reserve raised interest rates, leading to the Depression of 1920–1921. By 1923, the economy recovered.

The 1920s saw a debt-fueled boom and speculation in stocks. A housing bubble, especially in Florida, burst in 1925. Debt reached unsustainable levels, and the stock market crashed in October 1929.

Political Changes

The Pure Food and Drug Act of 1906 led to the creation of the Food and Drug Administration (FDA). The Sixteenth Amendment to the United States Constitution (1913) allowed the federal government to tax all income.

The Emergency Quota Act (1921) and Immigration Act of 1924 limited immigration based on country of origin.

Early American leaders generally believed in laissez-faire (limited government interference in the economy). This changed in the late 19th century as small businesses, farmers, and labor movements asked for government help.

By the early 20th century, Progressives favored government regulation to ensure fair competition. Laws like the Interstate Commerce Act of 1887 (regulating railroads) and the Sherman Antitrust Act (preventing monopolies) were passed. Presidents Theodore Roosevelt and Woodrow Wilson enforced these laws more strictly. Many of today's regulatory agencies were created then. Journalists, called Muckrakers, exposed problems in business, leading to reforms like the Food and Drug Administration.

President Woodrow Wilson implemented progressive policies. The Sixteenth Amendment created the income tax. Wilson also created the Federal Reserve.

World War I

World War I involved a huge effort to mobilize money, taxes, and banking to pay for the American and Allied war efforts.

Roaring Twenties: 1920–1929

Under President Warren G. Harding, taxes were cut, and the federal debt was reduced. Secretary of Commerce Herbert Hoover worked to improve business efficiency. This period of prosperity was known as the Roaring Twenties. The automobile industry boosted other industries like oil and glass. Cities boomed. The new electric power industry changed business and daily life. However, farmers struggled. In October 1929, the Stock market crashed.

Quality of Life

The early 20th century saw big improvements in quality of life. Homes were better, with more space and better protection from cold. Sanitation improved with water supply and sewage systems. Cars and trucks removed horse waste from streets.

Federal regulation of food helped reduce food-related illnesses. Infant mortality continued to decline. The workweek became shorter, and household chores became easier with new appliances. Electric light was cheaper and safer than kerosene lamps.

Welfare Capitalism

Some large companies, like Kodak and IBM, adopted welfare capitalism. This meant treating workers as important, offering job security, healthcare, and pensions. This was seen as good for society and a way to prevent unions and government regulation. This approach declined by the 1980s.

Great Depression and World War II: 1929–1945

Pre-War Industry and Farming

Despite the Great Depression and World War II, this period had high productivity growth. Research cooperation between industry and universities grew rapidly.

Manufacturing

Factory Automation became widespread, allowing fewer workers to operate large factories.

Great Depression: 1929–1941

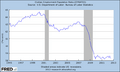

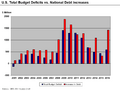

After the Wall Street Crash of 1929, the world economy plunged into the Great Depression. The U.S. money supply shrank. The Smoot–Hawley Tariff Act caused other countries to retaliate with their own tariffs. Congress raised income taxes in 1932. These actions made the crisis worse. By 1932, unemployment was 25%.

Franklin D. Roosevelt was elected President in 1932. He introduced the New Deal, a series of programs to help the economy.

Spending

Government spending increased. Roosevelt balanced the "regular" budget, but emergency spending was funded by debt. Some economists, like John Maynard Keynes, suggested more government spending to boost the economy. The federal government doubled income tax rates in 1932. Spending increased sharply when World War II began.

Banking Crisis

From 1929-1933, bank failures destabilized the economy. People lost trust and rushed to withdraw their money (bank runs). Many banks went bankrupt.

President Roosevelt closed all banks when he took office. He then passed the Emergency Banking Act, which allowed sound banks to reopen under government supervision. The Glass–Steagall Act limited bank speculation and created the Federal Deposit Insurance Corporation (FDIC), which insured deposits and stopped bank runs.

Unemployment

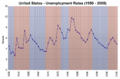

Unemployment reached 25% in 1932-1933. Job losses were worse for men and in heavy industries. Millions of people moved from farms to cities in the 1920s, but during the Depression, many moved back to farms where food was more available.

City governments tried to help with public works projects, but they were overwhelmed. Federal programs like the CCC and WPA built and repaired public infrastructure, providing jobs for unemployed men.

New Deal Impact

The New Deal's impact is still debated. Some say it helped the economy recover, while others say it slowed it down. The economy did grow significantly from 1932 to 1940. Unemployment fell from 25.2% in 1932 to 13.9% in 1940.

Many New Deal reforms, like Social Security and the FDIC, are still in place today.

Wartime Output and Controls: 1940–1945

Unemployment dropped to 2%. The industrial economy grew rapidly as millions moved to war jobs, and 16 million men and 300,000 women joined the military.

All economic sectors grew. Farm output and manufacturing doubled. Railroads worked hard to move goods. The War Production Board coordinated production for military needs. Automakers built tanks and aircraft, making the U.S. the "arsenal of democracy."

To prevent inflation, the Office of Price Administration rationed and set prices for consumer goods. Six million women took jobs in manufacturing, many replacing men in the military. After the war, many women returned to home life.

Post-World War II Prosperity: 1945–1973

This period was a "golden era" of economic growth. War bonds matured, and the G.I. Bill helped veterans get education and jobs. The middle class grew, as did GDP and productivity. This growth was fairly even across economic classes.

The Council of Economic Advisers was created to promote high employment and low inflation. The Eisenhower administration supported active government involvement to manage the economy.

The ""Baby Boom" saw a big increase in births, driven by prosperity and optimism.

Farming

Farm Machinery and Fertilizers

Ammonia from wartime explosives plants became available for fertilizers, lowering prices. The 1950s saw a peak in tractor sales as horses were replaced. Farm machinery became much more powerful. A successful cotton picking machine was introduced in 1949, doing the work of 50 men.

Research on plant breeding led to the Green Revolution, producing high-yield crops. Corn yields, for example, increased more than four times.

Government Policies

New Deal farm programs continued, supporting farm prices. The decline in farm population meant farmers had less political power. Farm groups worked with urban politicians to support food stamp programs.

Aircraft and Air Transportation

Air transport benefited greatly from the war. The U.S. was the top producer of combat aircraft and had many factories and skilled workers. Radar was also developed. The aircraft industry had the highest productivity growth.

Housing

Very little housing was built during the Depression and war, leading to overcrowding. The growth of suburbs depended on cars, highways, and cheap housing. The population grew, and people had savings for down payments. This led to a huge housing boom.

The G.I. Bill guaranteed low-cost loans for veterans. Developers built large tracts of standardized houses, like Levittown, making homes affordable.

Interstate Highway System

Construction of the Interstate Highway System began in 1956 under President Eisenhower. It was a great success, boosting Eisenhower's reputation. While it hurt some city neighborhoods, it greatly reduced shipping and travel costs. It also made suburbanization possible and boosted tourism.

Computer Technology

Mainframe business computer systems were introduced in the 1950s. They were widely used by the 1960s for accounting and billing. The Sabre airline reservations system (1960) automated bookings and ticket printing.

Fiscal Policy

Federal taxes had been high during World War II. Congress cut tax rates in 1964. President Lyndon B. Johnson (1963-1969) started many new social programs like Medicaid and Medicare.

Military and Space Spending

After the Cold War began, military spending increased. President Eisenhower feared it would hurt the economy, so he focused on missiles and nuclear weapons (cheaper than army divisions). He also promoted the Interstate Highway system for defense and made space exploration a priority. This spending boosted economies in California and the South.

The Defense Department funded research and development, including ARPANET (which became the Internet).

Decline of Labor Unions

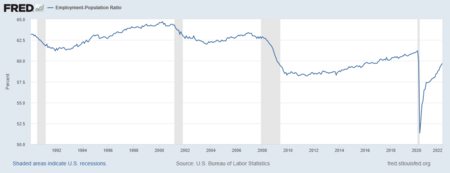

The percentage of workers in unions peaked in 1954 at almost 35%. Union membership has declined since the 1970s due to new laws, globalization, and political opposition.

Late 20th Century

Post-Industrial (Service) Economy

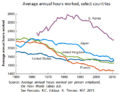

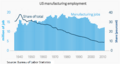

Manufacturing jobs and its share of the economy have steadily declined since World War II. By the end of the century, manufacturing made up about 11-12% of the economy.

The decline in manufacturing coincided with a rise in the service sector.

Productivity Slowdown

New technologies in the late 20th century were important, but not as powerful as earlier ones. Manufacturing productivity growth slowed, and overall productivity was affected by the growth of government and service sectors.

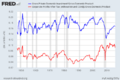

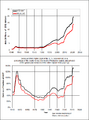

Inflation Woes: 1970s

The post-war boom ended in the early 1970s due to several factors:

- The collapse of the Bretton Woods system (1971).

- More imported goods like cars and electronics.

- The 1973 oil crisis.

- Productivity growth slowed.

- The 1973-1974 stock market crash.

The U.S. became more dependent on oil imports, leading to oil supply shocks in 1973 and 1979. Stagflation (high inflation and slow growth) hit the nation. President Richard Nixon tried wage and price controls.

The Bretton Woods Agreement collapsed in 1971-1972, and President Nixon took the U.S. off the gold standard.

President Gerald Ford launched the "Whip Inflation Now" (WIN) campaign. Productivity shrunk in 1974. Inflation continued to rise. Interest rates were very high. Unemployment dropped from 1975 to 1979, then rose sharply.

New environmental and consumer movements led to new regulations and agencies like the Occupational Safety and Health Administration.

Deregulation and Reaganomics: 1976–1992

Deregulation (reducing government rules) gained momentum in the mid-1970s. The Airline Deregulation Act (1978) was the first major step. Railroads, trucking, and interstate buses were also deregulated. Banks were partly deregulated.

President Jimmy Carter tried a large fiscal stimulus in 1977. But inflation rose sharply after the 1979 oil crisis. Carter appointed Paul Volcker to the Federal Reserve, who raised interest rates, causing a sharp recession in 1980. Manufacturing lost many jobs.

Ronald Reagan was elected in 1980. In 1981, he introduced Reaganomics, cutting federal income tax rates. Inflation dropped dramatically. The economy began to grow, and unemployment fell.

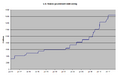

20 million jobs were created under Reagan. The stock market grew significantly. An economic boom lasted from 1983 until 1990. However, the federal debt tripled. The U.S. also started having large trade deficits.

George H. W. Bush became president in 1988. He increased taxes in a compromise with Congress. He also signed the Americans with Disabilities Act of 1990 and negotiated the North American Free Trade Agreement.

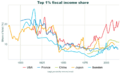

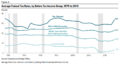

Income inequality increased dramatically from the late 1960s. Critics argued that consumer spending was fueled by debt, hiding stagnating wages for most workers.

The Rise of Globalization: 1990s – Late 2000

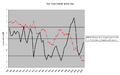

In the 1990s, government debt increased, GDP rose, and the stock market grew more than threefold. From 1994 to 2000, output increased, inflation was low, and unemployment dropped. This led to a soaring stock market known as the "dot-com boom." However, by 2000, it was clear a bubble had formed, and the market fell sharply.

Executive Compensation

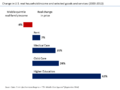

In the late 20th century, business executives started getting paid much more in stock than salary. CEO pay at top firms increased by 940% from 1978 to 2018, while typical worker pay grew only 11.9%. This difference has been criticized as unfair.

21st Century

The economy worsened in 2001, with slow growth and rising unemployment. This was partly blamed on the September 11 attacks. Many corporate scandals also hurt investor confidence. From 2001-2007, a booming housing market gave a false sense of economic strength.

Decline of Labor Unions

Most unions in America belong to the AFL-CIO or the Change to Win Federation. They advocate for workers and are active in politics. In 2010, 11.4% of U.S. workers were in unions. Most union members are public sector employees. Union workers in the private sector generally earn 10-30% more than non-union workers.

Great Recession and Aftermath (2007–2019)

The Great Recession was a sharp economic decline. In 2008, a worldwide housing bubble burst, causing housing prices to fall and construction to shrink. Many mortgages were bundled into securities that became "toxic" (worthless).

Major banks and insurance companies collapsed. Some went bankrupt, others were bailed out by the government. Congress approved $700 billion in bailout money. The stock market plunged 40%, and housing prices fell 20%. The "Big Three" automakers were almost bankrupt.

President Barack Obama signed the American Recovery and Reinvestment Act of 2009 for $787 billion in stimulus. This plan aimed to boost the economy by increasing government spending. Critics worried about future inflation and debt.

During the recession, many mid-wage jobs were lost. In the recovery, more lower-paying jobs were gained.

Gig Work

The rise of smartphones led to "gig workers" in the 21st century. These workers do jobs like package delivery or food delivery for companies like Amazon or DoorDash, or driving for ridehailing companies like Uber. This has led to debates about whether they should be classified as employees or independent contractors.

Great Lockdown and Aftermath (2019–Present)

In September 2019, the Federal Reserve started providing funds to the repo markets. Five months later, American stock markets suffered their biggest crash due to the coronavirus pandemic and an oil price war.

Before the crash, unemployment was very low (3.6%). However, income inequality continued to increase, reaching its highest level in 50 years in 2019. Manufacturing activity also slowed before the crash.

Images for kids

See also

In Spanish: Historia económica de los Estados Unidos para niños

In Spanish: Historia económica de los Estados Unidos para niños

| Selma Burke |

| Pauline Powell Burns |

| Frederick J. Brown |

| Robert Blackburn |